According to MicroStrategy Inc.’ (NASDAQ: MSTR) third-quarter 2022 financial results, the company is counting an impairment loss of approximately $1.99 billion on its Bitcoin holding. However, a study conducted by blockchaincenter.net has revealed that MicroStrategy’s crypto investment could be worth $ 5.598 billion if Michael Saylor purchased Ethereum.

The business intelligence company has been under heavy headlines from global investors closely monitoring bitcoin and digital assets. The company’s commitment to bitcoin could become its worst enemy as other digital assets gain more traction than the former. Furthermore, many digital assets have outperformed bitcoin in the last two bull markets.

As such, Kelvin O’Leary, aka Mr. Wonderful, has argued that it is best to approach investors with a portfolio mindset.

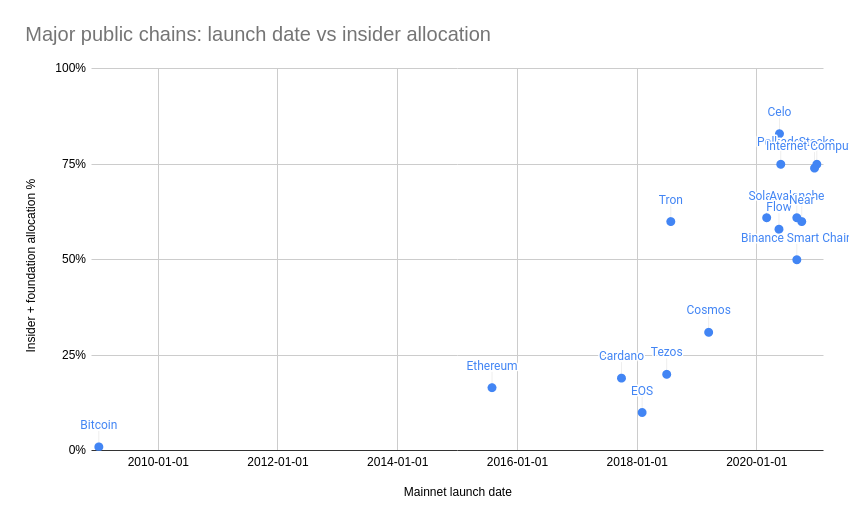

Nonetheless, Saylor has stood firm on bitcoin support and its prospects. In his defence, Ethereum’s lead developer Vitalik Buterin argued that the earliest projects in an industry are the most ‘real’. In that case, Bitcoin is almost six years older than Ethereum, which was launched around 2015.

Should MicroStrategy Diversify its Crypto Holdings Ahead?

MicroStrategy has largely influenced global hedge funds, institutional investors, and retail traders’ approach to digital assets. Furthermore, the company’s market capitalization is largely valued in Bitcoin. According to market data provided by MarketWatch, MicroStrategy has a valuation of approximately $2.81 billion.

However, the new data contradicts MicroStrategy’s approach to digital asset investing. According to Blockchaincenter.net, if Saylor focused on Ethereum, MicroStrategy’s crypto investment would increase to around $1.615 billion.

From another perspective, MicroStrategy could have earned as much as 239,690 ETH if Saylor purchased and staked Ether back in 2020. Additionally, if MicroStrategy converted its Bitcoin holding to ETH now and staked all, then annual revenue from staking would be $134 million.

Matters would go further if Microstrategy diversified its crypto portfolio onto altcoins, which have outperformed both Bitcoin and Ethereum. Nonetheless, bitcoin and ethereum are the most regulated digital assets globally, with the former already used as legal tender in two countries.

Notably, crypto regulations have been deemed as the next hurdle to global mass adoption. Perhaps, Saylor’s laser focus on Bitcoin is due to its deep liquidity, utility value, and future growth prospects. Furthermore, Saylor has indicated that MicroStrategy is a long-term Bitcoin holder.

Meanwhile, shares of MSTR are trading down about 68 percent over the past year, and another 54% drop is YTD.