Liquidation volume on market rises to dangerous level, confirming end of short-term recovery

The series of liquidations on the cryptocurrency market is reflected in a $300 million increase in liquidation volume due to the selloff tied to the situation around the FTX exchange. The most interesting part is the source of most of the liquidations.

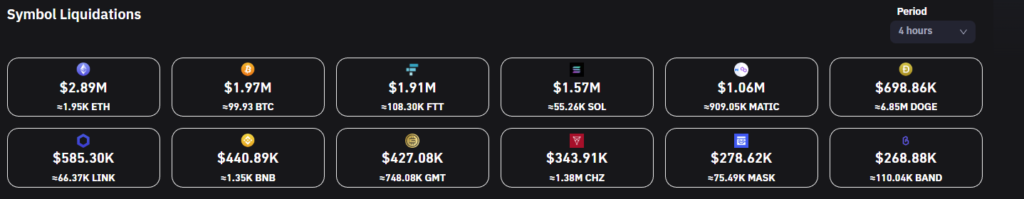

Traditionally, every plunge in the market and surge in liquidations is caused by the price performance of the biggest asset on the market, Bitcoin. However, today, this is not the case. According to Liquidation Data, the biggest providers of pain on the market today are FTT and ETH.

Why Ethereum and FTT Are Causing Crashes

Following potential insolvency issues on FTX, he had no choice but to infuse more capital, which included selling off his Ethereum holdings. The increase in selling pressure is confirmed by data from Sentiment, which confirmed the drain of the FTX-owned ETH wallet.

In just a few days, FTX removed almost 300,000 ETH from its wallets, causing such a massive increase in selling pressure on Ethereum markets that investors had no chance to absorb the aforementioned amount with no harm to the market price of ETH.

Considering the past price performance of Ethereum, the most likely reason behind such an unexpected spike in liquidations is linked to the increase in long numbers on the market. Earlier, U.Today reported on how traders are actively opening longs despite open interest turning bearish.

In contrast, liquidations on FTT have not happened because of FTX’s actions on the market. The most likely reason behind them is the large retail selling pressure caused by a panic around the exchange that uses the asset as a utility token.