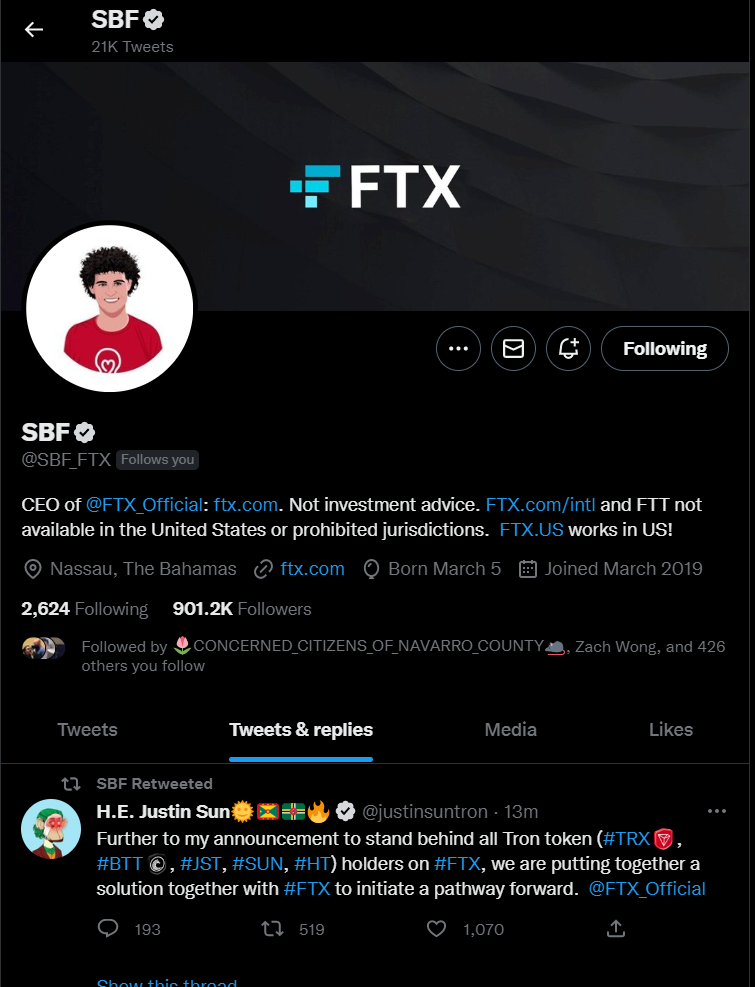

Following Binance’s backing from the FTX acquisition deal, Justin Sun, founder of the Tron ecosystem and Grenada’s ambassador to the WTO, announced that they are working on a solution to address the liquidity crunch. Sun notes that the ongoing FTX liquidity crisis poses a threat to the industry as a whole from a regulatory standpoint. As such, Sun and his team are reportedly working round the clock to prevent the collapse of FTX.

According to the latest crypto prices data, FTT has gained over 121 percent to trade around $3.33 at publication time. The digital asset hit rock bottom at about $1, obliterating gains since the project’s inception. Nonetheless, Sun noted that his team is optimistic about a possible solution, whereby Sam Bankman-Fried retweeted the announcements.

However, there are few details on the ‘Pathway Forward’ announced by Sun in relation to the FTX saga.

Crypto Community Comes Together for FTX Recovery

As a significant player in the cryptocurrency industry, FTX has received massive support from fellow exchanges and blockchain firms. Moreover, its capitulation spells a disaster for the whole crypto industry, which will receive more strict regulations from global lawmakers. Mind you, the United States Securities and Exchange Commission (SEC) has initiated a formal investigation on FTX.

The collapse of a major cryptocurrency exchange has caused a major uproar from regulators around the world. Furthermore, the FTX cryptocurrency exchange is regulated in Singapore, where the majority of users have switched to digital assets. Hence, licenses will be issued to crypto firms through extensive scrutiny to protect innocent investors.

While the FTX collapse was sudden to most people, Bankman-Fried had previously noted that the company was in good shape, particularly on its balance sheet. Hereby raising questions about whether some FTX whales liquidated their position on competitive bids. Notably, Binance has a stake in FTX, whereby the exchange holds some FTT tokens.

However, the cryptocurrency market is very unpredictable, and the bulls could handle it before the year ends. Hereby consolidating our levels for future support levels. For example, the Bitcoin Monthly Dollar Derivatives chart shows that the asset may close the month with a bullish outlook.

As such, day traders are cautioned to proceed with care as stop hunts are likely to get sharper and longer with heightened volatility. Meanwhile, the total cryptocurrency market capitalisation has dropped over 8.7 per cent to approximately $874 billion.