The crash of the popular crypto exchange FTX has become an embarrassment for the entire crypto space as it failed to build trust among users and provide properly secured infrastructure.

The demise of FTX has undoubtedly caused many investors to lose billions of dollars and forced miners to abandon their mining journey as their profitability decreased significantly due to the market downturn.

It is anticipated that the current crypto winter will have a prolonged effect on the market, extending by several months or even a year, as the remediation will take enough time.

Profitability of BTC miners plummets as crypto winter intensifies!

Bitcoin miners seem to be in trouble as crypto winter hasn’t spared them from the effects of the FTX collapse.

As Bitcoin trades near a vast bearish region of $16K, the mining potential of BTC miners decreases along with reduced profitability.

Margins for bitcoin miners have been pushed into a tight zone as BTC holdings held by miners touched a low of 1.826 million BTC, worth $30.6 billion.

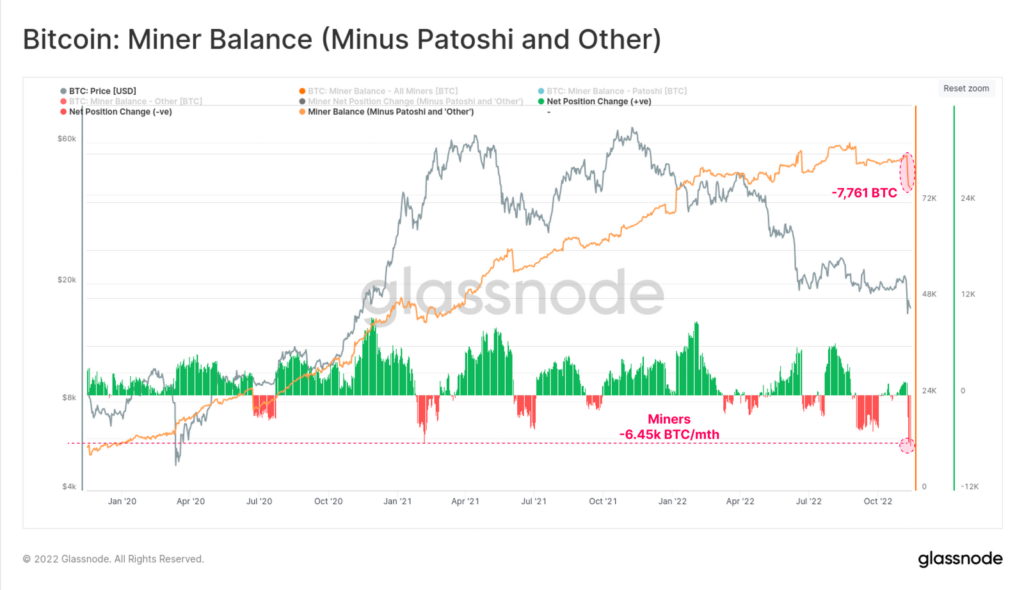

Furthermore, on-chain analyst firm, Glassnode, highlighted that the net position change of miners after January 2022 has come down to 10,972 BTC.

The firm further noted that Long-Term Holder supply has dropped by 61.5K BTC, registering a non-trivial event.

The BTC hash rate took a sharp drop, forcing miners to liquidate around 9.5% of their Treasury positions, the biggest drop since 2018.

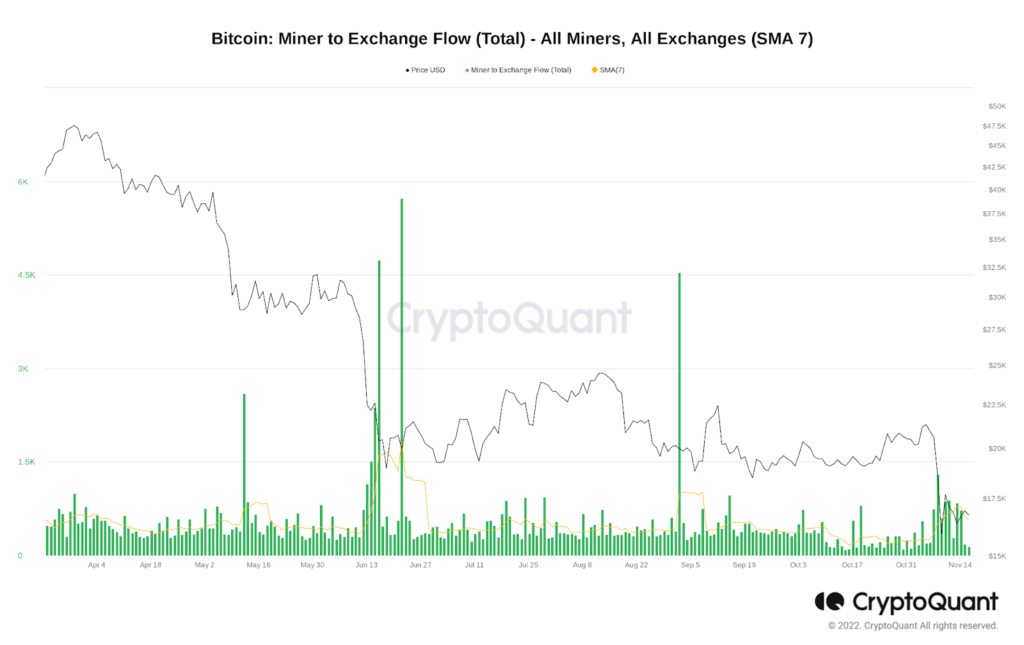

Another on-chain data provider, CryptoQuant, mentioned that miners exchanged a total of 1300 BTC on 8 November, the day of FTX’s collapse. The FTX’s failure has played a significant role in creating selling pressure in the price chart by BTC miners.

Additionally, the Miner Positions Index (MPI) has also turned lower since May, indicating considerable momentum in BTC outflows by miners in relation to their one-year moving averages.

Is It The Final Capitulation For BTC?

The downfall of FTX has become a black eye to the crypto industry as it has barred the market from making green candles in the price chart. The horrific event has trapped the BTC price near its crucial support region with no sign of a reversal.

BTC previously held monthly support at $18K, but a breakout below it sent the digital asset plummeting to the bottom line.

However, BTC tried to recover as it attempted to break its immediate resistance level of $17K following the news of Binance’s introduction of a reserve fund. It failed to hold its price after facing rejection.

Bitcoin price is now in a recovery phase at $16K as it formed a support level and continues to trade above it. Bitcoin is currently trading at $16.5K, well above the 100-hourly simple moving average, and a breakout above the immediate resistance at $18K could bring investors some hope of a bullish return as BTC continues its upward trajectory. One can aim to trade near the EMA. -100 trend line at $20.5K.

However, the RSI-14 still trades at an overselling region of 36-level, which can be a signal of a further downtrend for BTC.

If BTC breaks below the lower $15.5K range of its Bollinger Bands, which is a key support level to start a bearish move, BTC price could form a lower $13K-$14K price range over the next few weeks. Can