The Bitcoin price has continued to shrink in 2022 since Terra Luna initiated a significant crypto crash in Q1. The FTX and Alameda meltdown has stirred fresh selling pressure, which analysts expect to push through 2023. Moreover, confidence in centralized crypto exchanges has significantly slumped, which may push some to the insolvency route.

According to our latest crypto price prediction, bitcoin is trading around $16,500, above the recent low of $15,900. The digital asset is trading down 76 percent from its ATH, $69k, set almost a year ago.

Long-term Bitcoin critic Peter Schiff thinks Bitcoin price is yet to bottom per the current sentiments. Shiff highlighted a scenario where long-term Bitcoin holders sell their bags to sustain themselves—adding that sooner than later, only long-term holders with sustainable paychecks will survive the shakeout.

Nonetheless, long-term bitcoin holders are optimistic about the overall BTC market, which has seen significant adoption around the world. According to on-chain data, long-term bitcoin holders view the current bear market as similar to 2018.

Glassnode explained: “Bitcoin Long-Term Holders are currently experiencing acute financial stress, holding an average of -33% in unrealized losses. This is comparable to the lows of the 2018 bear market, which saw a peak unrealized loss of -36% on average.”

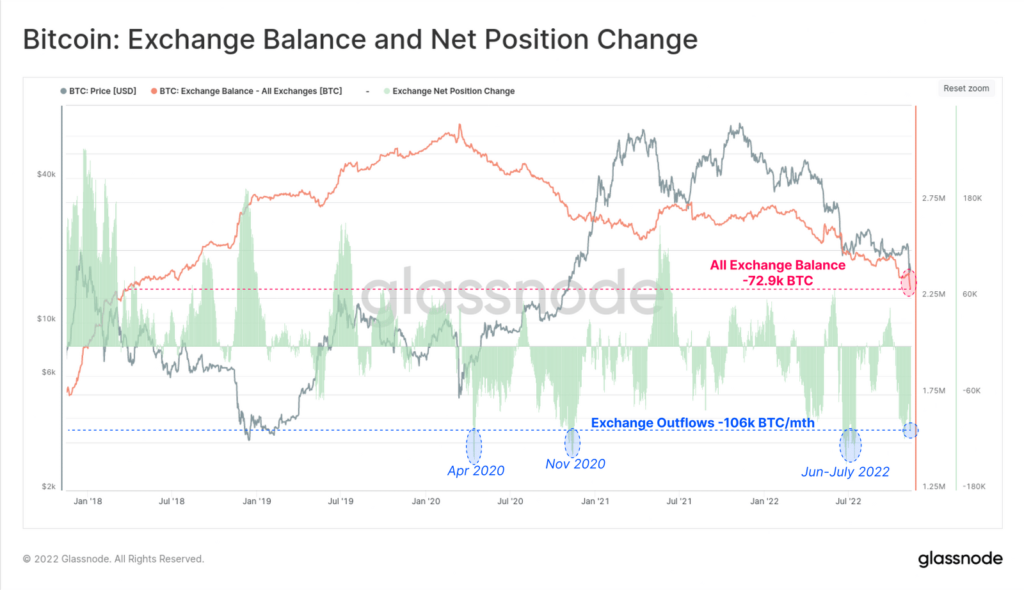

Notably, Glassnode data shows that crypto exchanges have registered a sharp increase in withdrawals towards non-custodial platforms. The cryptocurrency exchange reportedly saw the most significant net drop in total BTC balances in history, falling by 72.9k BTC in 7 days.

Further Notes on Bitcoin Market Outlook

Bitcoin (BTC) is a legal tender to two countries -El Salvador and the African Central Republic – and is regulated as a digital asset in many other jurisdictions. With a hard cap of 21 million Bitcoins and a halving to reduce the overall supply over time, market strategists are optimistic about its long-term success.

Nevertheless, global geopolitics and prevailing macroeconomics continue to push bitcoin price towards higher volatility. For example, the ongoing war between Russia and Ukraine has left international regulators largely divided over using bitcoin and other crypto assets.

Furthermore, western governments argue that Russia has used Bitcoin and other crypto assets to manoeuvre the set sanctions.

However, with rising global inflation rates that have significantly reduced the purchasing power of fiat currencies, bitcoin and other digital assets are expected to register significant cash inflows.