Bitcoin’s crash, triggered by the implosion of the popular crypto exchange FTX, is now trading in a fear zone, creating uncertainty among investors. Moreover, Bitcoin’s current solid bearish trend has raised concerns about its stability, as it has dropped over 22% since June.

As the recent bankruptcy filing by FTX wiped out huge amounts of bitcoin from the crypto market, the reduction in circulation could soon lead to a significant price drop for BTC.

FTX Bankruptcy To Bring Max Pain For BTC!

FTX’s native token, FTT, which once bragged lucrative profits for investors and traders, is now struggling to hold even $2. The collapse of the FTT token has created extreme selling pressure, which brought several cryptocurrencies to the bottom line.

Furthermore, the current bearish momentum of the market will further increase as the bankruptcy of FTX has looted a huge amount of crypto funds from the market, creating maximum pressure on the downtrend.

A well-known crypto trader and analyst, Doctor Profit, hinted that FTX’s bankruptcy filing might play a leading role in plunging Bitcoin’s price hard to the bottom level. According to him, the effect of the bankruptcy created a situation of robbery where big whale investors lost their BTC holdings which were locked in FTX, and would never get their funds back.

The analyst further claimed an insider nexus between government officials and exchanges, “Historical mass robberies on the part of exchanges, lending platforms and a few dozen coin operators with mysterious ties to some governments around the world. Some governments seem to have failed to hoard enough bitcoin, so they take what they want.”

Bitcoin Can Face More Challenges

The entire crypto space is facing economic challenges due to the current FTX drama, and it is expected to worsen in the upcoming days as FTX’s bankruptcy is acting as a black hole in the crypto market. As Bitcoin is seen dangling near its yearly lows, investors continue to liquidate their positions to avoid any unexpected price fluctuation in the near future.

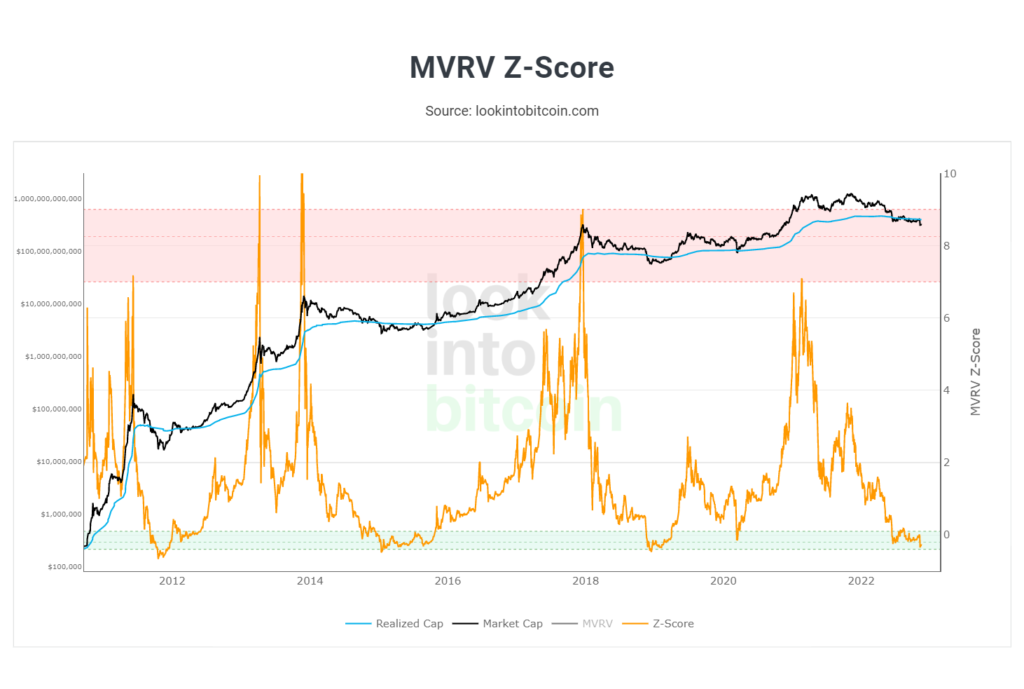

According to on-chain data provider LookintoBitcoin, the MVRV Z-score trend line has reached its lowest since 2019, making bitcoin more undervalued than its fair value. The indicator further suggests that bitcoin may spend more time in its lower range and may drop towards the final surrender zone, hinting at the $12K price range.

Bitcoin is currently trading at $16.6K after facing rejection at its immediate resistance level of $17K. The RSI-14 indicator is trading at an overselling region near the 35-level, which may bring more price drops for BTC as the rate of liquidation continues to spike. The MACD line is also falling sharply in the negative region, extending the recovery time for Bitcoin from the current bearish mud.

Bitcoin could decline heavily if it fails to hold its price above the lower range of $15.5K of the Bollinger Bands, below which BTC price could trade in the range of $12.5K-$14K. To start a fresh bull run, bitcoin needs to re-establish its immediate support level at $16K, and a breakout above the fundamental resistance level of $18K could sketch a bullish scenario for the crypto king. Is.