The entire crypto market has witnessed a sharp fall following unexpected events which caused catastrophic waves across the industry. Bitcoin has dropped below its two-year low of $18K and continues to remain in an uncertain price range.

In addition, concerns about inflation and the outcome of the midterm elections have brought mixed conditions for the future movement of the market.

As Bitcoin investors dump their BTC holdings and exit the market amid an alarming trend, BTC continues to trade in a crucial price range to test long-term holders’ patience.

The price of bitcoin is down!

The lack of concept and clarity regarding proof-of-reserve has become one of the main reasons for the recent collapse of FTX, responsible for a significant amount of BTC disappearing from its circulation.

According to a well-known crypto trader, DonAlt, the current rate of Bitcoin’s bearish trend makes a similarity to its previous bearish cycles.

The analyst analyzed that bitcoin is currently down about 80% compared to the bearish cycles of 2014-2015 and 2017-2018, where the drawdown rates were 86.17% and 83.84%, respectively.

If Bitcoin follows its bearish trend of 2017-2018 and extends its rate of downtrend above 84%, then the BTC price can witness a bottom level at $11K.

Furthermore, DonAlt further predicts that BTC could drop to $9.5K if it follows the bearish mark of the 2014-2015 cycle and extends the rate of decline above 87%.

A Breakout Above This Level May Spark Surges For BTC Price

Bitcoin is struggling to bring bullish hopes to its long-term holders as it faces hurdles in surpassing its resistance level at $17K.

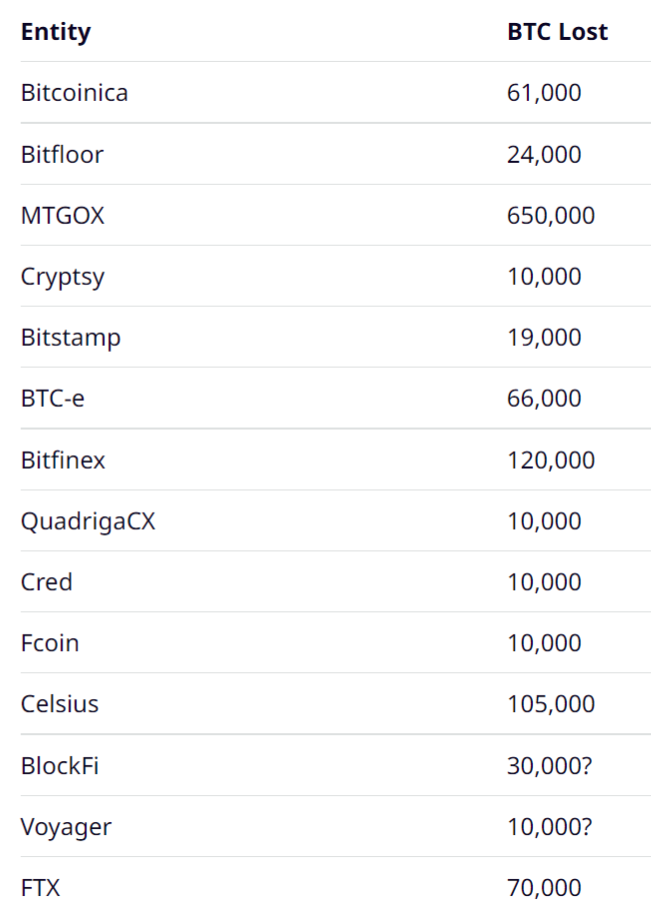

Historical data from the crypto crash shows that 14 exchanges were responsible for erasing 1,195,000 BTC from its circulation, which has created a shortage creating a stable bullish infrastructure to push the price of bitcoin upwards.

However, amid all these situations, investors are still accumulating Bitcoin, even in FUD, with a hope for a bullish breakout soon. Moreover, El Salvador’s president Nayib Bukele has announced plans to buy 1 BTC daily starting from 17 November.

Bitcoin trades at $16,662, down 0.27% from yesterday’s price. Looking at the daily price chart, the SMA-14 is declining significantly, and it is trading at the 38-level, well above the RSI trend line, which has forced Bitcoin to test its support at $16,350.

Moreover, Bitcoin’s Net Unrealized Profit/Losses metric has seen massive volatility as it drops to its bottom zone.

However, the NUPL trend signals an eventual capitulation, allowing BTC price to begin a rapid recovery, as seen in its previous bearish cycles.

A sustainable price movement above $17K may trigger the buying pressure, which can lift the RSI indicator above the 50-level. If BTC’s price holds its momentum between the EMA-20 and EMA-50 trend lines, it can aim for a breakout above its strong resistance at $20K.