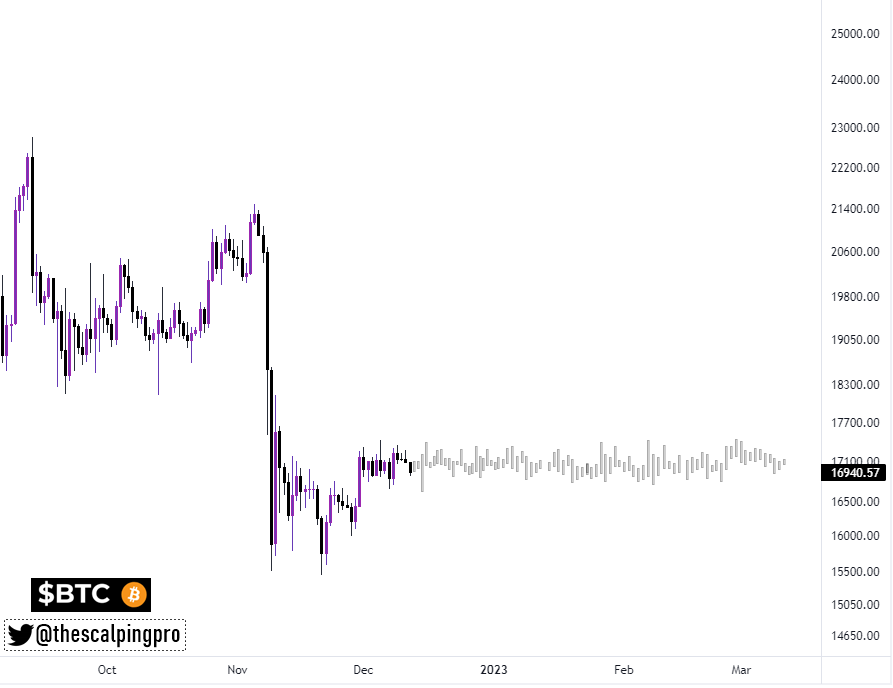

Bitcoin’s price remains in a downward trend as we approach the last meeting of the Federal Reserve Board for the year. The value of the king crypto has decreased by 1.05% in the previous twenty-four hours and by 1.66% in the past seven days as of the time this article was written.

Following its most recent weekly close, the bitcoin to US Dollar exchange rate displayed roughly a slight upward movement before the start of trading on Wall Street on December 12. More eager for new triggers to drive the price action.

Traders are now in a state of uncertainty, not knowing how to do business in such a market. It would be prudent for them to investigate the options markets in order to determine whether or not Bitcoin will finally give in to the negative newsflow.

Analyst Share Opinion on BTC Max Pain Point

While it is fair to conclude that a new bitcoin price drop will force many hodlers to re-evaluate their investment approaches, it is still unclear whether this bear market will be similar to those that came before it. No.

In the past Bitcoin’s history, bear market bottoms were accompanied by at least 60 percent of the BTC supply being exchanged at a loss. This was the case when the market was at its lowest point. To this point, the market has nearly, but not quite, followed that trend.

However, as an analyst Mag clarified in his Twitter post, this does not mean that the real maximum pain point is just around the corner. Maggs is a cryptocurrency trader as well as a technical analyst, and he claims to have been holding bitcoin since 2016.

What is the max pain point?

The “max pain” or “max pain point” is the striking price point at which the greatest number of options contracts are currently active, and the price at which the asset would result in losses for the most option holders after expiry.

Simply put, “maximum pain” refers to the time when buyers stand to lose the most money. Conversely, option sellers may benefit the most.

In Mags’ words:

“$10k – $14k won’t be Max pain for majority because most of you are prepared for it! The real max pain is the price moving inside a $500 range for months.”

He also added that most individuals would lose a significant amount of money due to excessive trading within the 2% flat range, adding that “as long as BTC does something (in either direction), we’re good”.

Meanwhile, as 2023 draws near, crypto enthusiasts are guessing at what would be the lowest potential price for cryptocurrencies. The failure of the exchange FTX has further compounded Bitcoin’s woes.

Some experts predict that by 2023, the price of bitcoin could unexpectedly fall to the $5,000 range. If that happens, its current price of $16,900 would then drop another 70%.

The decline or success of the crypto king will be influenced by inflation, interest rates, and the presumably oncoming recession. As we enter the year 2023, we can only hope that they become lower.

closing thoughts

Analyst Mags’ claims have been largely corroborated by the crypto community. Some others are hoping that Maggs’ prediction will come true so they may wait until later to invest in the leading cryptocurrency.

The interest in Bitcoin’s future performance among community members seems to be high. Where does it go, up or down?