Since the beginning of its existence, Bitcoin has been roundly criticized for the extreme volatility and risky character of its market. However, recent occurrences in the cryptocurrency space seem to lend credence to the aforementioned worries.

Bitcoin has lost 3.8% in value over the past twenty-four hours, settling at $17,400 at the time of this writing. Despite the fact that 2018 was a rough year for the vast majority of the cryptocurrency market, there appears to be no shortage of believers that 2023 will provide an opportunity for recovery. This was demonstrated by a survey conducted by Coinmarketcap, a well-known cryptocurrency analytics platform.

At the time of publication, the results are overwhelmingly optimistic, with 83.2% of respondents indicating a bullish outlook for the next year on the cryptocurrency markets, according to data obtained by Coinpedia on December 15. On the opposing side, 16.89% of voters are bearish about the future market conditions in 2023.

Benjamin Cowen, a cryptocurrency analyst who is also the founder of the well-known CryptoNewsletter, recently sent out a bitcoin analysis video to his nearly 800,000 subscribers. In the video, he compared several bitcoin bear markets.

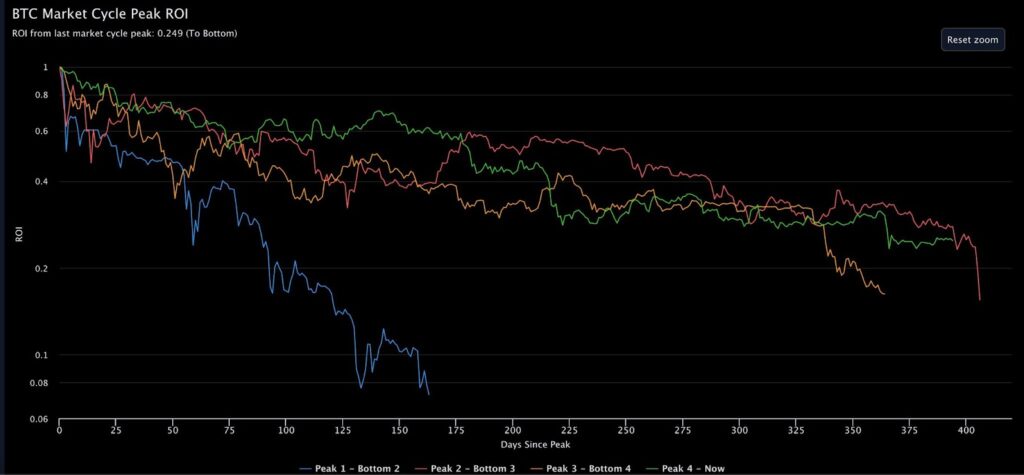

The Bear Market Cycle Peak ROI is a helpful indicator that can be used to detect capitulation levels of the current cycle in bear markets. Analysts evaluate the extent of the market’s current losses by evaluating the Return on Investments from the top of the current cycle. The current bear market is in the green line.

According to the analyst, if April is considered to be the peak for BTC, this bear market lasted for 401 days, which is quite a long time and makes it the second longest BTC bear market in the history of the cryptocurrency.

The one that lasted from November 2013 all the way through January 2014, a total of 406 days, was the longest. That is to say, if Bitcoin (BTC) does make a new bottom in the next five days or more, it will break the record and become the longest bear market in the history of Bitcoin.

According to Cowen, there are many reasons to believe there will be no new bottom, but there are also many reasons to believe so.

He went on to say that even if the BTC has reached the bottom, this does not indicate that the bear market is about to end.

Cowen believes that things will start to turn neutral sometime in 2023 and that we will start to see some strong bullish signs as the halving approaches.

What Can You Expect From BTC in the Coming Weekend?

Goldman Sachs opines that Bitcoin’s present value is driven by the breadth of its potential future use cases, making it both extremely volatile and a solution in search of a problem.

The recent price increase of BTC is an encouraging indicator of market demand. This is especially true now that BTC has fallen from $20,000 to $15,600 following the FTX crash and is trading at $17,600, slightly above the June low.