Bloomberg Intelligence senior commodity analyst, Mike McGlone, believes a “warm spell” is coming in terms of bitcoin markets as the market strategist detailed on Monday that “bitcoin appears poised to resume its inclination to outperform.” McGlone’s comments follow his previous prediction that noted bitcoin and ethereum appear to have “completed the bulk of their drawdown.”

Mike McGlone Believes A Crypto ‘Warm Spell’ Is In The Cards, Suggests A Resurgence In Bitcoin’s Value When ‘The Fed Pivots To Easing’

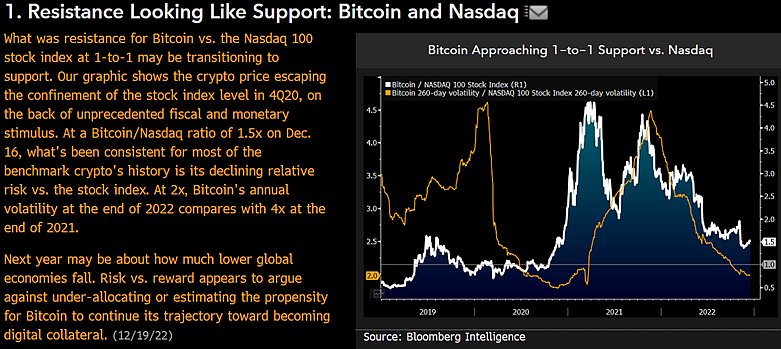

Mike McGlone believes bitcoin is in for some healing ahead as he tweeted about “warmth” as recently as Monday. McGlone’s comment details that “what was resistance at 1:1 for bitcoin versus the Nasdaq 100 stock index may transition to support.” McGlone also shared a chart that he says “points to crypto price escaping stock index level confinement in 4Q20, on the back of unprecedented fiscal and monetary stimulus.”

Right now, McGlone says what’s been consistent for most of the benchmark crypto’s history is “its declining relative risk vs. the stock index.” “At 2x,” the market strategist continues, “Bitcoin’s annual volatility at the end of 2022 compares with 4x at the end of 2021.” Bloomberg’s senior commodity analyst added:

Next year could be about how far down the global economy sinks. Risk versus reward appears to argue against allocating less or speculating for bitcoin to continue its trajectory towards becoming a digital collateral.

Bitcoin is down more than 75% lower than the crypto asset’s all-time high (ATH) reached on Nov. 10, 2021, at $69,044 per unit. Over the last 14 days, BTC has slid 2.3% lower against the U.S. dollar and since the start of Nov. 2022, following the FTX collapse, BTC has dropped 16.5% against the greenback. Bitcoin’s market capitalization is around $322 billion, which represents 38.2% of the $843 billion crypto economy.

McGlone suggests that the bitcoin heat will not fructify until the US Federal Reserve moves towards monetary easing. “A hot spell ahead,” said McGlone. “Bitcoin Crosses Versus Trend to Outperform – The world’s benchmark digital asset has taken a beating along with most others in 2022, but bitcoin looks set to resume its propensity to outperform. When the Fed turns to easing is,” McGlone’s tweet ends.