What Is MELD?

In one sentence, MELD is a decentralized non-custodial banking protocol. MELD was started in April of 2021, and its development is done by MELD Labs, based in Singapore. The governance is done by MELD Foundation based in Switzerland. They oversee, for example, all of MELD’s fiat bank accounts. While only a young project, MELD has a large team of 25 people plus 9 reputable advisors. Partners include both native crypto projects like Polygon and traditional companies like the Agri-Fintech company Tingo. Lastly, MELD also has a handful of respected investors, including Silicon Valley Blockchain Society and Brotherhood.

Being in an extremely early stage, they don’t have many of their planned features up and running just yet, but according to their roadmap, which I’ll be covering later, many things are coming during this year. Once fully operational, MELD will be found on IOS, Android, web browser and as a chrome extension. Currently, you can only access MELD’s dapp in the browser; the mobile applications should be available sometime in Q2 or Q3. MELD is also not yet fully decentralized, but they have a roadmap for that too. Also, although decentralized, you still need to complete KYC/AML to get access to most of the features. This is naturally understandable since you’ll be receiving funds to your own bank account etc.

According to the MELD whitepaper, they want to provide individuals with control of their own finances. Basically, anyone is the key customer for MELD, but they multiple times highlight the need for financial services for the unbanked. The whitepaper talks about $15 trillion being left out from the traditional financial system. However, while the thought is excellent and they’re working on making it a reality with partnerships like the one with Tingo, I believe that crypto companies and individuals will at least, in the beginning, be key customers.

How Does MELD Work?

As mentioned, MELD will have a lot of features, and most of them are still up and coming. Here I’ll go through the most basic features and how they work, and then we’ll look at the rest in the next section. Being a lending protocol, we’ll start with how that works.

From the picture above, you see how all the pieces fit together, but to make it simpler, we’ll go through the procedure step by step (ignore the numbers in the picture). If you go to MELD to get a loan or a line of credit, the first thing you do is provide collateral. The accepted cryptocurrencies are ADA, ETH, BTC, and BNB. After providing collateral, you’ll be able to borrow 50% of the value of your collateral and receive the funds to your account as a wire transfer. The money you borrowed will come from the fiat liquidity smart contract supplied by fiat lenders. Now you have the loan, and as with any loan, you’ll pay the interest and principal monthly until the loan is fully paid back, at which point your collateral will be released and returned to you. The interest rate you pay will depend on how much fiat liquidity is available and how many want to borrow, so basic supply and demand economics.

That’s essentially how the protocol works if everything goes according to plan from the borrowers’ side. As I mentioned, you can borrow in an LTV ratio of 50% (loan-to-value), but it doesn’t mean you should and here’s why. If the value of your collateral drops so that the LTV becomes 65% or stays over 50% three days, then a margin call will happen, and you must provide additional collateral to bring back the LTV to 50%. If not provided or the LTV hits 85%, an automatic liquidation event happens. The collateral is sold for USD/EUR and transferred back to the customer, minus a 5% fee. This is why you need to keep an eye on your LTV and maybe leave some room and not borrow the full 50%. The MELD app will inform you if your LTV changes; the data is sourced to various data oracles.

Additional Features of MELD

Because the whole defi industry is relatively new on Cardano, there isn’t yet a lot of infrastructure in place. This applies to, for example, wrapped assets. As you can probably guess, MELD will solve this. MELD will support defi infrastructure to wrap assets. These wrapped assets will be called MELDed assets. The initial stage will only include BTC, ETH and BNB, but the plan is to support other ERC-20 and BEP20 tokens later on. This will be managed through MELD DAO, and a 0.2% fee will be collected on every transaction. The wrapping of BTC and ETH will be done using Polygon, and for BNB, they’ll work with the Binance Smart Chain network.

Next up on the list is the MELD debit card. The details around the card are quite thin, while the competition in this space is fierce. The idea is to allow people to spend their money without cashing out of crypto. I don’t know the benefit of using their card, but I can imagine that some cashback can be earned. If the card is seamlessly integrated into MELD, I could imagine it could be a nice addition if you’re a user of their other services. Also, the card looks quite nice in a picture in their whitepaper.

MELD Tokenomics

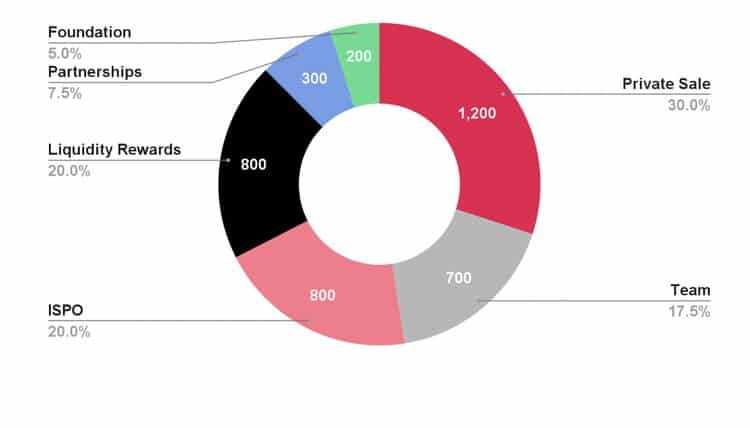

As mentioned, MELD has a native token called MELD. This token was first distributed via a private sale. Later, the public could enter through an Initial Stake Pool Offering (ISPO). An ISPO works with people delegating their ADA to a specific staking pool. In this case, MELD had two staking pools where one would give you rewards in MELD and ADA while the other only distributed MELD tokens. In the first staking pool, MELD acquired 50 % of the ADA block rewards, and in the second, they got 99%. Once the ISPO was finished in December of 2021, all the participants were airdropped their MELD tokens. This solution was done because the MELD team felt this was the fairest way. Currently, MELD is only available on Bitrue and FMFW.io, according to CoinMarketCap, but the team is working on making the token more accessible.

From the image above, you see the token distributions in percentages. While the ISPO itself might have been quite fair, the allocation to the public is relatively small. When it comes to vesting schedules, I’ll leave a picture down below, but essentially all participants will have their tokens released gradually. The team and advisors will have to keep their tokens locked up for 9 months after the token launch, and then they’ll be released 4% a month. The private sale investors will be able to unlock their tokens from the beginning with a 4% a month rate, meaning they don’t have the 9 months lock-up.

MELD Compared to Others

You’ll see how MELD compares to some well-known cefi platforms from the picture below. While it seems that using MELD is a no brainer, we do need to be a little critical. First, MELD does not really offer the same things compared to the others. The other platforms are fully functional and add to and improve their services as we speak. The offering of these platforms has improved and become substantially wider from the time this whitepaper was written. MELD, on the other hand, doesn’t have any of their core functions functionality just yet, meaning theoretically they sound better than others, but in the real world, they’re far behind. Now that doesn’t mean they can’t become the best; it just means that all of what they’re saying is only theoretical at this point.

However, if we look at these things without accounting that MELD isn’t fully operational, they have some exciting benefits. First of all, as I already mentioned, the Genius loan itself sounds extremely intriguing, and I think it can be a good demand driver for MELD if the interest rate isn’t too high. Another thing I also mentioned as a substantial benefit is the non-custodial part which I believe will also be a good demand driver.

MELD Roadmap

The MELD roadmap is quite extensive since, as I’ve made clear multiple times in this article, there aren’t a lot of features available just yet. If you’re interested in looking at the detailed roadmap, you can use this link. Now, most of you probably want to know when we’ll see the most basic functions like borrowing and lending, and I’m sad to tell you that you’ll have to wait over six months. Borrowing and lending are going live on a testnet in Q3 of 2022 but won’t be fully available until Q4. Before that, there aren’t really that interesting or meaningful things going on from a consumer standpoint but rather more technically significant milestones. However, these milestones will be significant for the final product, which might be a reason to follow what’s going on to see if everything is moving on schedule. A few things also seem to be a little open about when the mobile application will be released. As a matter of fact, it wasn’t even listed, and I had to ask a member of the MELD team for more information. But speaking of the team, I have to credit them for helping me out and answering my questions whenever I had any. It’s always great to see that a team cares about those interested in their product.

Final Thought

On paper, I have to hand it to the MELD team that they’ve done an excellent job, and I believe they’ve got a chance to become a top tier defi protocol. The competition is fierce, and it might be hard to distinguish from them, but the team seems to know where to take the project to do that. Still, everything has to be proven, and before I see a working product, it’s hard to give them all too much credit. One concern is that if their launch dates are pushed much further back, they might be too late in the game. As mentioned, their competitors are consistently improving their own products. I believe that changing services is a far higher barrier for many than to start with one, especially if you’ve already locked up a substantial amount of funds on some other platform or maybe even have a loan from some other place.