There are many traders out there who are interested in using trading bots, and others who are already using them with success. The issue with bots is that they can be difficult to configure and add to your trading if you don’t have the know-how. But one exchange is fixing that by offering built-in bots! We’ll be discussing how in this Pionex Review.

That exchange is Singapore-based Pionex, and they have 12 different trading bots that can be added to your account, with no experience needed on your part. You simply set the bot to be trained and let it run, generating profits in many cases as it does so. Honestly, the performance reported by many users from the Pionex bots is truly impressive.

Pionex Summary

It’s not surprising that in a technologically focused field like cryptocurrencies traders have turned to technological solutions to their trading. This is creating increased popularity for automated trading, or “bot trading” as it is also called.

There are several platforms that have begun to use API keys to allow automated trading to occur 24×7. This has been a relief for traders who use technical signals since it means they are no longer glued to their computer screens, watching each tick of the markets.

The biggest problem with trading bots has always been the complexity involved. Even if you can’t program them yourself you do need to have some background in programming in order to monitor the bot and make changes to its code if markets shift. And then there was the cost of buying or renting the bots from their creators. In some ways it was simply more trouble than it was worth.

Pionex has changed all that when they launched in 2019 with free, built-in trading bots. They provide the bots, and they provide them for free. All you pay is the small trading fee, just as you would at any exchange when trading manually.

Better still, it isn’t just one or two bots to choose from. It isn’t even six bots. No, Pionex offers twelve different trading bots, all operating on different algorithms and targeting different market conditions.

Regulation and Security

The team behind the Pionex Exchange is the BitUniverse team. BitUniverse is an all-in-one crypto auto-portfolio and trading bot App and the most popular crypto portfolio App in South Korea, Indonesia, and Taiwan.

Thanks to the size and reach of this company Pionex has been able to achieve regulation, giving all its clients the peace of mind knowing there’s oversight on the broker’s activities.

Traders can rest easy knowing that Pionex is regulated in both Singapore and in the U.S. In April 2020, Pionex was granted the U.S. MSB (Money Services Business) License by the U.S. Treasury Departments Financial Crimes Enforcement Network (FinCEN).

It’s the same license that Binance, Huobi, and multiple top exchanges have received. Pionex is the first cryptocurrency exchange with in-built trading bots that has been granted this U.S. MSB license.

Pionex Trading Bots

Pionex is the very first exchange that’s focused exclusively on trading with bots, so let’s start by taking a look at the twelve different bots. We know this is the meat of the matter!

- GRID Bot (Grid Trading Bot) — The GRID Bot is the original trading bot from Pionex that looks to profit from normal market fluctuations. Users set a range for the bot and it works to buy low and sell high within the specified range.

- Spot Futures Arbitrage Bot – Thanks to the perpetual futures market in crypto there is often the chance to profit from arbitrage trades that capitalize on the difference between the price in the futures market and the spot price of the crypto. The Spot Futures Arbitrage Bot targets earnings of 15-50% APR with an extremely low risk arbitrage strategy.

- Infinity Grids Bot — Because the GRID Bot is best for sideways markets it’s possible that profits will be missed if the market begins trending. That’s where the Infinity GRIDS Bot comes in handy. It works in a similar manner to the GRIDS Bot, but has no upper range limit.

- Leveraged Grid Bot — Combining the GRID Bot with margin loans is how the Leveraged Grid Bot amplifies the results you would get from the original GRID Bot. Leverage is available as 1.2x, 1.5x, 2x and 3x, which increases the potential profits you can earn as your bot trades 24×7.

- Margin Grid Bot — The Margin Grid Bot allows you to lend out your BTC or USDT and earn additional yield while also profiting from the GRID Bot strategy.

- Reverse Grid Bot — The Reverse Grid Bot is used to increase your holdings as price falls. It will sell coins when price reaches highs, and then average back into the position as price retreats. It compliments the GRID strategy by increasing your total coin holdings.

- Leveraged Reverse Grid Bot — The Leveraged Reverse Grid Bot works in exactly the same way as the Reverse Grid Bot, however it adds leverage to super-charge trading results. Traders can choose from 1.2x, 1.5x, 2x and 3x leverage to amplify trading results.

- Smart Trade Bot — The Smart Trade Bot will allow you to get in on market trends and collect profits without exposing your account to excessive risks. It combines buying and selling concurrently with fixed or trailing stops to limit the market risk.

- Trailing Sell Bot – Avoid selling too early in a pumping market. The Trailing Sell Bot lets you place a trailing stop on all your orders, limiting the potential losses if the market suddenly reverses.

- Trailing Buy Bot – The best tool for buying the dips. The Trailing Buy Bot will continue adding to your position as price falls, and then stop buying once a bottom is reached and price snaps back and begins heading higher.

- DCA Bot (Dollar-cost averaging) — The Dollar-Cost Averaging Bot allows you to set a recurring buy at intervals. Purchases are made based on time rather than price, which gives you a better average price over time. Pionex lets you choose one of the following 5 time intervals for the DCA strategy: 10 minutes, 1 hour, 1 day, 1 week and 1 month.

- TWAP Bot — The TWAP Bot is an excellent way to buy or sell large quantities of crypto without influencing the market price. Whales often use this strategy when they are loading or unloading their bags. Basically the TWAP Bot is a way to execute one large order as many smaller orders over a given period of time.

Liquidity Aggregated Engine

Pionex is able to run its bots 24×7 because it is the first exchange that is aggregating the liquidity from both Binance and Huobi Global. By combining the liquidity from these two leading global exchanges Pionex is able to ensure it can always match the orders the bots need to continue performing.

According to the CTO of Pionex roughly 60% of the Binance and Huobi orders are aggregated and available to Pionex bots and traders. The reason it isn’t 100% is there are always some fake orders on the order books. But even 60% of the liquidity from these two brokers is enough to ensure the automated trading bots from Pionex can perform properly.

Low Pionex Trading Fees

Because Pionex is a market maker for Binance and Huobi Global (and one of their largest customers) it benefits from extremely low trading fees from the two exchanges. That’s how Pionex can offer trading fees of only 0.05% for all trades. And still provide traders with free trading bots while enjoying the immense liquidity from Binance and Huobi.

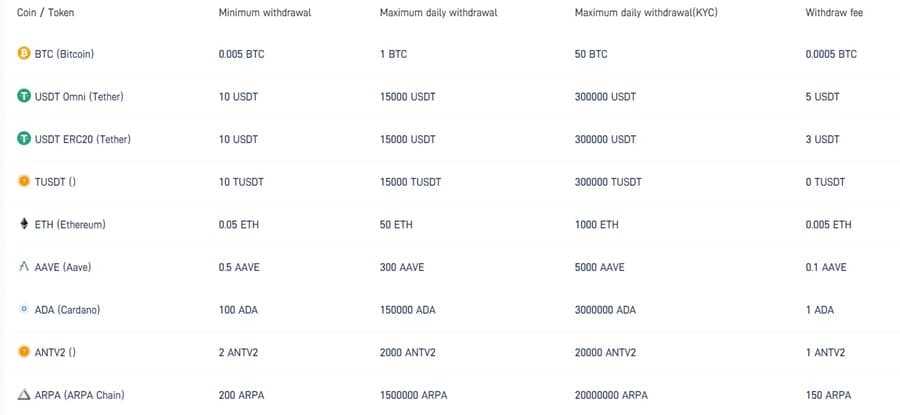

In addition to the trading fees there are withdrawal fees, but those are basically the network fees for each coin. The withdrawal fee differs from coin to coin, but you can see the full fee schedule here.

Pionex Assets

Pionex is more than just a broker with trading bots. They also support regular manual trading, which is still attractive given their low fees. And you can choose from more than 120 different cryptocurrencies and hundreds of trading pairs.

How to use a GRID Bot on Pionex

The GRID Bot is the original trading bot from Pionex and it remains the most popular as well. In order to keep this article from going too long we’ll look at how the GRID Bot is set up and configured. For instructions on setting up the other 11 trading bots have a look at the Pionex Blog.

While there are several other platforms that offer trading bots (3Commas, Bitsgap, TradeSanta, etc.), Pionex was the first and all the others have copied the UI/UX used by Pionex. So, once you know how to add and configure a GRID Bot at Pionex you can probably figure out how to configure bots elsewhere as well. But why bother when Pionex offers so many free trading bots, and such low trading fees?

Using the GRID trading bot is fairly straightforward and begins with logging into your Pionex account, or creating one if you don’t already have one. It’s also possible to log in using your BitUniverse credentials if you have an account over there. If you do need to create an account it’s pretty quick and easy. As you can see the registration form will take less than 30 seconds to complete.

If you want to increase your deposit and withdrawal limits later you can complete the KYC process, but it isn’t necessary. Once your account is created you can deposit and get started. Pionex accepts deposits in BTC, USDT, ETH, and 36 other cryptocurrencies.

How the “AI Strategy” Grid Bot Works

- First the bot looks at the volatility of the coin over the prior seven days. It uses this to set the upper and lower limits for the range that will be used for the GRID bot strategy.

- Next it splits the amount that you’ve allocated to the trading pair chosen. Call this hypothetical pair XXX/YYY. Half your investment will go to XXX and half will go to YYY.

- Then it sets up a grid of limit buy and sell orders within the range already specified. Those are the trade triggers.

- As price increases the bot sells XXX when the trigger levels are reached, taking profits in YYY on the way up. Once price reverses the bot will buy YYY while selling XXX. The bot will continue doing this for as long as price remains within the range set by the AI.

How Grid Bot Works in Set Myself Mode

The Set Myself mode allows you to set all the parameters yourself. This means you are able to change the upper and lower limits of the range, the number of grids used, and the distance between the grids.

For those with the appropriate knowledge and skills this allows for the trader to make adjustments based on their own knowledge. Note that when working in manual mode the distance between grids must be larger than the size of the commission times two for the bot to trade profitably.

Pionex Customer Service

Pionex only offers customer support via Telegram and email. While that might discourage some users, online reports are that customer support is quite good. When we tested the support channels by emailing with some basic questions we did receive a quick response. That’s likely because support is being provided by the parent company BitUniverse. Looking around the Telegram channel it looks more like a forum thread for traders than a support channel.

Maybe we are old fashioned, but we really would like it if there were a way to directly contact support. A telephone number would be excellent, but even an online chat app would be preferable to the current Telegram/email support.

Final Word

Perhaps the most impressive part of Pionex is the ability to use their out of the box AI bots to make a profit. And that the bots offered are completely free, with Pionex keeping just a small trading fee.

In fact, when Pionex launched in 2019 they did so with a promotion using the phrase “Users keep the profits, we take the loss.” That’s right, they were taking any losses suffered for users running their bots in automatic mode. Now that’s confidence in your product.

If automated trading is your thing then you really do need to check out Pionex. We think it will end up as your top choice for bot trading. Not only are the bots free to use, and profitable to boot, they are also just so darn simple to use. There’s no more need to worry about setting up API keys or dealing with their unstable performance.

Pionex is a true simple solution to automated trading. You can honestly have an account registered, a deposit made, and a GRID trading bot set up within minutes.