Perhaps the most underrated and under-utilized potential for cryptocurrency is leveraging the benefits of CeFi lending platforms. Why I believe many overlook the opportunities offered here is that the yields don’t match our expectations when crypto is the topic. Many get into crypto for those +100% earnings in a couple of weeks rather than earning 10% a year. However, remember that traditionally the stock market was viewed as the asset class with the highest returns at 7-9 % a year. That’s why we shouldn’t overlook the potential crypto earnings just lying around.

In this article, I’ll go through the top 4 centralized (CeFi) lending platforms. I know some of you prefer DeFi platforms to centralized crypto platforms, but seriously, some of these Centralized Finance platforms are great and there are many benefits these platforms offer. Plus, I know some might appreciate the feeling of a more secure environment (not saying it is).

Quickly before starting, I want to point out that not all of these platforms are available globally, so you’ll have to check on that before using them. For example, I know that YouHodler and Swissborg are completely out of reach for US customers while Nexo has also recently announced its withdrawal from the US markets. Also, a few of these platforms have their own tokens and the tokens might also be out of reach for US customers.

Nexo: Great CeFi Rates

Nexo is a subsidiary of Credissimo that was founded all the way back in 2007. The Nexo platform was deployed in 2018. To date, Nexo has paid over $200 million in interest, gathered over 2.5 million users in over 200 jurisdictions, and supports 27 different cryptocurrencies. Nexo offers both lending and borrowing as well as a payment card. Nexo also has its own native token called NEXO.

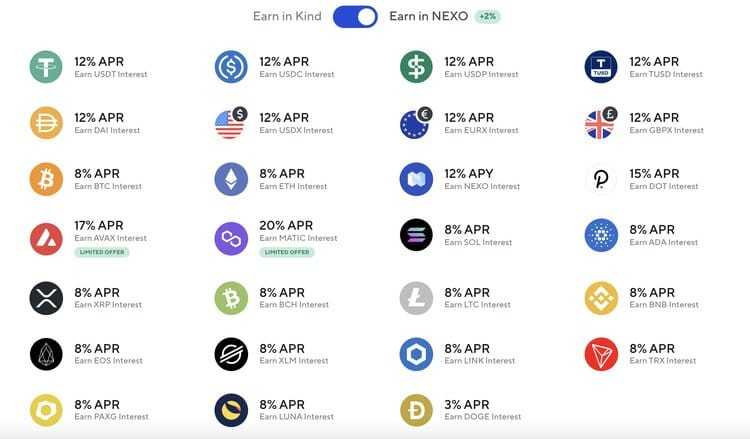

Starting with lending, Nexo has extremely good rates and for almost all tokens they’re higher than what most other platforms offer. For example, the interest on your Bitcoin and Ether can be as high as 8% if you opt for a fixed term and get paid in Nexo tokens. Other interest rates are also extremely high, DOT at up to 15%, and then AVAX and MATIC have limited time boosted rates 17% and 20% respectively.

For stablecoins, the rates are up to 12% but what really differentiates Nexo is that you can lend fiat money too. Currently, it’s possible to lend USD, EUR, and GBP, the rates are the same as for stablecoins. What’s also different with the Nexo CeFi platform is that the interest earned is paid daily while some platforms pay weekly. However, while some might enjoy this depending on where you live, I would not since it would be a huge burden to keep up with the taxes, so make sure to check what the reporting requirements in your country are and be sure to follow them.

When it comes to borrowing crypto, you’ll be happy to know that interest rates can be as low as 0% in certain situations, and they never exceed 13.9%. I couldn’t find exactly what the interest rates for different situations look like even though they have a borrowing calculator on their site, so be sure to use the calculator before jumping in so you know exactly what to expect.

Crypto.com: Crypto Loans and More

Crypto.com has become a go-to platform for users with various different crypto needs. This powerhouse platform supports just about everything crypto-related such as trading, an NFT marketplace, a self-custodial DeFi wallet, their own blockchain network, one of the most popular crypto cards, an attractive Earn program, and of course, crypto loans.

With Crypto.com, users can earn interest on their crypto holdings up to 12.5% APY through the Earn program, and take out crypto-collateralized loans up to 50% LTV. Interest rates will heavily depend on how many of the platform’s CRO tokens a user stakes and the TVL selected. Here is a look at the repayment rates for crypto loans:

Users who take out crypto loans on Crypto.com can pay the loans back on their own schedule and can deposit 20+ crypto assets as collateral, borrowing PAX, TUSD, USDC, or USDT without credit checks, statement deadlines, or late fees.

As far as the Earn program goes, Crypto.com users can earn passive income on 37+ crypto assets, making this one of the best earn programs available, with up to 6.5% p.a on USDC stablecoin, and some of the highest returns on multiple altcoins depending on how much CRO the user stakes.

YouHodler: Unique CeFi Provider

YouHodler was founded in 2018 and differentiates itself by supporting a multitude of different currencies that others don’t. Another difference is that they have a few unique features, however, with the downside that a few features like a payment card aren’t on the list.

As with all the others let’s start with lending. YouHodler offers competitive interest rates with 12 % on most stablecoins, 4.8 % on BTC, and 5.5 % on ETH. On top of that they have rates on coins like YFI (4.5%) and Sushi (7%). Altogether YouHodler supports 39 different cryptocurrencies. The interest is paid weekly in the same currency you deposited, nothing new here.

The borrowing side is also fairly similar to others excluding one major difference. On other sites, the amount you can borrow on your collateral is around 50% while YouHodler allows as high as up to 90% and you can use all of the top 20 coins as collateral.

Now, while some might think this is great, I find it a bit scary. That’s because cryptocurrencies are extremely volatile, and your collateral might easily drop in value and leave you with a huge amount of debt compared to what’s left of your collateral. Speaking of collateral, YouHodler also offers the possibility to provide NFTs as collateral but that needs to be applied for separately. Now I don’t know which collections are supported but my guess would be that those blue-chip NFTs like BAYC and Punks are among them.

The two features not offered on other platforms are Turbocharge and Multi-Hodl. These are essentially borrowing, and lending combined with steroids. When using this what happens is that you put your coins as collateral and take a loan with which you’ll buy more crypto which will again be used as collateral for a new loan, and so on (everything is done automatically of course).

What should immediately go through your mind is the extremely high risk of this and as a personal opinion, I wouldn’t suggest this to anyone. The potential gains are nice, but you can lose a lot of money with this which is why YouHodler itself doesn’t suggest allocating more than 20% to this and the rest in traditional savings (traditional meaning the normal crypto lending).

Swissborg: CeFi and Crypto Exchange

As with YouHodler, Swissborg is vastly different from the previous platforms mentioned. This centralized finance platform is the only place I could consider using as my exchange and the yield earning possibilities are an extra bonus to use in earning additional rewards on my portfolio. Swissborg was founded in 2017 and has since gathered over 1 million users with over $1.6 billion on the platform. Different from the other platforms Swissborg doesn’t offer borrowing, but how are the yields?

Well, I have good news and bad news. The yields are great IF you have the genesis premium plan which boosts your earnings by 2x, I’ll get to the plans later. If you have the genesis premium, you’ll be earning almost 9% on stablecoins and for big boys BTC and ETH roughly 1% and 5.6% respectively. Now you might be wondering what else you can earn interest on and sadly there’s not much to wonder about since including those mentioned above Swissborg only supports earning on 9 different cryptocurrencies. The highest yield here is that of the Swissborg native token CHSB and currently, the rate is sitting at 24%.

Why I said I might be open to using Swissborg as my exchange is because with the genesis premium you get low fees of only 0-0.25%. On top of that Swissborg offers some analytics tools as well as good portfolio statistics. They also allow trading with many more cryptocurrencies than they offer yields on, so you don’t need to be worried about that.

Now to the disappointing part. I’ve been writing about the wonderful things in Swissborg for those who have the Genesis premium, but the truth is that I don’t think many will go for it. In order to get it you need 50 000 GHSB tokens which will cost you over $30k in today’s prices.

Another possibility you can go for is the community premium which only requires 2000 GHSB tokens (≈ $1200). With the community premium you get 1.5x yield boost and 0.75% trading fees. Now depending on the size of your portfolio, this could be worth it since the GHSB has been able to get you a 115% gain in 1-year excluding the high staking rewards on top of that, but it’s up for you to do your own research and decide.

Final Word

Before getting to the actual conclusion, I just wanted to quickly add that all of these platforms are available as mobile applications and some of them are even mobile-first built. Therefore, if you can’t seem to have access to some features, you should check if it’s available in their mobile app.

Another thing I want to remind everyone about is that the rates stated here do fluctuate based on supply/demand. Those high rates for DOT might quickly fade if more people lend them. Also, the total amount you receive does take a hit if the underlying asset falls in value so don’t trust all the calculations you do to a full 100% since your earnings will fluctuate.