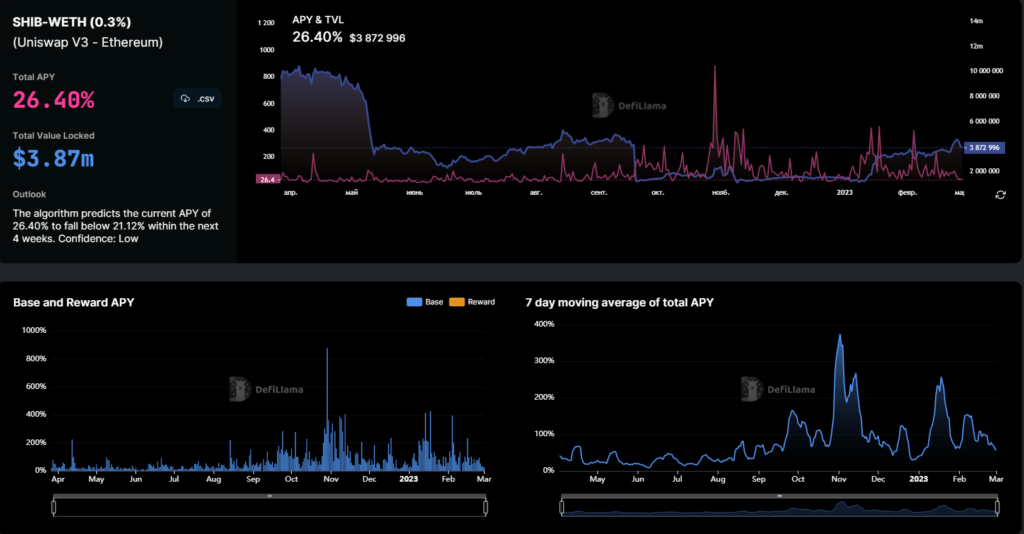

Shiba Inu, the meme-inspired cryptocurrency, has experienced a significant drop in its APY (Annual Percentage Yield) in one of the largest liquidity pools on Uniswap. The APY has gone from almost 400% to around 20%, which could indicate that fewer SHIB rewards will be released on the market.

Liquidity provision plays a vital role in enabling the smooth trading operations of digital assets by facilitating easy entry and exit for traders on the market. It involves contributing a certain amount of cryptocurrency to a liquidity pool, which in turn grants the user a portion of the trading fees and LP tokens proportional to their investment.

High APY rates can be enticing to investors, but they can also be a warning sign of high risk. Extremely high APYs can be unsustainable and indicate that the market is overheated, or there is too much volatility. The sudden drop in Shiba Inu’s APY could be seen as a positive sign, suggesting that the market may be stabilizing and that the token’s value is no longer being artificially inflated.

Shiba Inu has been experiencing a tumultuous period, with the coin’s value plunging in line with the broader cryptocurrency market. As of press time, SHIB is trading at $0.0000123, down from its all-time high of $0.0000377 in early May. Despite the drop, the coin continues to be popular among retail investors, who are attracted to its meme-inspired branding and low price.

The drop in Shiba Inu‘s APY could lead to a shift in sentiment among investors, with fewer people being attracted to the high-risk, high-reward proposition that the cryptocurrency represents. Instead, they may opt for more stable investments or liquidity provision opportunities for lower but more sustainable returns.