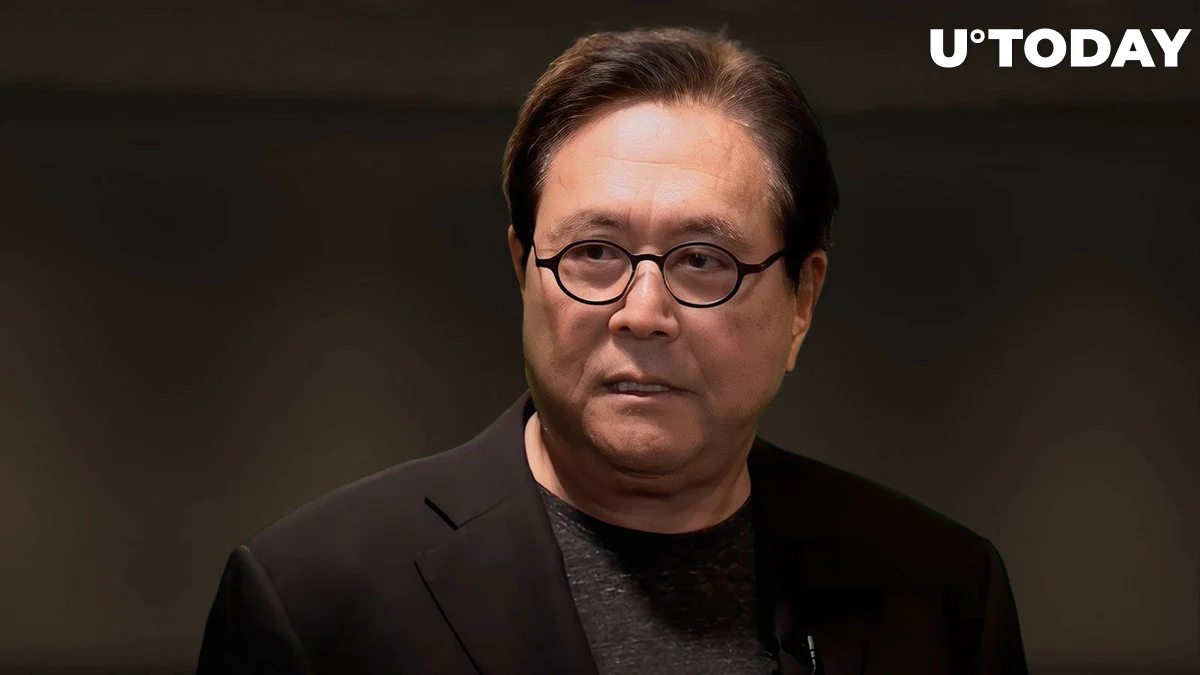

Robert Kiyosaki, a vocal proponent of Bitcoin and author of the well-known book “Rich Dad Poor Dad” on financial self-improvement, has commented on the collapse of the share price of San Francisco’s First Republic Bank on Twitter.

“Fed is killing regional banks”

According to Kiyosaki, the Federal Reserve is obliterating local banks all throughout the United States through the repo market. Those banks are the “heart and soul of the economy,” he continued. Around ten banks have opened in the United States since the beginning of the year, including Silvergate, Silicon Valley Bank, and Signature Bank.

The U.S. government provided bailout funds for the other two while closing down Silvergate. The First Republic Bank stock price fell yesterday, and deposits fell by tens of billions, intensifying the U.S. financial crisis. The bank must now decide whether to sell its assets.

This caused the price of Bitcoin to briefly regain the $30,000 high.

However, on the same day, the leading cryptocurrency dropped precipitously to a level of $27,000; holdings in Bitcoin worth close to $190 million were sold on several cryptocurrency exchanges. There were $161.21 million (87.96%) of them on long BTC holdings.

This occurred at the same time as rumours of massive Bitcoin transfers between Mt. Gox and U.S. government accounts started to circulate.

According to Kiyosaki, the financial issue is even having an impact on the massive Amazon, which has had to reduce 18,000 positions in order to avoid a credit crunch. “Was this planned? Is depression deliberate?, the “Rich Dad, Poor Dad” author ponders rhetorically. He thinks it’s advisable for customers to withdraw their USD from local banks right now.

Bitcoin heading to $100,000, Kiyosaki believes

In a recent tweet, Kiyosaki made the assumption that the aforementioned financial crises and bank bailouts are driving Bitcoin’s price towards $100,000. Kiyosaki has generally identified the Fed’s excessive USD printing over the past three years as the main cause of the expected rise in the price of bitcoin. When the epidemic first appeared in 2020, the US government and Fed produced more than $6 trillion out of thin air.

Before predicting that Bitcoin would cost $100,000, Kiyosaki stated that he thought the top cryptocurrency may reach $500,000 by 2025 for the same reason.

The investor and nonfiction author tweeted three days ago that he likes fund manager Steve Van Metre and believes gold will fall below $1,000. Given that he is a long-term investor and not a trader, Kiyosaki claims that if that occurs, he will purchase more gold and bitcoin. Additionally, he views bitcoin and gold as “real money.”