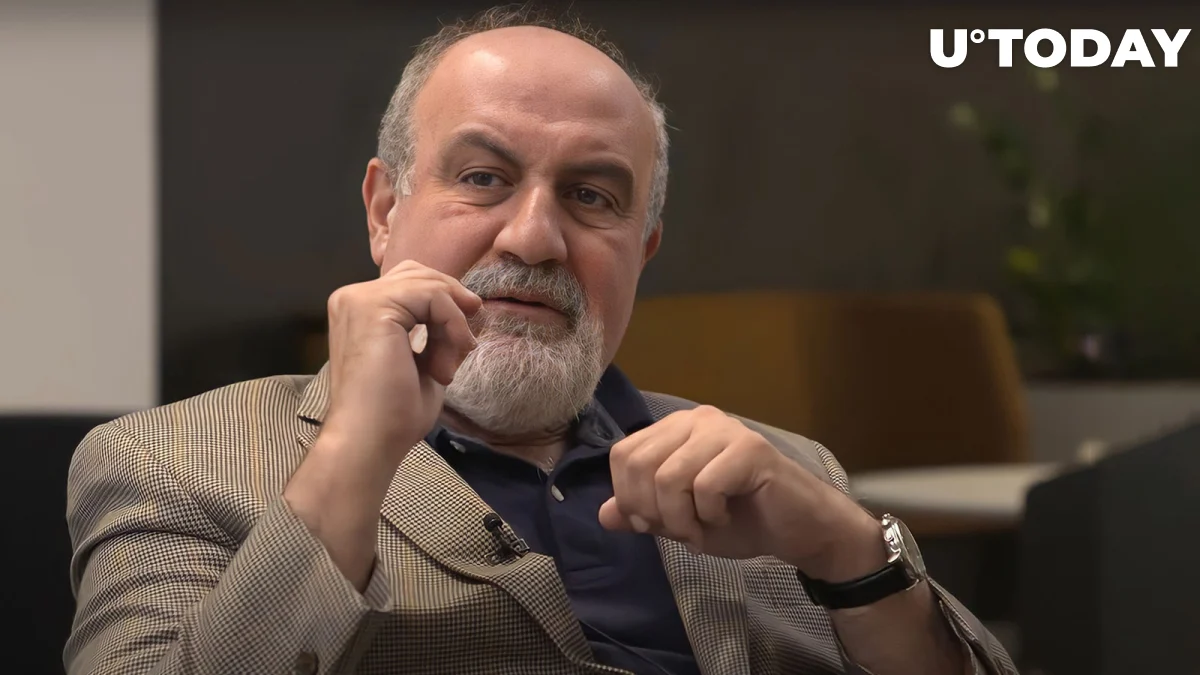

Nassim Nicholas Taleb is a well-known opponent of cryptography and is a risk management expert, mathematician, and author of multiple best-selling books on battling uncertainty (including “Black Swan,” “Antifragile,” “Skin in the Game,” and others).

He has used Twitter to draw attention to what he sees as the bitcoin market’s key flaw.

Taleb names crypto market’s weakest point

According to Taleb’s tweets, the market for cryptocurrencies is presently worth $1.5 trillion ($1.23 trillion, according to CoinGecko). However, he asserts in the tweet that the overall market value will decrease by 50% if participants in the market sell between 1% and 4% of the cryptocurrencies provided in it.

Typically, this relates to Bitcoin because it sets the bar for other cryptocurrencies’ pricing, making them connected with BTC — falling when BTC rises and rising when BTC goes up.

Bitcoin lover converted to BTC hater

Despite having formerly been a supporter of Bitcoin and having lauded it when a financial crisis and the “WhatsApp Revolution” rocked Lebanon in 2019, Taleb is renowned for his consistent and severe criticism of cryptocurrencies.

But in 2021, he sold all of his Bitcoin, citing the sharp volatility waves in BTC as the reason for this action. Then, he tweeted, “You can’t price goods in BTC.”

Bitcoin pushed back by Fed’s recent decision

Bitcoin has been rebounding over the past two months as a result of the US financial crisis, which saw several sizable regional banks fail, including Silicon Valley Bank, Signature Bank, and most recently First Republican Bank.

The price of bitcoin reached $30,000. BTC, however, dipped below the $29,000 mark three days ago when the Fed Reserve announced another rate rise. As of right now, it is trading at $28,568, according to CoinMarketCap.