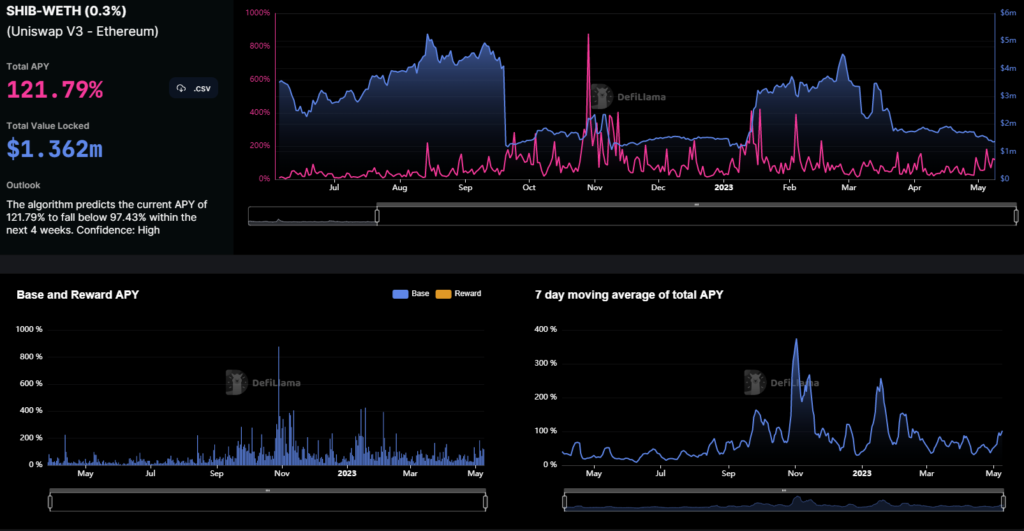

Shiba Inu (SHIB) has lately been in the news due to an extraordinary 120% annual growth in its Total Value Locked (TVL), which has surged. Many people are curious about the probable causes of this enormous spike. We will examine some of the potential causes of this extraordinary TVL development in this section.

The continuous liquidity issue the token is presently experiencing may be one of the main causes for the sharp rise in SHIB’s TVL. Offering high Annual Percentage Rates (APR) can be an efficient strategy to draw additional liquidity providers, which will ultimately solve the liquidity problem, as liquidity continues to be a critical component of any cryptocurrency’s success.

Shiba Inu is probably trying to stabilise the token’s liquidity and attract additional cash to its ecosystem by luring users with a 120% APR.

The recent price decline beneath the crucial $0.000009 mark is another element that might have led to the increase in SHIB’s TVL. A number of position liquidations and the unwinding of open Liquidity Provider (LP) positions may have been sparked by this unexpected price decrease.

The high APR provided by Shiba Inu may be perceived as an alluring chance for investors to recover some of their losses while supplying liquidity to the platform as they search for strategies to limit possible losses.

Additionally, the present market dynamics and investor opinion around meme coins may be contributing to SHIB’s explosive TVL. Shiba Inu’s TVL may increase as more retail investors flood the market, drawn by the potential profits of meme tokens. They may also be drawn by the high APR Shiba Inu is offering.