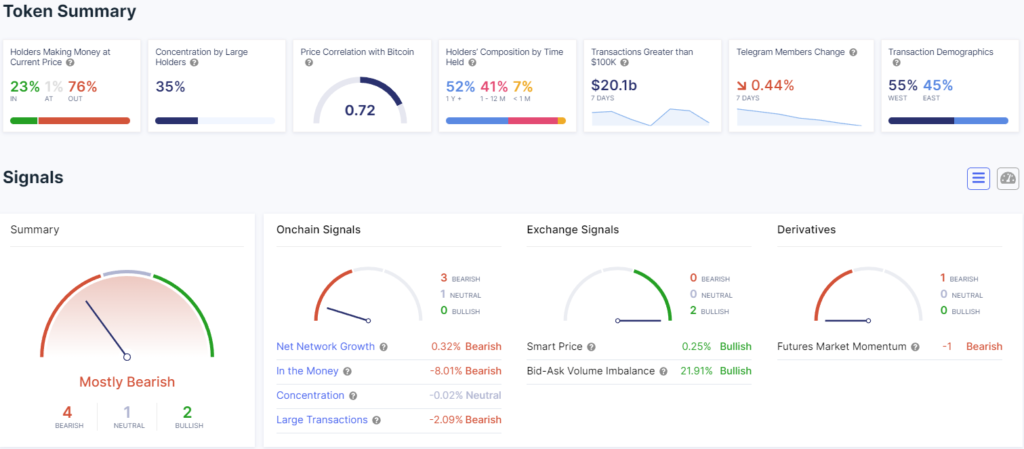

Cardano (ADA), despite a 2% decrease in price today, could be more optimistic than it first looks. A deeper examination of the on-chain data indicates a startling trend: more purchase than sell orders are being placed on the market. Given that investors appear to be placing their bets on ADA’s long-term prospects, this might perhaps be a hint of an impending reversal in the near term.

According to recent statistics, buyers are entering the market and buying up ADA at the present price levels. The idea that the digital asset is cheap and destined to see considerable price growth in the upcoming weeks or months may be the source of this purchasing push. The fact that this trend is developing despite a general market decline highlights the strength of Cardano’s fundamentals even more.

The project’s consistent advancement in terms of development and acceptance is one aspect of the optimistic feeling around Cardano. The long-term potential of the digital asset is further enhanced by the rising interest in Cardano’s DeFi and NFT platforms as well as the continued development of scaling solutions like Hydra.

Cardano’s emphasis on sustainability and energy efficiency is maybe another factor luring investors to the cryptocurrency. Proof-of-stake (PoS) cryptocurrencies like ADA provide a more environmentally friendly alternative to energy-intensive proof-of-work (PoW) cryptocurrencies like Bitcoin in light of rising concerns about the environmental effect of cryptocurrency mining.

Despite the market’s current bearish trend, Cardano’s solid fundamentals and the positive on-chain data may act as a catalyst for a future price increase. Investors should closely monitor market dynamics and look for clues that a trend is about to change, such as an increase in trading volume or a break over significant resistance levels.