Less than 24 hours after launching a complaint against Binance, the Securities and Exchange Commission (SEC) has now started legal action against Coinbase, a significant U.S. cryptocurrency exchange. According to the SEC, Coinbase functioned as an unregistered broker and avoided a disclosure system for securities markets beginning as least in 2019.

It’s unsettling to note that the regulator’s action also asserts that Coinbase offered unregistered securities, including the Cardano token, ADA, which was also included in the most recent case against Binance.

According to the SEC’s filing, ADA is regarded as a security as a result of information that Cardano, IOHK, and Emurgo have publicly published, especially since the initial sale of ADA. The claim made in the case is that owners of ADA, including those who purchased the Cardano token after March 2021, were misled to believe they were making an investment in the Cardano Foundation, IOHK, and Emurgo. These investors anticipated a later increase in demand and value for their investment, and they expected to profit from the platform’s development efforts.

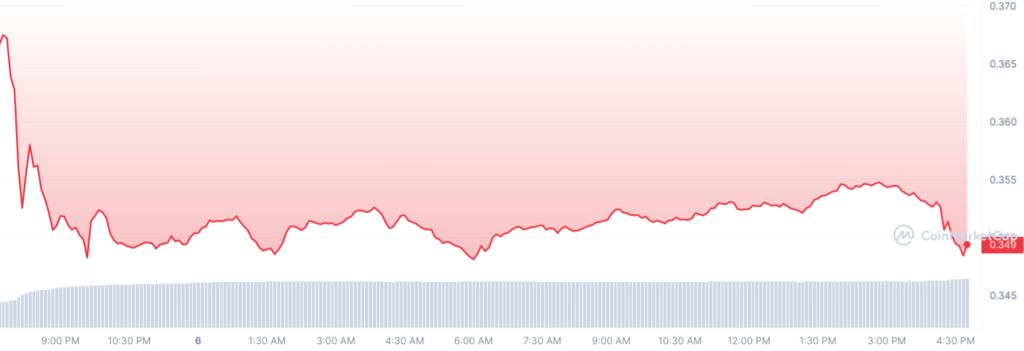

The Cardano coin was instantly hit by the announcement, which resulted in a sharp drop in price within minutes.

The effects extended beyond Cardano alone. As the news spread, the publicly listed business Coinbase saw substantial market volatility. In premarket trading on the American stock market, its shares, which are traded under the ticker COIN, fell by more than 15%.