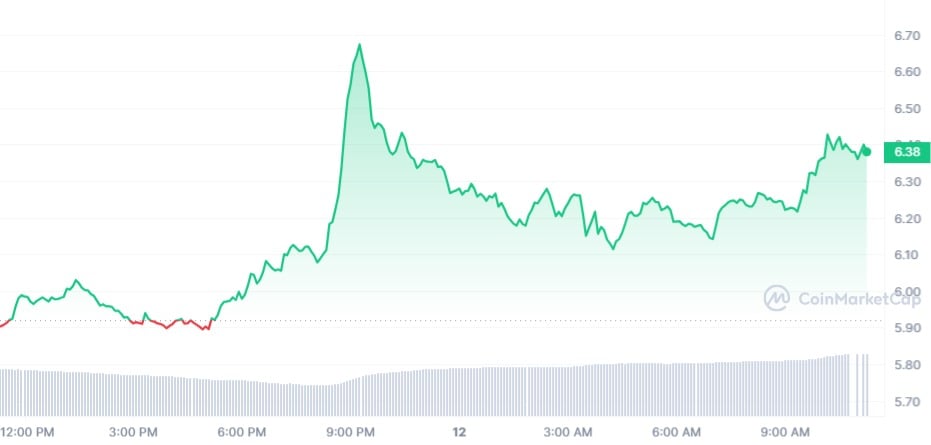

Today, Solana-killer Aptos (APT) has joined a limited group of alternative currencies that are attempting to support the market rebound. The digital currency has increased by 8.05% to $6.38 in a remarkable move that might aid in reviving market confidence.

The United States Securities and Exchange Commission (SEC) designated various tokens, including Cardano (ADA), Solana (SOL), and Filecoin (FIL), as securities earlier in the month, which had a negative impact on market sentiment.

Broad-based impact

The impact has been extensive and wide-ranging over the past week, notwithstanding the SEC’s exemption of Aptos as an investment contract in the same manner that it did with SOL and ADA. Following the market decline, Aptos has seen a loss of up to 28% of its price value over the previous week, matching the loss of the tokens that the regulator indicted.

The SEC’s present categorization of the main cryptocurrencies has caused a lot of confusion in the Aptos community, with users wanting to know for sure whether or not APT would eventually be classified as a security.

Early on, the industry paid little attention to the ongoing Ripple v. SEC case; nevertheless, subsequent SEC actions have compelled ecosystem leaders to urge for unity in the struggle against the market regulator.

APT trigger

Investors in Aptos have concentrated on the protocol’s more fundamental aspects in an effort to find hope amid the general uncertainty in the sector as a whole. Aptos engineers have been concentrating their efforts over the past several weeks to raise the protocol’s security and scalability to a new level not seen in a Layer 1 protocol.

Aptos has provided its community with something more concrete to worry about through activities like Hack Holland than the present Fear, Uncertainty, and Doubt (FUD) that is permeating society as a result of the SEC’s actions.