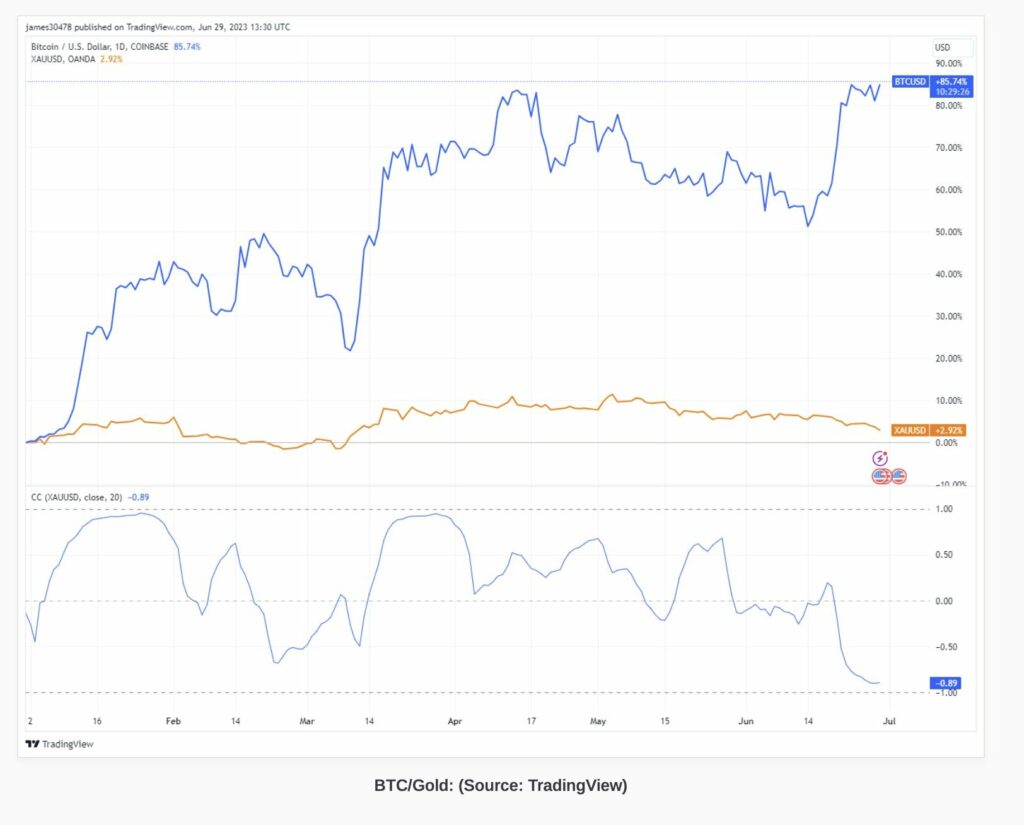

As a result of a significant change in how their prices move, the correlation between Bitcoin and gold has fallen to its lowest level in the past year.

As of right now, the correlation coefficient is -0.89, indicating an adverse association. Bitcoin has soared by an amazing 85.7% this year, whereas gold has only witnessed a small gain of 2.92%.

The joint reputation of these two assets as a hedge against traditional markets frequently draws attention to their connection.

Due to the anticipated spot Bitcoin ETF registrations by significant financial organisations like BlackRock, Fidelity, and Invesco, the price of Bitcoin has increased significantly.

These ETFs might possibly transform the course of Bitcoin by vastly enhancing its appeal to institutional investors. The much anticipated approval of a spot Bitcoin ETF might possibly lead to a capital influx akin to what was seen with the introduction of the first gold ETFs.

Crypto aficionados have long conjectured that the debut of the first spot Bitcoin ETF may have an impact on the price of the cryptocurrency comparable to what the debut of the first gold ETF did for the price of gold.

Access to the gleaming metal became more widely available in 2003 with the introduction of the first gold ETF. It also caused the price of gold to skyrocket, turning the precious metal into a popular investment.