The cryptocurrency market had unusual activity today as large investors, or “whales,” made substantial bets in options contracts for Bitcoin (BTC) and Ethereum (ETH), according to the Greeks Live portal. Market confidence has been fueled by this rise in activity, which suggests that things may go well in the second half of the year.

The trading floor was dominated by a sizable amount of block calls, mostly involving bull spreads (Buy-DEC-2200C/2400C and Sell-DEC-3000C Ethereum contracts). These optimistic trading techniques imply that investors expect ETH prices to rise. It is impressive that more than 12,500 sets of these options contracts were traded, with a total notional value of more than $50 million, demonstrating a sizable response from the market.

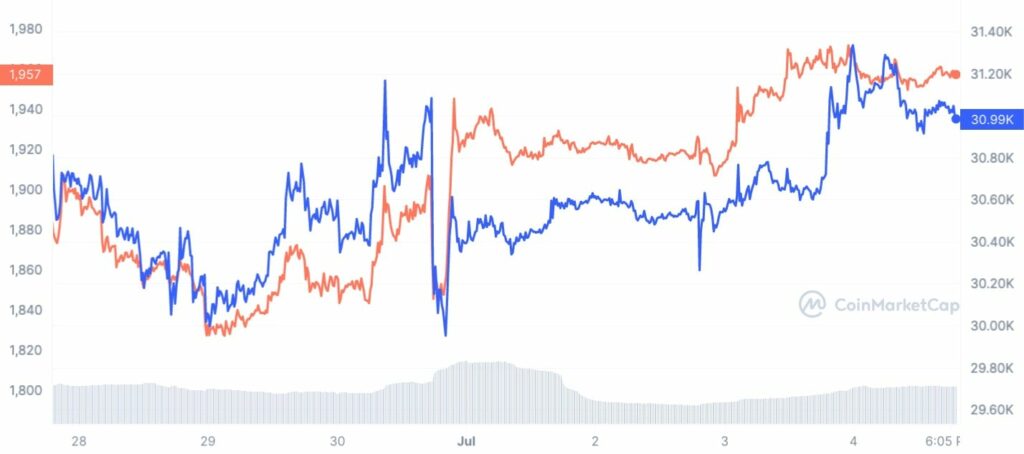

Furthermore, there was noticeable purchasing activity in Ethereum out-of-the-money (OTM) JUL calls. This indicates that transactions for options contracts with strike prices greater than the current market value of ETH were started by purchasers. Such buying activity suggests that investors think Ethereum’s price may rise further in the months to come.

While Bitcoin did not see the same amount of activity as Ethereum, there were still indications of aggressive purchasing, reiterating the cryptocurrency’s attraction to investors and dealers.

These occurrences are unexpected, especially in light of the customary drop in market activity following quarterly expiry. This norm has been questioned by the confidence shown by significant investors, which has led to conjecture among experts and market aficionados about the market’s prospects for the remainder of the year.