Cardano’s ADA, which reached highs of $0.38 on July 14, has been steadily declining ever since. But if ADA closes down today, it will be the sixth day in a row that it has traded in the red.

Between July 13 and July 14, the price of ADA skyrocketed as investors renewed their belief that Cardano would be free from the SEC’s regulatory threats as a result of Ripple’s triumph.

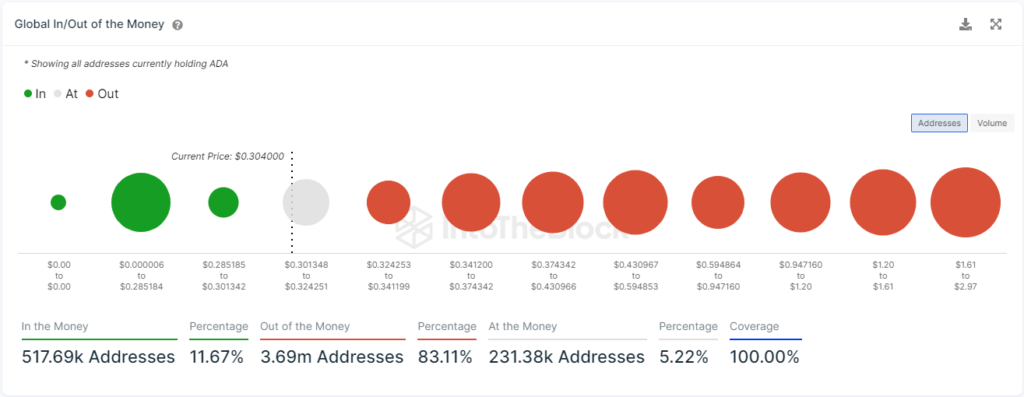

Following that, sellers reaped gains as ADA continued to end days in the negative. ADA was trading at $0.305 at the time of writing, down 3.05% over the previous day. On-chain data from IntoTheBlock indicates that a two billion ADA demand wall might, nevertheless, discourage bears.

Cardano is now trading in the $0.285 to $0.301 area, which corresponds to the two billion ADA support level. Here, 2.08 billion ADA were purchased by 62,400 addresses for an average cost of $0.292.

Given that locations that have previously purchased in this price range are likely to provide support, buying activity is anticipated to increase here.

The demand wall that was mentioned above is technically just below the daily MA 50, which is now at $0.301.

The work for the bulls, who would have to turn this level into support, could not be simple given that the MA 50 price level has recently restricted the ADA price.

Bulls and bears will battle until equilibrium is established during an upcoming consolidation, as the RSI is quite near to the mid-50 level.

Buyers can aim for a retest of the $0.38 level if the bears are pushed back and the ADA price starts to rise from its present levels.

However, a break and closing below $0.30 might tilt the scales in favour of the bears. Below the $0.30 demand wall, where 439,220 addresses purchased 6.12 billion ADA on average for $0.203, a significant support is anticipated.