In its ongoing legal battle with the SEC, U.S. cryptocurrency exchange Coinbase made significant progress when well-known people and organisations entered the case as amici curiae.

In the Coinbase lawsuit, amicus briefs have been submitted by six law professors, the Blockchain Association, the Crypto Council for Innovation, the Chamber of Digital Commerce, the DeFi Education Fund, the Chamber of Progress, the Consumer Technology Association, andreessen hortowitz.

The chief legal officer of Coinbase, Paul Grewal, expressed his appreciation and said that the papers will help the Court comprehend the SEC’s legal mistakes.

An important development in the case is highlighted by legal expert “MetaLawMan” who draws notice to a “devastating” amicus brief in favour of Coinbase written by six securities law professors.

Professors of law from Yale, the University of Chicago, UCLA, Fordham, Boston University, and Widener University are included in this group.

The amicus brief skillfully traces the evolution of the term “investment contract” before, during, and after the federal Securities Act’s passage in 1933, claims MetaLawMan.

The SEC’s “investment contract” argument is severely undermined by the brief, in his opinion, and its claim that crypto tokens sold on secondary markets constitute investment contracts is severely refuted.

Reactions trail law scholars’ brief

The legal professors’ amicus briefs undoubtedly received praise, but responses also brought to light the arguments’ apparent weaknesses.

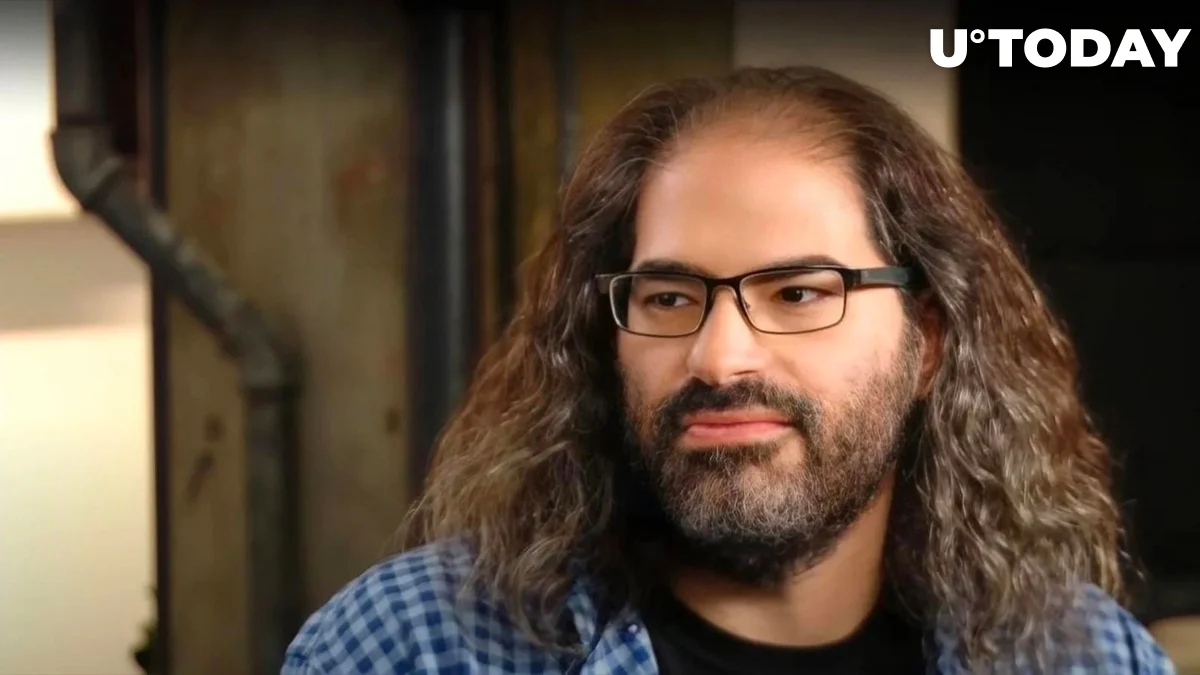

The chief technology officer of Ripple, David Schwartz, criticised the brief for not adequately addressing the holding in Joiner. This, in his perspective, is still the brief’s weakest argument.

In this vein, Twitter user David Barrera drew attention to the law experts’ flagrant disregard for the actual ruling in Joiner. In Joiner, the Supreme Court’s initial interpretation of what an investment contract is is discussed.

The issuer in Joiner did not, contrary to what the experts assert, make “contractual undertakings to deliver future value reflecting the income, profits, or assets of a business.”

The law academics’ brief concludes with a sentence that states, “An investment contract requires contractual undertakings to deliver future value reflecting the income, profits, or assets of a business.” Barrera contends that Joiner renders this claim untrue.