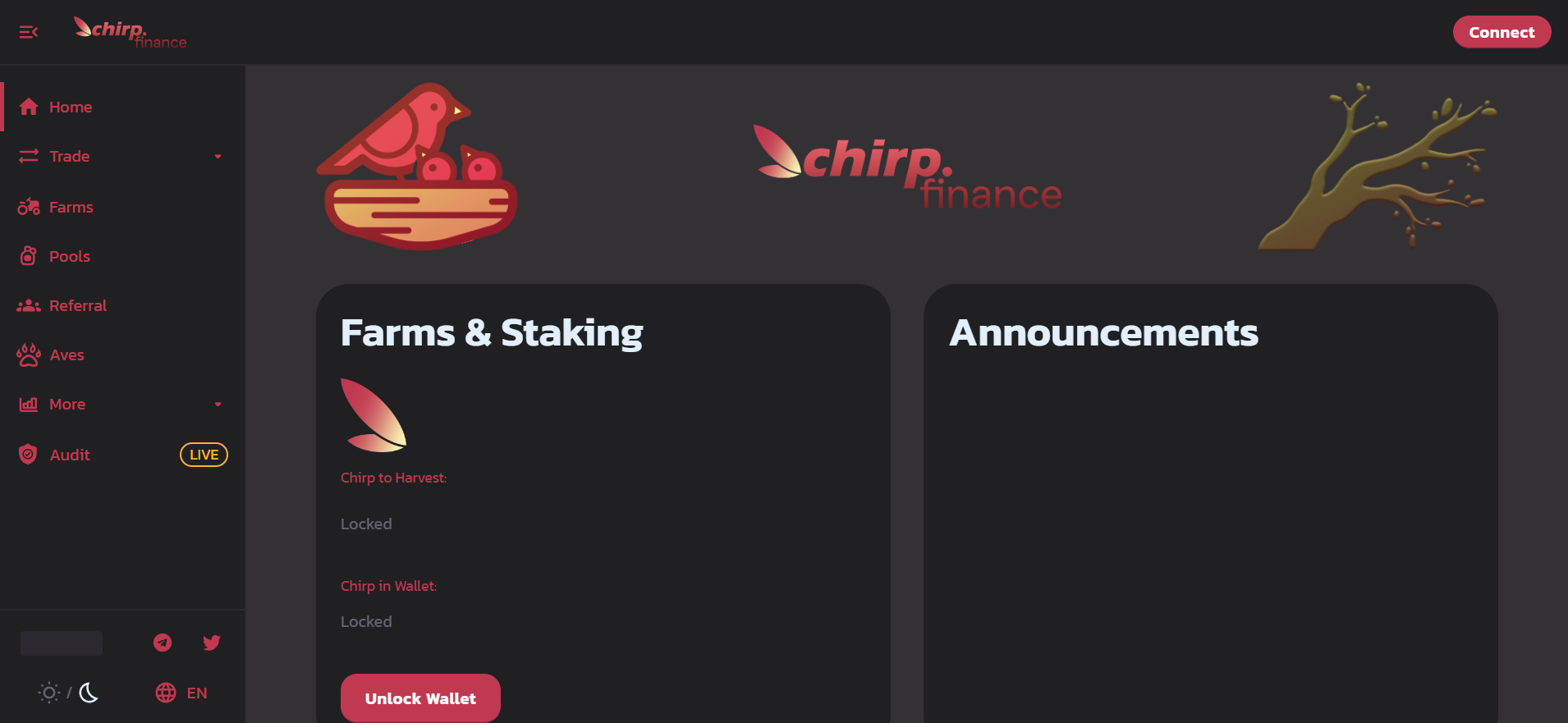

About Chirp Finance

Chirp Finance strives to become an all-encompassing protocol within the Pulsechain ecosystem, offering a diverse set of financial services. Their ambitious vision includes offering users opportunities for yield generation, asset storage in secure vaults, engaging in exciting battles, lending activities and much more.

Not content to rest on its laurels, Chirp Finance plans on constantly planning for expansion and adding innovative features that cater to users’ ever-evolving needs – thus becoming their go-to platform when looking for comprehensive and all-encompassing financial experiences within Pulsechain networks.

How It Works

Chirp Finance operates as a multifunctional protocol within the Pulsechain ecosystem, offering users with an array of financial services. To better understand its operation, let’s look at some of its core features. First and foremost, Chirp Finance enables users to generate yields through various investment opportunities offered through carefully designed mechanisms, enabling them to deploy assets in yield-generating strategies in order to earn passive income on their holdings.

Chirp Finance also incorporates secure vaults as digital safes to safeguard users’ assets. These vaults employ advanced security measures such as multi-signature technology and time lock mechanisms, providing an extra layer of protection and mitigating any risk related to hacks or theft.

Chirp Finance stands out with its distinctive battles module. This engaging feature allows users to engage in exciting battles within the platform involving elements such as staking assets, competing for rewards or participating in governance decisions – making the financial experience even more engaging and interactive for its users. Chirp Finance’s ultimate aim is to make financial experiences engaging and interactive for its users.

Tokenomics

The initial supply of CHIRP tokens is set at 1,000,000, with a portion allocated for the presale event and liquidity provision.

During the presale, 250,000 CHIRP tokens will be made available to early investors, generating crucial funding to support development and project-related expenses.

To ensure liquidity and facilitate trading, 750,000 CHIRP tokens will be allocated for liquidity provision, enabling users to trade CHIRP tokens seamlessly on supported exchanges.

Additionally, the tokenomics model incorporates a staking mechanism where users can stake their CHIRP tokens to earn rewards in the form of xCHIRP. This incentivizes users to actively participate and engage with the protocol, fostering a vibrant and committed community.

Chirp Finance’s carefully crafted tokenomics aims to strike a balance between user rewards, liquidity provision, and long-term sustainability, positioning the protocol for success in the evolving landscape of decentralized finance.

Emissions

Chirp Finance implements an emissions model to reward users who actively participate in yield farming, liquidity provision, and other protocol activities.

Initially, 100,000 CHIRP tokens will be distributed as emissions to incentivise users. However, the emissions rate is subject to adjustment based on votes from the DAO. This democratic approach ensures that emission levels can be modified based on the consensus and collective decision-making of the community.

By incorporating this dynamic emissions system, Chirp Finance aims to maintain flexibility and responsiveness to the evolving needs and preferences of its users, fostering a sense of community ownership and governance within the protocol.

Features

Yield Generation

Chirp Finance gives users opportunities to generate yields on their assets through various investment strategies and mechanisms. Users can generate passive income while increasing potential returns from their holdings.

Vaults

Chirp Finance offers secure vaults as digital safes for its users’ assets, featuring advanced security measures like multi-signature technology and time lock mechanisms to guarantee their protection.

Battles

Chirp Finance offers an exciting battles module, enabling users to engage in engaging competitions involving assets or rewards staked, governance decisions made or governance committee decisions made – providing users with an interactive and gamified experience.

Lending

Chirp Finance facilitates lending activities by enabling users to both lend and borrow assets through secure smart contracts with clear rules and transparent rules for easy borrowing and lending activities. Lending also provides liquidity options as users can use collateral assets as potential earning assets by offering them as loans collateral against interest earnings.

Continuous Expansion

Chirp Finance is committed to continuous expansion. Over time, they will introduce new features and functionalities tailored to the changing needs of their users, thus remaining an innovative solution within Pulsechain network.

Conclusion

Chirp Finance strives to become an all-in-one protocol within the Pulsechain ecosystem. Offering users yield generation, vaults, battles and lending among its many features, Chirp Finance gives users access to an array of financial services. Chirp Finance seeks to meet the varying needs of its users by offering opportunities for yield generation, safe vaults for asset storage and battle engagement as well as lending activities.

Chirp Finance stands out as a Pulsechain protocol with continuous expansion plans that showcase its commitment to growth and innovation, placing itself at the forefront of this exciting network. Through their ambitious vision and dedication to offering users a holistic financial experience, Chirp Finance strives to offer users access to a versatile and all-inclusive financial protocol within Pulsechain’s dynamic ecosystem.