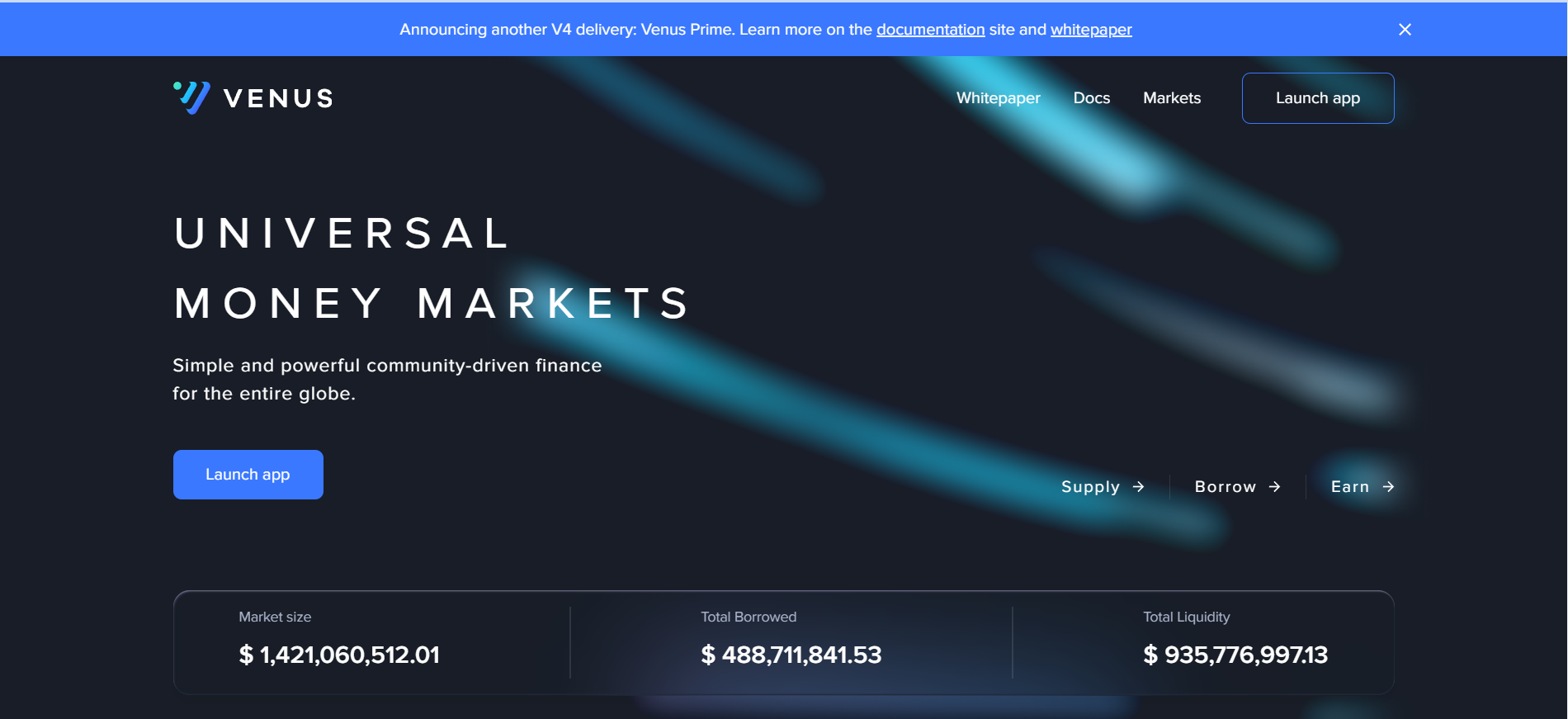

About Venus.io

Venus.io is an algorithmic money market and synthetic stablecoin protocol launched exclusively on Binance Smart Chain (BSC). The protocol introduces a simple-to-use crypto asset lending and borrowing solution to the decentralized finance (DeFi) ecosystem, enabling users to directly borrow against collateral at high speed while losing less to transaction fees. In addition, Venus allows users to mint VAI stablecoins on-demand within seconds by posting at least 200% collateral to the Venus smart contract.

VAI tokens are synthetic BEP-20 token assets that are pegged to the value of one U.S. dollar (USD), whereas XVS tokens are also BEP-20-based, but are instead used for governance of the Venus protocol, and can be used to vote on adjustments—including adding new collateral types, changing parameters and organizing product improvements. The governance of the protocol is entirely controlled by XVS community members, since the Venus founders, team members and other advisors do have any XVS token allocations.

XVS Price Live Data

The live Venus.io price today is $5.97 USD with a 24-hour trading volume of $5,124,277 USD. They update XVS to USD price in real-time. Venus is down 2.26% in the last 24 hours. The current CoinMarketCap ranking is #293, with a live market cap of $88,879,309 USD. It has a circulating supply of 14,882,192 XVS coins and a max. supply of 29,745,110 XVS coins.

Who Are the Founders of Venus (XVS)?

The development of the Venus project is being undertaken by the Swipe project team. The main goal of Venus is to achieve decentralization through community-governance. There are no pre-mines for the team, developers or founders, giving XVS holders total control over the path the Venus Protocol takes.

Venus Token (XVS)

The Venus Protocol is governed by the Venus Token (XVS), which is designed to be a “fair launch” cryptocurrency. There are no founder, team, or developer allocations, and the XVS can only be earned through the Binance LaunchPool project or through providing liquidity to the protocol. There will be an initial 20% of the total supply of 30,000,000 (6,000,000 XVS) allocated to the Binance LaunchPool project where users can mine (farm) these tokens alongside 1% of the total supply (300,000 XVS) placed aside for the Binance Smart Chain ecosystem grants.

The remainder of the supply will be exclusively available for the protocol, which will result in 23,700,000 XVS mined over a period of approximately four years, which begins after the Binance LaunchPool event at a rate 0.64 XVS per block (18,493 per day). The distribution of XVS is based on liquidity mining, where 35% of the daily rewards get distributed to borrowers, 35% to suppliers, and 30% for stablecoin minters.

vTokens

The protocol-created pegged assets when collateral is supplied are called vTokens. vTokens represent the unit of the collateral supplied and can be used as a redemption tool. vTokens are created and implemented by Governance processes and voted by Venus Token holders

What Makes Venus.io (XVS) Unique?

Venus’ main strength is its high speed and extremely low transaction costs, which are a direct result of being built on top of the Binance Smart Chain. The protocol is the first to enable users to access lending markets for Bitcoin (BTC), XRP Litecoin (LTC) and other cryptocurrencies to source liquidity in real-time, thanks to its near-instant transactions.

Customers sourcing liquidity using the Venus Protocol do not have to pass a credit check and can quickly take out a loan by interacting with the Venus decentralized application (DApp). Since there are no centralized authorities in place, users are not restricted by their geographic region, credit score or anything else, and can always source liquidity by posting sufficient collateral.

These loans are provided from a pool contributed by Venus users, who receive a variable APY for their contribution. These loans are secured by the over-collateralized deposits made by borrowers on the platform.

To avoid market manipulation attacks, the Venus Protocol utilizes price feed oracles, including those from Chainlink to provide accurate pricing data that cannot be tampered with. Thanks to the Binance Smart Chain, the protocol can access the price feeds at a lower cost and with better efficiency, reducing the overall cost footprint of the system.

Venus.io Features

Exclusive to Binance Smart Chain

Venus.io is only available on the Binance Smart Chain (BSC), which provides quicker transaction times and reduced fees in comparison to other blockchain networks.

Lending and Borrowing

Venus.io is an easy-to-use platform for lending and borrowing cryptocurrencies. Users can earn interest on their cryptocurrency holdings or borrow money using their cryptocurrency as security.

Algorithmic Money Market

Venus.io adjusts borrowing and lending interest rates based on the supply and demand of the underlying assets via an algorithmic money market. By doing this, it is made sure that the market is efficient and stable.

Synthetic Stablecoin

In addition, Venus.io introduces VAI, a synthetic stablecoin that is linked to the value of the US dollar. VAI can be utilised for trade and as security for loans borrowing other crypto assets on the platform.

Decentralized Governance

Venus.io’s community of users governs the platform through a decentralised autonomous organisation (DAO) framework. Users are now able to vote on protocol ideas and amendments.

Support for Multiple Collaterals

Venus.io accepts a variety of cryptocurrencies as collateral, including well-known ones like Bitcoin, Ethereum, and Binance Coin as well as less well-known tokens.

Cross-Chain Compatibility

Venus.io is designed to be cross-chain interoperable, which enables future integration with additional blockchain networks.

How is the Venus (XVS) Network Secured?

The Venus network is secured by the Binance Smart Chain, a blockchain that runs in parallel to the Binance Chain. BSC is compatible with the Ethereum Virtual Machine (EVM) and is capable of running even if the Binance Chain goes offline or encounters issues.

Binance Smart Chain utilizes a unique consensus algorithm known as proof-of-staked authority (POSA) to secure the blockchain. This is essentially a hybrid consensus mechanism that combines aspects of both proof-of-stake (POS) and proof-of-authority (POA). It is built around a network of 21 validators who are responsible for executing tasks on the Binance Smart Chain, and reaching consensus about recently processed transactions.

Beyond this, Venus suppliers are protected by automatic liquidation measures, which will automatically liquidate the collateral of borrowers if it falls below 75% of their borrowed amount—thereby reimbursing suppliers early to maintain the minimum collateralization ratio.

Bottom Line

Let’s sum up by saying that Venus.io is a ground-breaking algorithmic money market and synthetic stablecoin system that has only been made available on the Binance Smart Chain (BSC). The platform not only introduces a stablecoin to the market but also provides a simple way for users to lend, borrow, and trade cryptocurrency assets. Its decentralised governance system and algorithmic money market make it special and effective, guaranteeing that the platform will always be stable and able to meet the demands of its users. Venus.io is a wonderful addition to the DeFi ecosystem on the Binance Smart Chain and has the potential to change how users engage with cryptocurrency assets in the future.