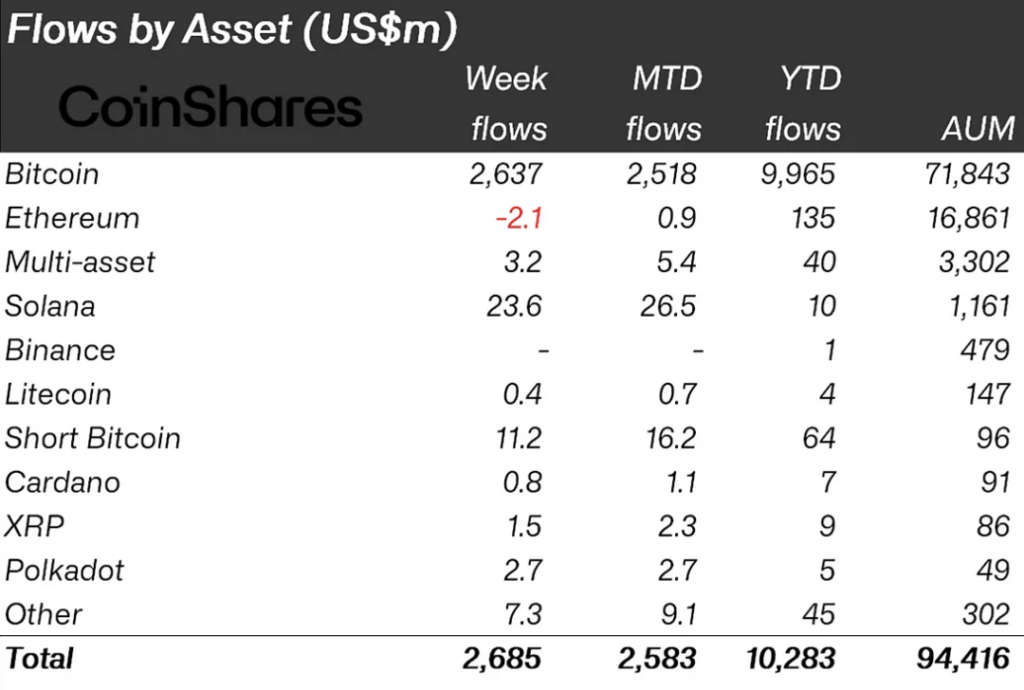

According to the most recent CoinShares study, there have been notable changes in the market for investment products focused on cryptocurrencies. Interestingly, XRP-focused investment products had a significant inflow of $1.5 million as recently as last week. With $2.3 million coming in since the beginning of March and a healthy $9 million since the year’s beginning, this represents a continuation of XRP’s upward trend.

These numbers highlight XRP’s rise to prominence as a top altcoin-focused investment product. The only other stocks with larger inflows are Solana (SOL), at $23.6 million, and surprisingly Polkadot, at $2.7 million, indicating XRP’s continued attraction to investors.

A larger upswing in the cryptocurrency industry, supported by Bitcoin’s record price explosion and a significant input of capital into Bitcoin ETFs, is concomitant with the spike in XRP inflows. Digital asset investment products have reached unprecedented heights due to the continued ETF boom, with weekly inflows of an astounding $2.7 billion. With this, the year-to-date inflow has reached $10.3 billion, edging ever-closer to the record $10.6 billion in inflows for the whole of 2021.

In addition, the strong market circumstances have resulted in astounding trade turnover numbers, which hit $43 billion this week—a significant rise above the record $30 billion set the week before. Total assets under management (AuM) has reached a new high of $94.4 billion as a result of the recent price advances. This is an incredible 88% increase year-to-date and a phenomenal 14% increase during the previous week.