During an exceptionally tumultuous time for the cryptocurrency market, the trading volume of the well-known coin XRP increased by an astounding 80% in the last day, reaching a value that surpassed $4 billion.

According to CoinGlass, derivatives contributed for $2.16 billion, with spot markets contributing an extra $1.9 billion. This is a 55.4% increase from the day before. The token’s market capitalization, which is $32.5 billion despite this significant surge, indicates robust but not exceptional trading with a trading volume-to-market cap ratio of 12.5%.

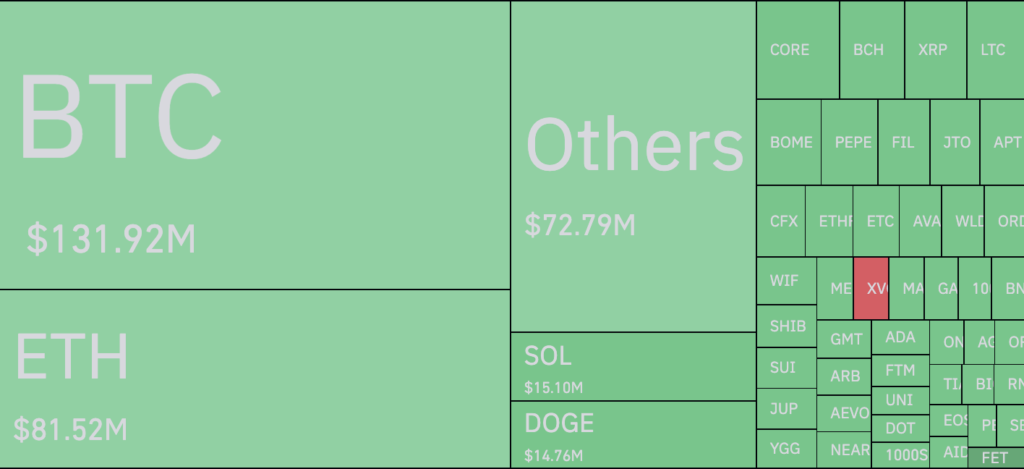

But this spike in XRP trading activity happened in the midst of what can only be called a crypto carnage. According to liquidation figures, almost $400 million worth of positions were forced liquidated, with long positions or purchases making up the vast bulk (85.5%). In the case of the XRP market, the ratio was even larger, with 94% of liquidated futures holdings ($5.47 million) reflecting bullish bets.

XRP price takes dip

The sudden drop in XRP prices that followed this sharp rise in trading activity led to stop losses and margin calls, which compelled purchasers to quickly liquidate their positions. As a result, there was a noticeable increase in the token’s trading volume, which was indicative of increased market activity during the mass sell-offs and liquidations.

Even while the increase in XRP trading volume is clearly noteworthy, it’s important to consider it in the context of the larger crypto market, which is marked by high volatility and substantial losses.

Even with the outstanding volume levels, investors are still having to navigate through choppy waters as they consider the effects of the continued carnage on both their portfolios and the overall cryptocurrency market.