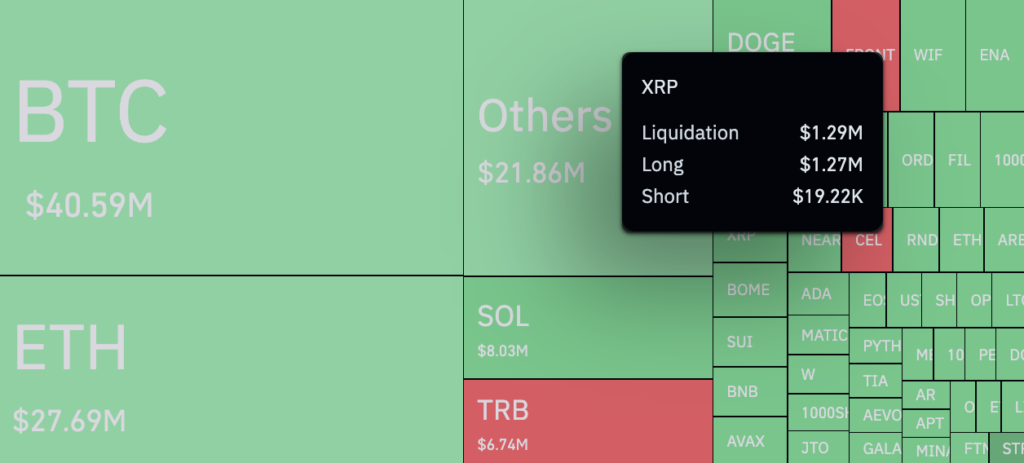

Contrary to typical market patterns, XRP has witnessed an extraordinary uptick in bullish liquidations, which stands in sharp contrast to the comparatively muted action on bearish holdings. Based on information obtained by CoinGlass, notable long position liquidations over the last 24 hours have totaled $1.27 million, much exceeding the relatively small amount of $19,220 liquidated from short holdings.

The enormous disparity, amounting to 6,350%, has drawn the interest of both market observers and stakeholders.

The sharp increase in bullish liquidations and the 3.85% drop in XRP’s price indicate a change in investor opinion. But the exact cause of this notable disparity in liquidation trends is still unknown, which has led to conjecture and criticism in the bitcoin community.

The effects of this anomaly go beyond liquidation data; over the same time period, XRP’s derivative trading volumes saw a noteworthy fall of more than 55%. This drop is indicative of a larger pattern of decreased trading activity in the face of increased market turbulence.

Analysts predict that the aftermath of these peculiar liquidation patterns may bring about a period of relative calm, and that XRP may be well-positioned to recover from important support levels. Retail traders are not projected to drive the expected rebound; instead, institutional investors and larger market players are expected to do so.

While bears take advantage of XRP’s decline in price to make money, bullish stakeholders are left bandaging the wounds from the previous dip.