One of the worst months for the cryptocurrency industry overall, and for Bitcoin specifically, is said to be September. Bitcoin’s profitability is -6.18% on average and -4.43% on a median basis. For cryptocurrencies, historical patterns are rarely trustworthy, but given that Bitcoin is a $1.2 trillion asset and has been trading on the exchange for more than 11 years, its price history may be trusted.

The analysts at Spot On Chain, however, don’t just accept the strong likelihood of a bad September; instead, they provide five important explanations for why this time may be different for Bitcoin.

Ironically, one of the primary points of contention is predicated on historical tendencies that might not always be true. Spot On Chain therefore notes that favourable Septembers have followed approximately 43 percent of years with bad Augusts. This implies that despite the general pessimism, the market may experience a recovery.

Sellers out, holders in

The fact that major players have been selling less lately is another significant aspect. A significant amount of Bitcoin has already been sold, with the German government, Mt. Gox, and Genesis Trading collectively selling over 170,000 BTC in July and August.

The United States government still owns more than 203,000 Bitcoin, but it has been moving cautiously lately, choosing to sell most of it over-the-counter to lessen its influence on the market. The market may remain steady as a result of this release of selling pressure.

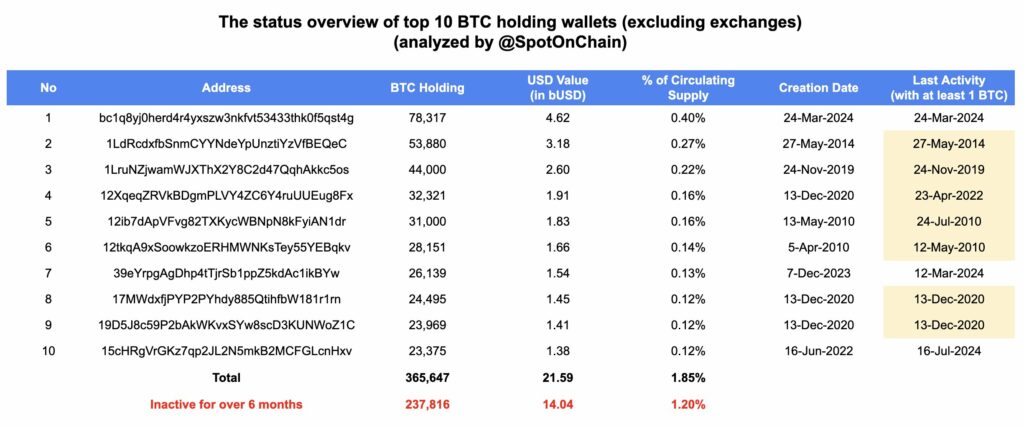

Moreover, long-term investors are still strong; in August, they increased their holdings by 262,000 BTC. Currently holding 75% of the whole supply, these holders are demonstrating their trust in the asset’s future. Prominent anonymous wallets that possess substantial quantities of Bitcoin have also stayed dormant, so diminishing the probability of abrupt sell-offs.

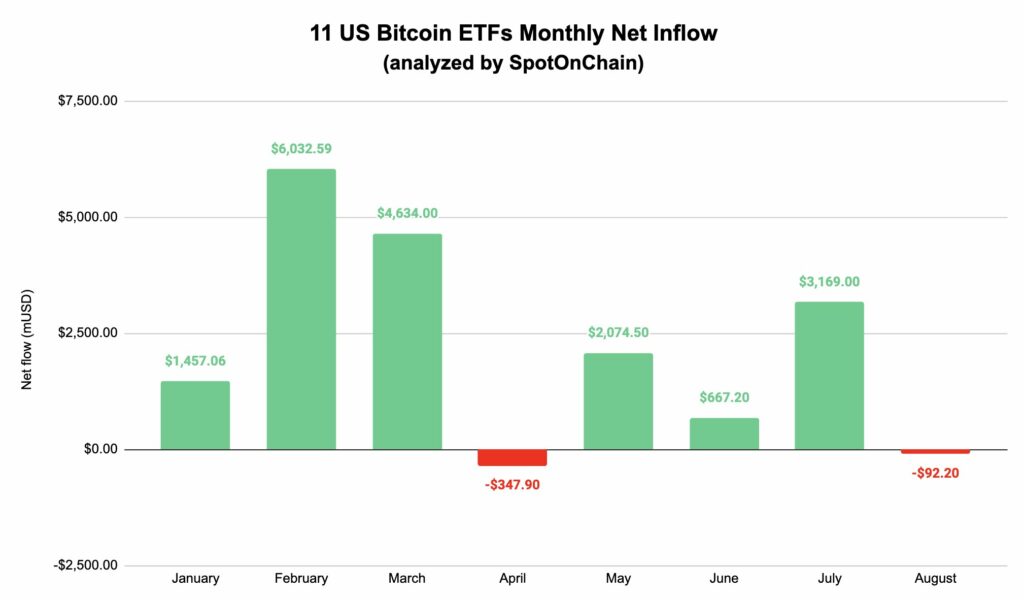

Bitcoin ETF inflows expected

The positive argument is strengthened by the potential for a fresh wave of investment in Bitcoin ETFs. Based on past trends of alternating positive and negative months, September might witness a positive inflow of $500 million to $1.5 billion following a minor decline in net flows in August.

The market may also be impacted by other factors. There may be more demand for Bitcoin as a result of FTX returning $16 billion in cash and the Federal Reserve potentially lowering interest rates. Additionally, increasing legislative backing for pro-cryptocurrency policies in the United States may bolster investor confidence and give Bitcoin an additional lift in September.