Market sentiment across the month of August has been largely bullish. Particularly since some crypto-assets recovered considerably to the touch their ATH ranges as soon as once more. Ethereum hasn’t been one of those assets, however. Even so, sustaining a consolidating vary above $3000 because the starting of August speaks volumes.

Right now, Ethereum is holding a position near the $3200-mark. Over the previous few days, nonetheless, some bearish issues had begun to floor on the charts.

Now, the trend looks a little shaky over the short term. Ergo, on this article, we are going to try to analyze the worst-case state of affairs for Ethereum, one which has a bit of historical backing.

A Dead-Cat Bounce on the weekly?

Markets fractals are thought of to be an important a part of technical evaluation, with the identical wanting on the prospect of sample repetition. Simply put, an asset may tend to follow a direction that was identified well in the past.

Think about the case of Ethereum, for example. At the moment, its weekly chart seems to be picturing similarities with its 2018 structure.

As might be seen from the hooked up chart, Ether’s weekly chart is presently tracing a powerful dead-cat bounce fractal. A dead-cat bounce is a market condition where the price momentarily rallies back after a correction. Following the mentioned hike, the market continues to drop and types new decrease lows on the chart.

At the moment, there are many similarities between Ethereum in 2018 and 2021. In 2018, earlier than the value went down, it consolidated sharply for 3 weeks straight. A similar situation is unfolding right now, with ETH‘s value moving sideways since 7 August.

Receding buying and selling volumes throughout each time durations is yet one more similarity. Ergo, if the price does move south following corrections, the possibility of a new low under $2000 might be on the cards for the altcoin.

Ethereum active addresses refuse participation?

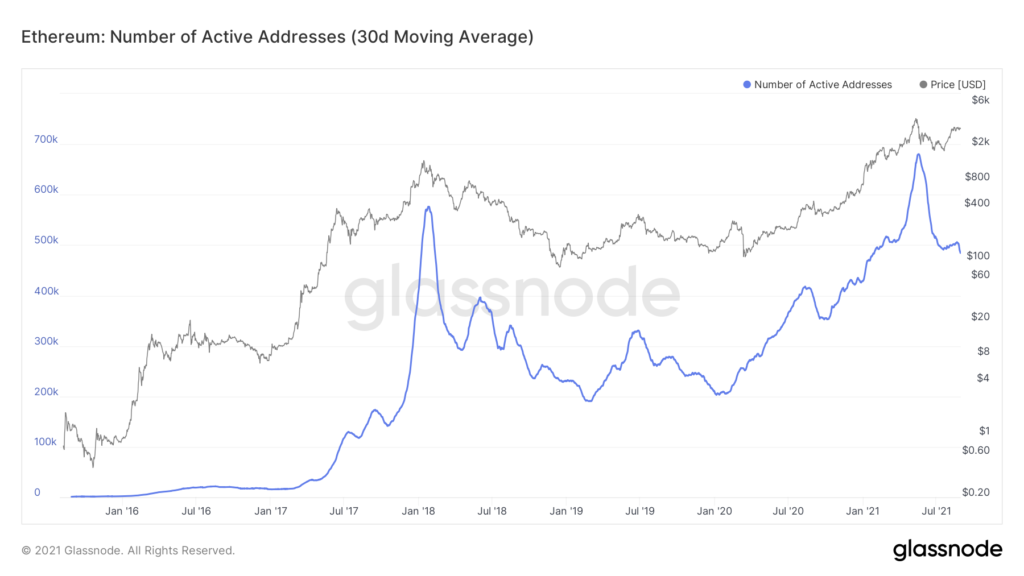

From an on-chain perspective, most belongings have seen a scarcity of exercise. This was the story for Ethereum too. After peaking throughout its rally, energetic addresses have largely dropped on the charts. The “recovery” hasn’t prompted a spike in active addresses either.

What this means is that the continued rally depends on a couple of buyers. Now, while it is still early days to call an outrightly bearish market for Ethereum, the signs are clearly there.

Over the following couple of weeks, if Ethereum breaks above $3400, the fractal sample shall be disrupted. This disruption could be the bullish trigger ETH needs. If that doesn’t occur, ETH would possibly simply comply with the norms set by the market in 2018.