Investors primarily favor Bitcoin and Ethereum. Always have and perhaps, always will. However, of late, a few of that curiosity has been transferring into the market’s altcoins. And for that very reason, this pair of altcoins appears to be a hot choice for investment.

Both Chainlink and Uniswap not too long ago registered some essential native highs, making them both worth a very close look.

The $30 altcoins

Chainlink today finally broke the 3-month-old barrier of $30 as it traded at $31.1 at press time. Uniswap breached that very same worth degree 2 days in the past, earlier than the SEC’s investigation into Uniswap Labs induced some corrections.

Even so, both these altcoins have been faring fairly well as this week alone, LINK rose by 22.86% while UNI was up by 17.42%.

For LINK, this marked an nearly 50% restoration since the crash from its ATH of $52.

However, price actions notwithstanding, investors have been facilitating bullish behavior too. Daily transactions for the altcoins have been round 4k for UNI and 12k for LINK. At the same time, buying and selling have also been strong for both cryptos.

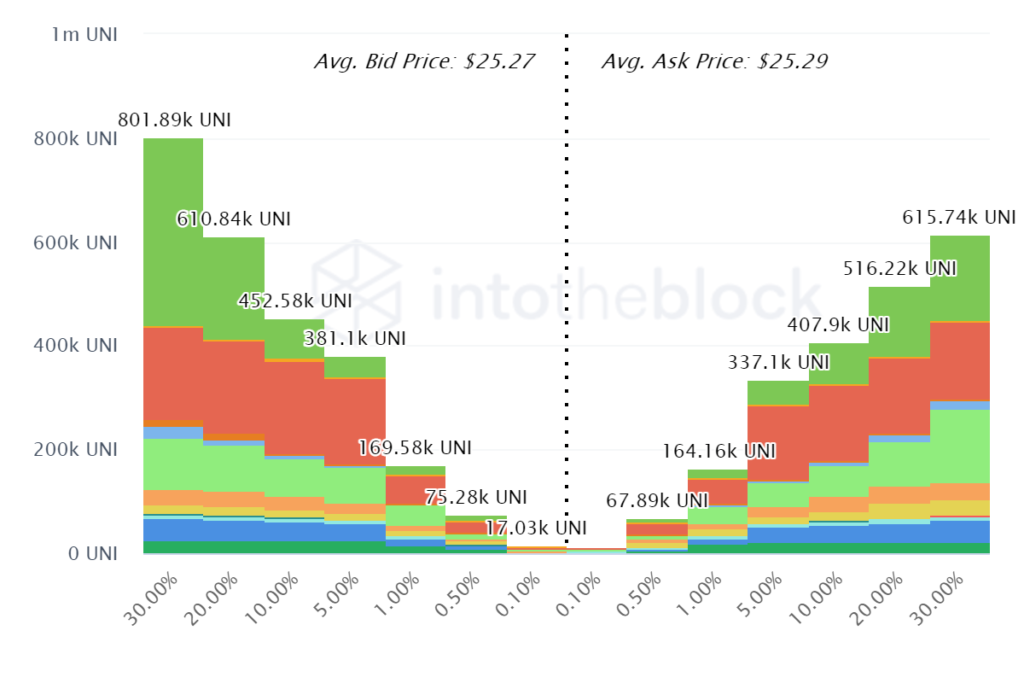

In reality, order books appeared to be exhibiting that there’s a 200k UNI larger demand for purchasing. On the other hand, sell orders for LINK stood at 1.5 million LINK.

But, is the network a good bet?

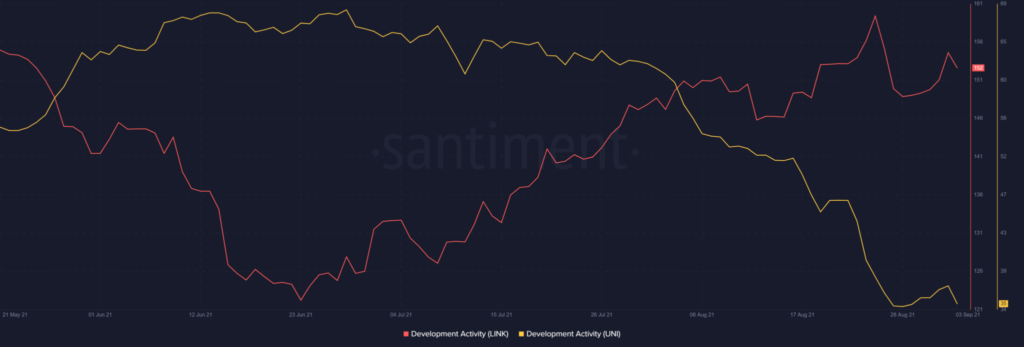

At the second, the networks seem to be in a good condition as nicely. The MVRV ratio hit a 4-month high for both LINK and UNI. And but, Chainlink has loved higher growth exercise than Uniswap, regardless of all the upgrades to its community.

Not only this, but LINK also has a better correlation with Bitcoin, with LINK standing at 0.72 and UNI at 0.36.

Recently, the KuCoin launchpad integrating with Chainlink for safe, market alternate charges info put Chainlink in the limelight. For Uniswap, that was achieved by Arbiturm’s main net launch.

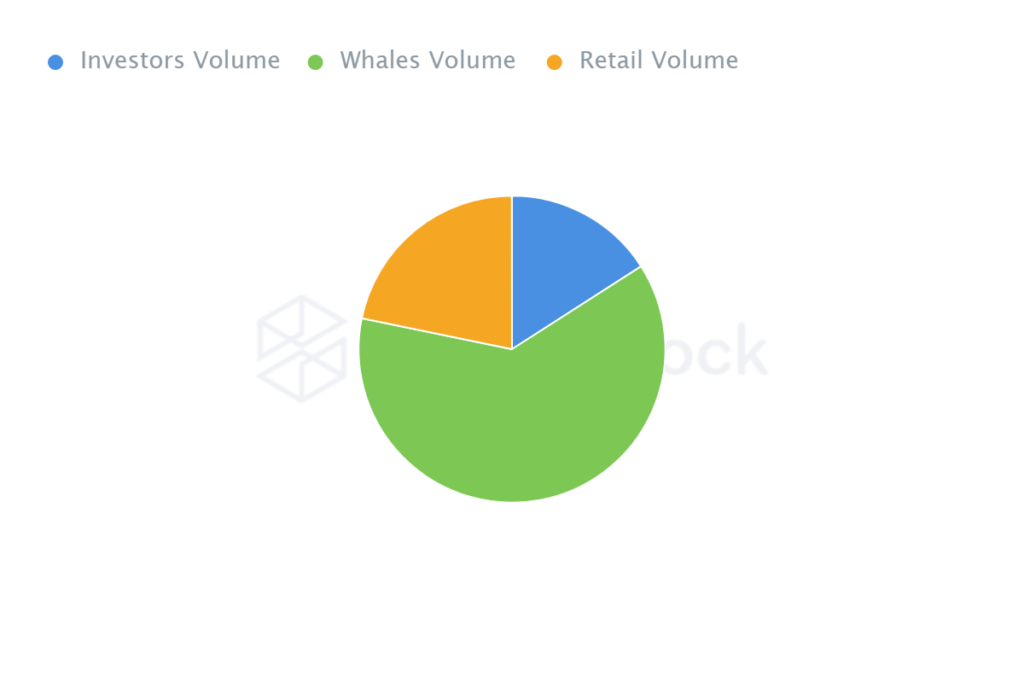

However, the matter of concern for traders comes if you take a look at possession, which is dominated by whales. Due to both these altcoins being whale-dominated tokens, they are always susceptible to flash crashes.

Any time whales determine to dump their holdings, retail traders will face the warmth since they’ll bear the most losses throughout such worth falls.

Thus, it would be smart to be wary and research well before entering any of these crypto’s markets.