The market had many surprising moments over the last month, with altcoins such as Cardano, Solana taking center stage and recording new ATHs. Towards the end of the month, Ethereum also gained momentum, with the alt noting weekly gains of 21.82% at the time of publication.

Now, it perhaps won’t be wrong to say that Ethereum and Solana had all eyes on them after speculators identified some similarities between their trajectories.

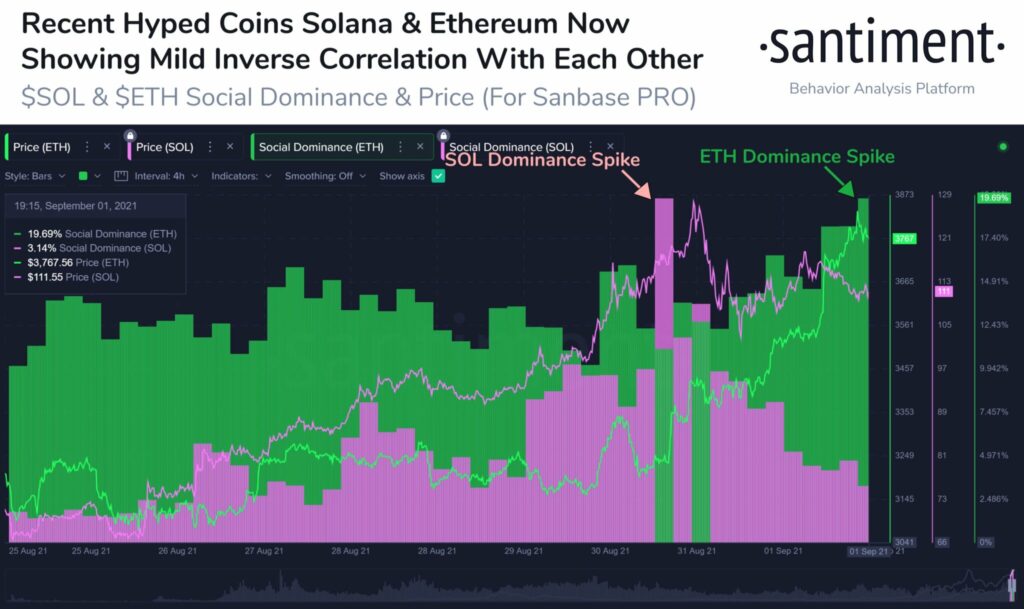

At the time of going to press, Solana was up 58% and Ethereum up 21% for the week. In fact, according to Santiment, they both took turns to have the market spotlight. However, aside from their impressive price gains, there were other notable trends as well.

Ethereum stealing traction from Solana

Social sentiment generally aligns with price pumps, especially in the case of alts. For Solana and Ethereum, crowd sentiment played a crucial role in their prize pumps. In fact, their social dominance was highest as their prices saw newer highs.

On August 30, Solana’s strong social dominance coincided with her record price of $ 119. Just a day later, Ethereum managed to steal social dominance as the metric peaked alongside a high price of $3,830.

Solana dominates the cash flow?

Even though Ethereum managed to steal social attention, Solana appeared to be on fire in terms of asset flow. CoinShares’ Digital asset fund flows weekly revealed that investors have increasingly been “selling off Bitcoin funds in favor of investments tied to other cryptocurrencies.”

Notably, Solana funds led investment growth this month, reaching over $ 7 million in the week ending August 20. The same for Ethereum was $3.2 million while there was a loss of $2.8 million for Bitcoin. Additionally, Solana took over BTC’s cash assets under management which stood at $ 15.57 million.

Other than that, the recent NFT hype has had a huge role to play in pumping both Ethereum and Solana. Strong demand for NFT trading and investing pumped up total ETH transaction fees, which stood at around 10,000 ETH per day. This was a relatively high level, comparable to ‘DeFi summer’ and the 2021 bull run.

Likewise, for the price of SOL, Degenerate Apes, Solana’s first big foray into NFTs, acted as a nice boost. Since the launch, Degen Ape sales have recorded more than 100K SOL in volume traded, with a price floor of almost 15 SOL.

Without a doubt, Solana has had a fairly quick journey to glory. But, can this so-called ‘Ethereum-killer’ actually beat other Ethereum-killers or maybe Ethereum one day?

Here’s what the metrics say

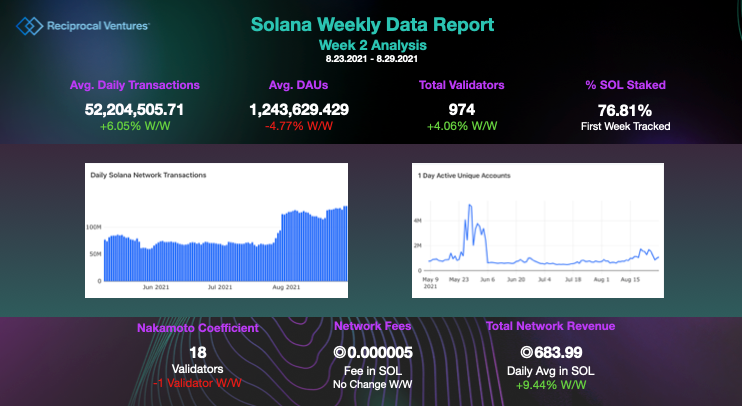

Notably, Daily Active Users (DAU) fell for both Solana and Ethereum. Despite a drop in DAUs, the average transactions per day on Solana saw a modest uptick while its competitors fell off W/W.

SOL had 52.20 million (+ 6.05%) average transactions per day while ETH stood at 1.17 million (-4.00%).Solana’s price in the near term could see some minor pumps owing to the recent announcement by the Solana Foundation about an upcoming hackathon with $5M in prizes plus funding.

Solana is viewed by many in the industry as a rival to Ethereum as it claims to offer cheaper transactions and faster transaction speed at 50,000 transactions per second. All in all, while it did look like Solana is doing pretty well, it is largely pumping because of its smart contract operability and recent NFT hype.

However, as blockchains begin to use smart contracts and move to NFTs, Solana could face more competition in the years to come.