The battle for $50k continues because the bitcoin value is buying and selling above and beneath the important thing stage.

On Friday, September 3rd, 2021, Bitcoin successfully made the first daily close above the $50k mark since May, a sign of strength for the bulls. Buying and selling quantity got here in 36% above common on Coinbase, indicative of robust spot shopping for. In addition, BTC short liquidations came in below average, indicating the recent price rally was spot-driven rather than short covering.

BTC printed a bullish engulfing candle on the above 3-day chart with a detailed above $50k, breaking out of the inexperienced zone of assist between $46k to $48.1k. Since the engulfing candle was printed, the bitcoin price remained around the $50k level consolidating during the ongoing weekend trading.

On-chain Stays Bullish

The aggregate on-chain data remains bullish, strongly suggesting further upside for September. Spot alternate reserves stay at multi-year lows. Miners continue to accumulate with minimal outflows to exchanges and falling transaction count outflows, while aging groups of coins that realized profit during parts of the recent rally are back in accumulation.

UTXO Age Distribution Exhibiting Lengthy Time period Holders Accumulating

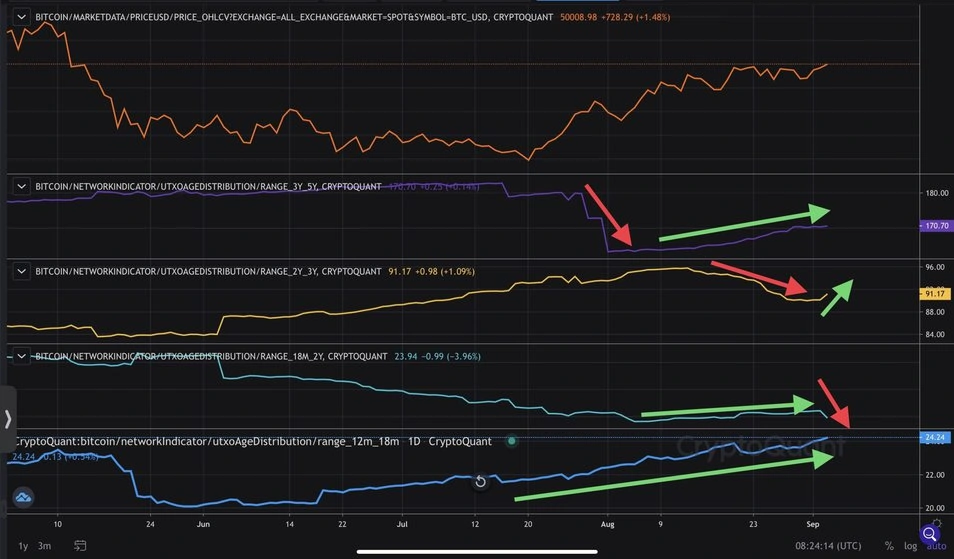

CryptoQuant on-chain analysts Gaah Cordeiro and I, Daniel Joe, just lately lined the UTXO Age Distribution metric, to research how the getting old teams of long-term and short-term holders are behaving.

In late July 2021, throughout the rally from $29.2k to $42k, the age distribution metric shows holder of coins around 3 to 5 years old taking a profit. As this group continued to age, we will see that promoting cooled off, and accumulation resumed inside August.

During August, 2 to 3-year-old coins slowly took profit as BTC tested $50k. Not too long ago, as getting old continues, this cohort now seems to be again in accumulation with a slight uptick proven within the chart.

12-18 Month Old Holders Partially Sold Lows: Now Back in Accumulation

The 12 months to 18-month-old cash confirmed fascinating exercise as this group seems to have bought the preliminary leg down when BTC was falling again in Might 2021.

A portion of this particular group of coins was accumulated during the March 2020 crash, where BTC fell from $10k to $3.8k as global markets faced the March 13, 2020 liquidity crisis. It’s attainable this cohort might have been apprehensive about one other March 2020 occasion and panic bought.

After the May 2021 plunge to $30k, the 12-18 months old coins aged and steadily showed accumulation as BTC consolidated between $30k to $40k and pushed higher towards today’s prices of around $50k.

Quick-Time period Holders Offered the Backside

Looking at short-term holders, the chart below shows 1 month to 6-month-old coins were selling while BTC was consolidating between $30k to $40k as larger entities accumulated. This group of holders accrued throughout the large rally as much as $64.8k and panic bought close to the underside at a loss.

Going forward, it will be important to watch the 3 to 6-month cohort closely as these coins are slowly aging, which will start to include the BTC accumulated in the $30k to $40k range.

Total, it’s bullish to see the promoting from cash older than 12 months cool off with a return to accumulation. This behavior can be verified by the temporary spike in age spent output bands, a metric tracking the age of coins being moved. Thus far, the information present no indicators of main whale promoting turning right into a pattern, which additional invalidates the BTC bears name of a bull lure.

With the weekly close coming up, market participants will closely watch to see if BTC can weekly-close above $50k, marking one other main step ahead in bull market continuation.