Close up man hand arranging wood block stacking as step stair on paper pink background. Business concept growth success process, copy space.

Bitcoin has damaged out of its vary for the second time prior to now month. The first cryptocurrency by market cap is making its way up from its yearly low, $29,900, after a season trending to the downside.

On the time of writing, BTC trades at $52,333 with a 1.4% and seven% revenue within the each day and weekly charts, respectively. Bitcoin smashed the major resistance at $52,000, as news about El Salvador buying its first BTC came out of that country’s presidential office.

The bulls are again in management, it will appear, and Bitcoin might doubtlessly rise to its subsequent resistance stage at round $56,000, for the primary time since Might. If it does break that resistance, the bulls could attempt a move into the $60,000 area.

This might put BTC’s value within the “path of least resistance”, as Senior Commodity Strategist for Bloomberg Intelligence Mike McGlone mentioned. The price target for that path is $100,000 by the end of 2021 for the first cryptocurrency by market cap, and $5,000 for the second, Ethereum. McGlone noted:

After enduring a gut-wrenching correction, we see the crypto market extra prone to resume its upward trajectory than drop under the 2Q lows. What could stop Bitcoin and Ethereum from achieving record highs in 2H may be the more elusive question. Growing demand and adoption are dealing with diminishing provide.

A report by Glassnode support the bullish thesis for the short term. The agency data a restoration within the mining sector after these operators had been pressured to maneuver from China and relocate to different areas.

The recent appreciation in the crypto market has allowed BTC miners to secure profits, the report claims. Thus, the Miner Internet Place Change “has returned to a impartial space”.

Institutions Back On Bitcoin, Indicators Suggest More Profits

This Glassnode indicator has been used to measure the correlation between the number of coins accumulated or sold by miners and the price of Bitcoin. Due to this fact, the promoting strain that drove down BTC’s value throughout Might and June appears to be out of the image.

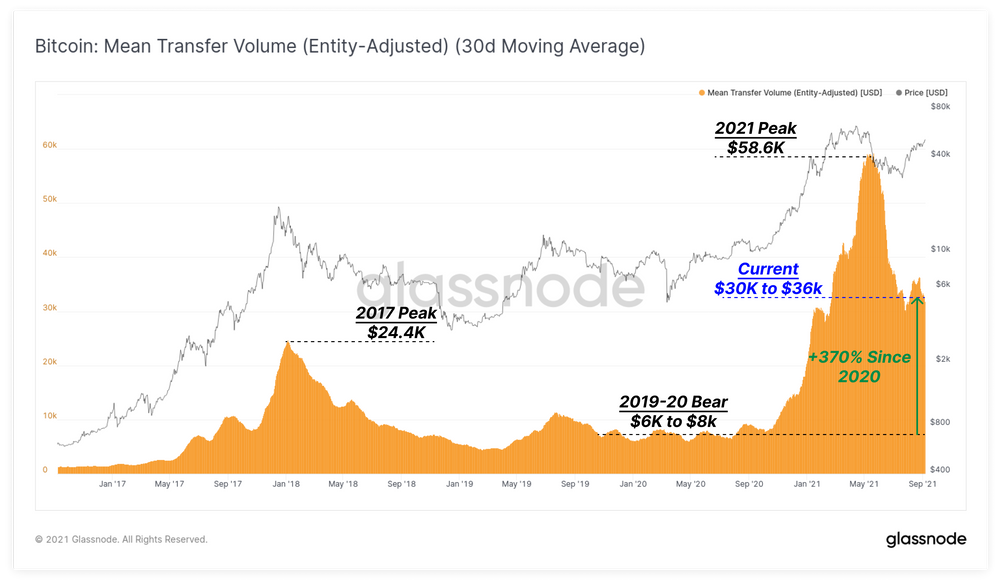

In addition, Glassnode records a permanent rise in the transaction size made by BTC users. This has created a distinction from the present market cycle to the earlier one and suggests establishments have stayed on the community regardless of the 50% decline within the value of Bitcoin throughout Might.

As seen below, the transaction size has experienced an important increase reaching a peak during that month. Glassnode added:

This has largely cooled off from July onwards, with the present common transaction dimension between $30k and $36k. Relative to the 2019-20 period, this represents a significant 370% increase, despite the recent correction, reflecting continued and sticky institutional sized interest.

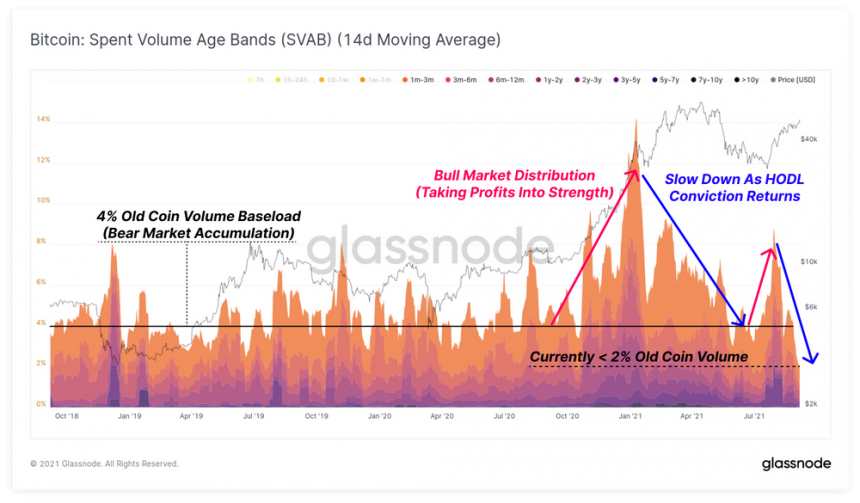

As well as, Glassnode claimed that traders have excessive ranges of conviction to carry their Bitcoin, as suggested by the Spent Volume Age Band, a metric used to classify the proportion of daily coin volume by coin-age.

In different phrases, the variety of BTC being offered available on the market and the way lengthy have traders have held on to these cash. At moment, the BTC traded is part of the “younger coins”, while “old coins remain dormant”.

Bitcoin might as soon as once more be impacted by a domino impact brought on by the derivatives sector. As the price tries to reclaim previous highs, speculators and short-term investors turn to futures contracts to amplify their gains.

That is inflicting the funding charges for this product to rise. The research firm records a 0.03% for this metric across exchange platforms, levels “seen prior to the May sell-off”. So, traders stay cautious and regulate the Bitcoin futures. Glassnode added:

The combination of positive funding rates and high open interest can be an important indicator set for assessing a shorter term risk of cascading long liquidations.