Certain altcoins took a bullish turn following Bitcoin and Ethereum’s upward movement. NEO logged a powerful 9.7% appreciation and was near testing its instant resistance of $65.71. Litecoin too gained by 6.8% amidst growing institutional interest. It may revisit $232.56 which is a multi-month excessive for the coin. Solana made minor gains while trading sideways on its charts, although it traded close to its all-time high of $143.77.

Litecoin (LTC)

LTC appreciated by 6.8% during the last 24 hours. It was available for $223.45. The coin hovered close to its multi-month excessive value degree. With a continued uptrend, it could revisit $232.56 and then touch the $237.77 price mark.

Nonetheless, technical indicators flashed combined buying and selling indicators.

Green bars on the MACD histograms declined over the past trading sessions. A crimson sign bar was seen on the Superior Oscillator, which was the results of a session within the crimson. Bollinger Bands showed slight divergence, which suggested lowered market volatility.

If the above notion holds true, LTC would discover help on $218.15 after which if unable to maintain at that mark, it may dip to $194.13. Failing to find support over the $194.13 mark, LTC could push lower, to revisit its four-week low at the $160.58 price line.

Solana (SOL)

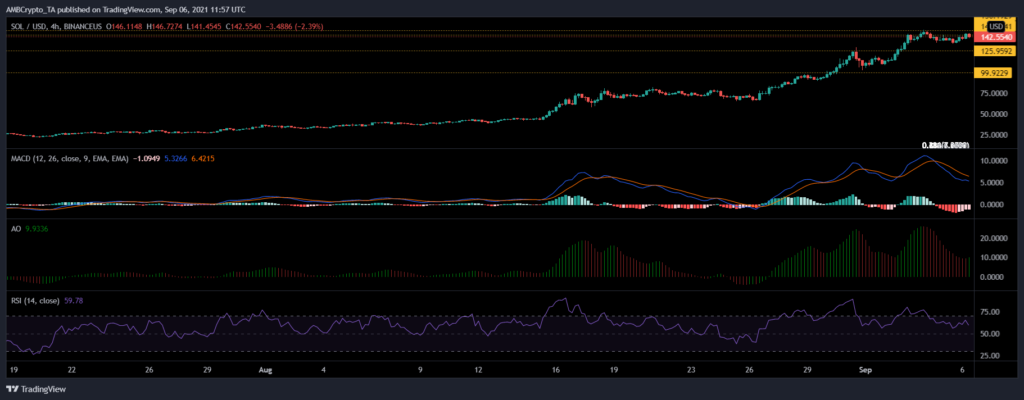

Solana was consolidating on its charts close to its all-time excessive mark. At present, it was trading for $142.55 after a 1.9% gain. Its overhead resistance lay at $143.77.

The 4-hour chart picked up on bearish price action for the alt. MACD displayed crimson bars on its histogram. Awesome Oscillator flashed red signal bars, although a last green signal only refers to one trading session in the green. Contrastingly, the Relative Power Index remained bullish, barely beneath the 60-mark.

If the abovementioned parameters hold true, and prices start to descend, the first support awaited at $125.95. The extra help line sat at a weekly low of $99.92.

NEO

NEO was priced at $63.78 and witnessed a sharp surge of 9.7% over the last 24 hours. It was buying and selling close to its three-month excessive and the instant value resistance for NEO stood at $65.71. Technical parameters were also in agreement, and gave out bullish signals for the coin.

Superior Oscillator displayed amplified inexperienced sign bars. Relative Strength Index was bullish as the indicator stood slightly below the 75-mark.

Chaikin Cash Circulation was additionally positioned above the half-line indicating a rise in capital inflows. A price reversal would mean that NEO would dip to find support near the $56.27 price line. Failing to maintain over that value degree, it may drop to its three week low of $49.45.