Bitcoin’s market has seen quite a few flash crashes over the years. In reality, they’ve kind of develop into an inevitable tradition at this stage. The one that took place on 7 September managed to instill fear and panic in the minds of relatively new market participants.

This, in flip, resulted in weak fingers promoting their HODLings. What did others do? Well, market participants who’ve seen such crashes in the past resorted to adding more coins.

So, is it already time to give up on Bitcoin?

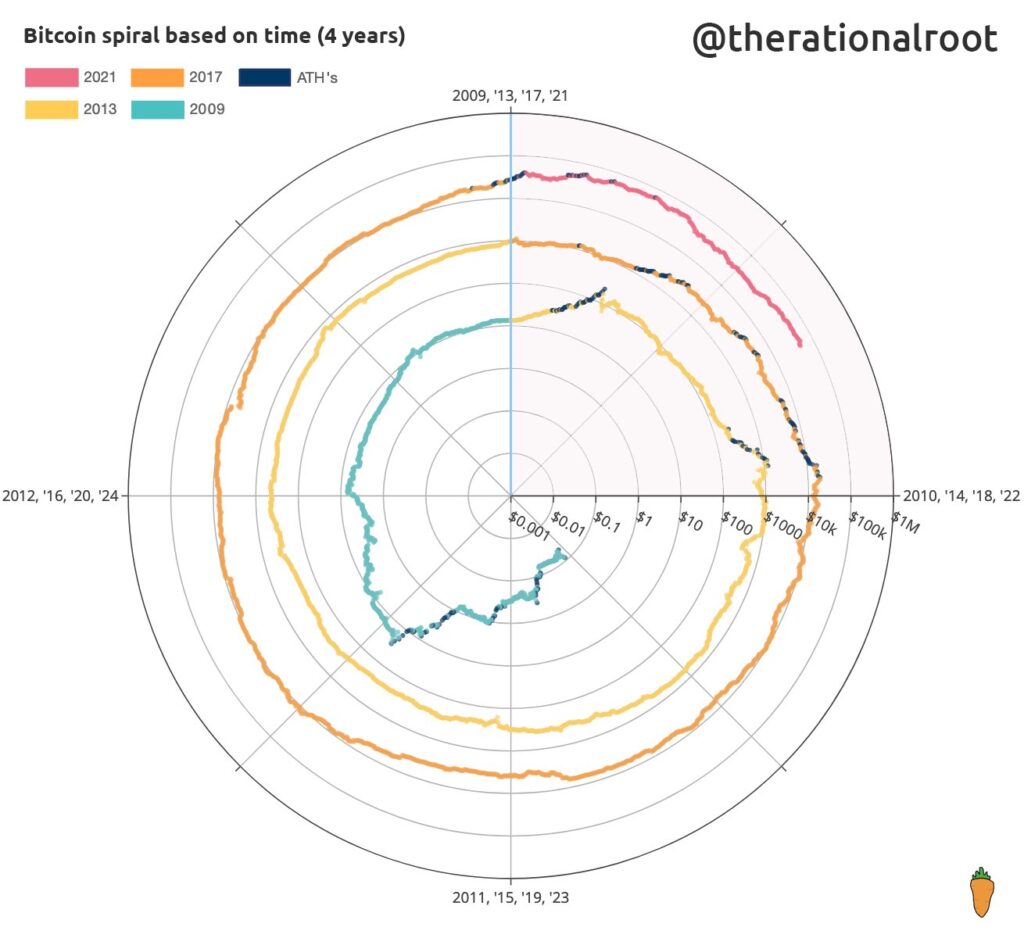

Cycles exist in all markets. The Bitcoin market too, for that matter, is cyclic in nature. After every 210,000 blocks are mined [approximately every four years], the cycle changes. That is primarily marked by the halving occasion that takes place the place miner rewards are reduce by 50%.Every phase of every cycle thus far has been significant in its own way.

Therefore, trying on the means bull markets have unfolded in earlier cycles would give us a tough thought about what to anticipate this time round.

In 2013, it took almost 287 days for Bitcoin’s price to hit an ATH. Equally, in 2017, it took the market round 289 days to realize the identical feat. As far as this year is concerned, we’ve already crossed the 250-day threshold and are merely a month away from stepping into the 280-day phase. By and huge, because of this the clock is ticking quick.

However, if the number of blocks since previous highs are to be considered, the Bitcoin market has additional time in hand. The crypto’s value peaked when it was round block quantity 50,000 in 2013, whereas it managed to tug off the identical at round block 44,000 in 2017.

Now, as can be seen from the chart attached, block 48,000 appears to be quite close to the implied top of this bull run.

At the moment, over 40000 blocks have been mined already and we have to go 8000 blocks additional to get to 48,000. Keeping the 10-minute block time in mind, it can be said that the market is about 55 days away from its peak.

What’s extra, the cyclic value has at all times maintained the sanctity of the spiral by remaining nicely throughout the boundaries of its respective concentric circles. As such, there is no deviation this time either.

The blue dots within the chart connected under characterize all-time highs. Curiously, they’ve all fallen within the same quarter of the circle thus far. Ergo, if the custom have been to be adopted this time too, the market would possible witness one other peak within the subsequent couple of months.

Signs of revival

By and large, the market has been able to put its resilient foot forward post the crash. At press time, the market’s king coin was seen buying and selling at $45.3k, down by 3% when in comparison with the day past.

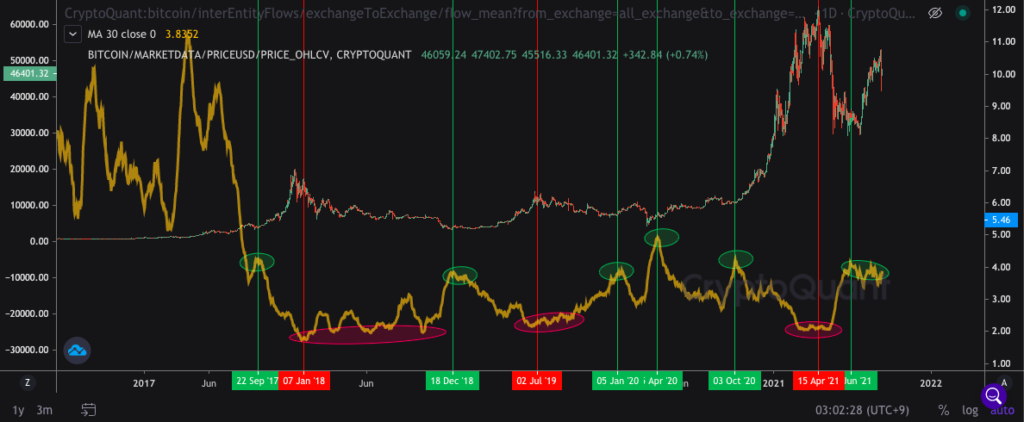

CryptoQuant CEO Ki Young Ju, in a recent tweet, highlighted that whales have started sending Bitcoins to derivative exchanges from other exchanges. In keeping with the exec, these giant market members are both punting new positions or filling margins.

Whenever this has happened in the past, Bitcoin’s price has ended up appreciating in the long term after their accumulation. In reality, the exec additionally argued that their positions appear to be lengthy positions this time too.

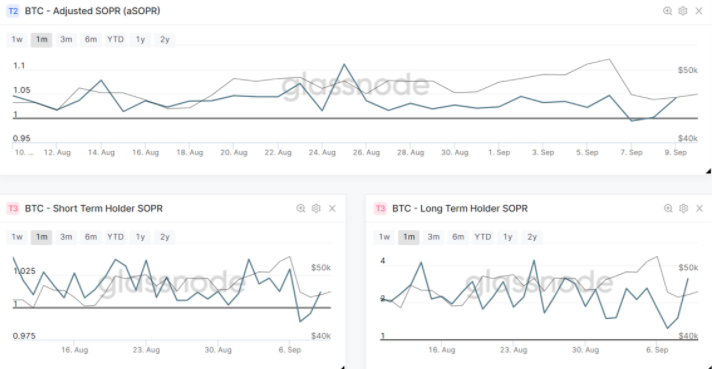

The Spent Output Profit Ratio too managed to flash a positive sign, at the time of writing. The SOPR is a measure of the state of revenue/loss cash buying and selling on a given day are carrying. This metric has managed to bounce off the dip and was seen to be in a state of profit, at press time.

As may be seen from the chart connected, the dip under 1 on 7 September was higher outlined for short-term HODLers, implying that they have been those who engaged in promoting.

On the contrary, the long-term SOPR has bounced back, without even paying a visit to 1. That is just about a textbook bull run setup.

Well, looking at the current state of the aforementioned metrics and the way things have unfolded in the past, it’s fair to claim that this is not the right time for market participants to give up on their HODLings.

The market is kind of two months away from its peak. Hence, selling at that time would fetch HODLers more profit than now.