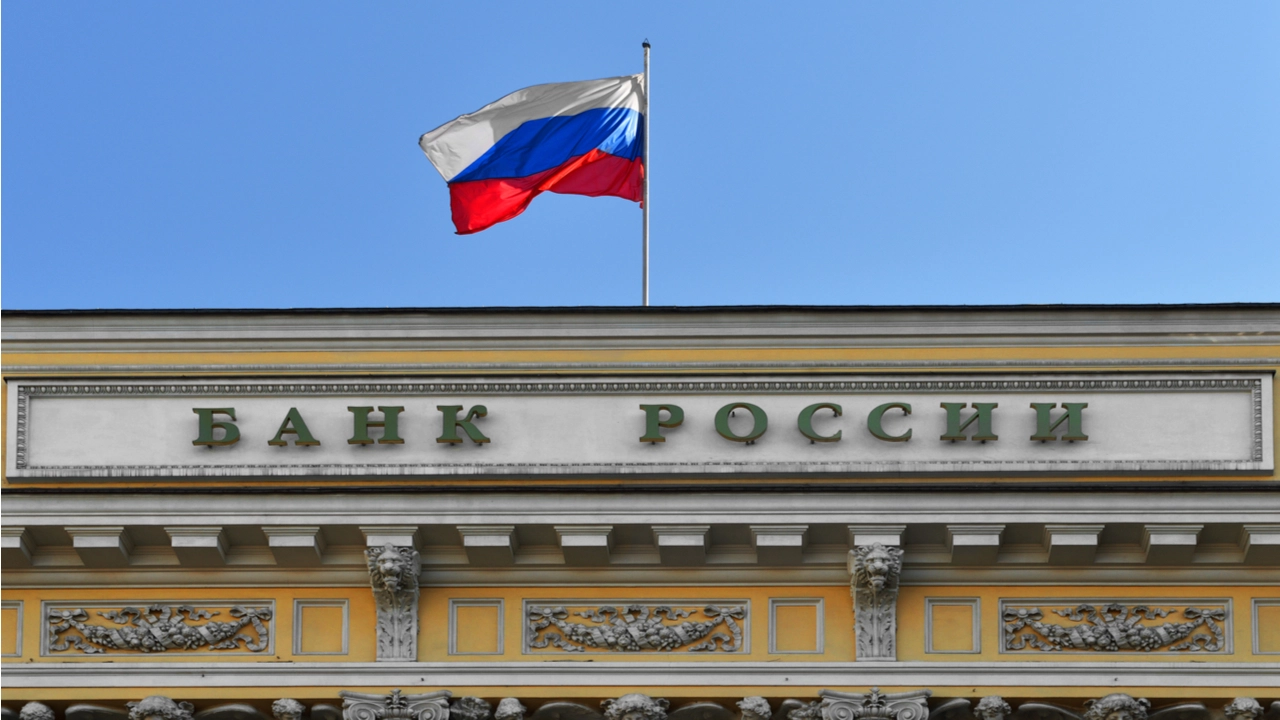

The central bank of Russia has advised commercial banks on how to identify and block cards and wallet accounts used by shady businesses. Together with unlawful foreign exchange sellers and monetary pyramids, the regulator has additionally listed crypto exchangers as suspicious entities.

New AML Recommendations by Bank of Russia Target Cryptocurrency Exchangers

Russia’s central bank has issued a set of criteria that banks can use to identify cards and e-wallets used by companies operating in the shadow economy, Forklog reported. In accordance with the financial authority, these embody not solely unlawful foreign exchange sellers and monetary pyramids, but in addition cryptocurrency exchangers.

The bank turns particular attention to transactions between private persons as the regulator claims such entities often use accounts registered under false names to make and receive payments. Russian banks are anticipated to investigate and determine suspicious transactions as a part of their anti-money laundering (AML) efforts and terminate providers.

Among the operations considered a cause of concern, Bank of Russia lists deposits and withdrawals of cash when they are more than 30 a day. A lot of particular person payers or recipients, over 10 per day or 50 per thirty days, also needs to set off motion on the a part of monetary establishments.

The same applies to frequent transactions when the total amounts to at least 100,000 Russian rubles (close to $1,400) daily or 1 million rubles ($14,000) a month, the report details. Small intervals — of lower than a minute — between deposits and withdrawals also needs to alarm financial institution officers.

Accounts Not Used to Pay Utility Bills to Be Deemed Suspicious

The Central Bank of Russia (CBR) advises commercial banks to also examine cases where the average remaining balance at the end of each day does not exceed 10% of the average daily transaction volume in the course of a week. Accounts that aren’t used to cowl utility payments or pay for items and providers could be blacklisted as properly.

A bank’s client may be considered suspicious if their transactions correspond to two or more of the described criteria. To determine such people, Financial institution of Russia additional instructs banks to trace digital fingerprints left by account holders together with info figuring out gadgets used to entry and switch the funds remotely.

Bank of Russia has been opposing the legalization of cryptocurrencies and related activities while other Russian authorities have been going after websites spreading information about crypto trading and platforms providing access to exchange services. In July, the monetary authority issued a advice towards the itemizing of securities tied to crypto property on Russian inventory exchanges.