This year has been marked by numerous lows for bitcoin. The digital possession has actually seen annual lows in the exchange reserves, deal costs, and now, the short-term supply of bitcoin is down. The short-term supply has been shrinking for the past year. With decreasing volumes revealing patterns that have actually not been seen in the previous 5 years. Given the low volume of bitcoin transactions, which has led to low transaction fees, only few bitcoins are moving around the network.

One And Three-Month Lows Show Shrinkage

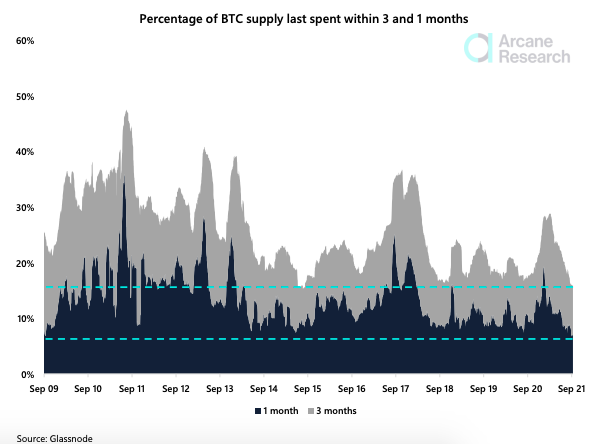

Bitcoin is no longer being invested as it remained in the past. One of the leading ideas behind the creation of the digital asset was so it could double as a currency, one which was not controlled by any one person or entity. Early adopters adhered to this preliminary vision. Using BTC for purchases where they can. Metrics reveal that in the previous month, 6.8% of the possession’s overall supply has actually been invested. While the three-month trend shows that only 15.8% of the total supply has been spent by investors.

The three-month lows reveal the short-term supply of bitcoin is shrinking to 2015 lows. In the month of August, short-term supply hit a low of 6.75%. With a small boost that just took place after the possession had actually recuperated back towards the $50,000 mark. But this did not last long. The supply per month is in a declining trend, indicating that subsequent months will also see shrinking short-term supply.

How Short-Term Supply Affects Bitcoin Price

Although low, the decreasing short-term supply of bitcoin does spell excellent news for the possession. It indicates that investors are still holding on to their coins, showing bullish sentiment amongst the investor community. It likewise reveals that bitcoin’s current gains have actually encouraged financiers to hold their funds. Instead of moving it onto exchanges to sell and cash out their gains.

With hold belief increasing, it will play into the favor of BTC. The asset’s value is likely to rise with more investors holding their BTC bags. Increased offer pressure likewise encourages brand-new financiers to purchase into the coins. Simultaneously motivating old investors to stay and ride out the low periods in wait for the bull markets.

The present patterns reveal decreasing short-term supply has actually taken place when the possession has actually seen a crash or dip in its price. It is obvious that investors are taking advantage of these price dips to top up their bags. Panic selling has actually likewise dropped significantly in the market with more understanding of price motions. Leading to more diamond hands in the market. Bitcoin, it seems, has entered the era of holding.