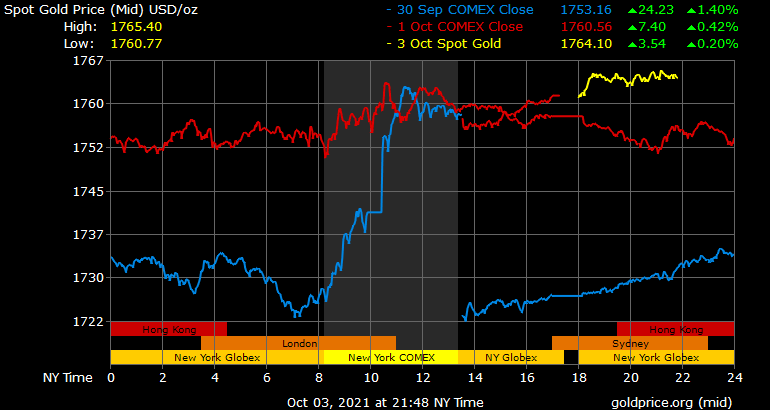

As the price of bitcoin surged in the first days of October, the price of the precious metal gold also rose as a percentage as the US dollar and the country’s 10-year Treasury yields fell last week. An ounce of fine gold exchanged hands this weekend for $1,760 per unit, up 1.32% since September 29.

Gold climbed more than 1% last week, metal’s rise attributed to weak dollar, fears of US default, upcoming Fed QE and benchmark rate decisions

After the end of September, like clockwork, bitcoin (BTC) and the crypto economy saw billions of dollars return to the crypto markets. Today, the entire crypto-economy is worth around $2.23 trillion and BTC commands $909 billion or 41% of that aggregate total.

Meanwhile, gold, on the other hand, has been lackluster on percentage gains, but assets have jumped 1.3% in the past six days. Gold bugs, speculators, and precious metal (PM) market analysts have pointed to the soft dollar last week attributing to the shiny yellow metal’s price rise.

Last week the dollar index and US Treasury yields fell in value and the PMs saw significant demand from other fiat currencies. Furthermore, market participants are worried about the Federal Reserve’s moves, as discussions of reducing massive asset purchases every month and raising the benchmark rate next year continue to rattle investors.

In addition, the lack of funds from the United States, the raising of the debt ceiling or a possible default have added to these market fears. Marc Chandler, chief market strategist at Bannockburn Global Forex explained that investors can’t imagine the U.S. defaulting on its debt.

“The more hawkish stance appears to have been the key factor in the dollar’s rise in late September,” Chandler noted over the weekend. “However, more immediately, fiscal policy is the focus, though investors appear to be looking through it, as many find it inconceivable that the U.S. would default on its debt,” the market strategist added.

On the other hand, analysts at schiffgold.com explain that “the [Federal Reserve] clearly monetizes US debt “in a research article titled”[the] The Fed absorbs $ 60 billion in 1-5-year US Treasuries in September. “

“The Fed has monetized a large percentage of debt issued since January 2020. The emphasis is clearly on notes and bonds to keep a lid on long-term rates,” the Fed’s study published by schiffgold .com on October 1. “The Fed can talk about tapering and even make attempts to do so, but they will inevitably reverse course and begin expanding their balance sheet by more than $120 [billion] a month.”

FX Empire disowns its year-end gold price forecast

Despite the 1.3% jump last week, FX Empire said its year-end forecast for gold was wrong. “[We’re nixing] our forecast for gold is at a high of $ 2,401. We are wrong and not even close. Period,” FX Empire sternly noted. Even though there are still a few months left, FX Empire explains it’s irrational to think gold will reach $2,401 at this point in the game.

“Since we are quantity driven, unless something horribly massive happens, expect gold to even hit $ 2,000 by the end of the year, let alone 2 $ 401, is totally out of any rational range, ”noted FX Empire author Mark Mead Baillie.

“Gold just commenced Q4 by settling out the week yesterday (Friday) at $1,761, (after having settled Q3 on Thursday at $1,758),” the author added. “The stretch to hit $ 2,401 over the remaining 63 trading days of the year therefore requires a 36.3% price increase, “Baillie added. The FX Empire analyst continued:

Now has such [a] percentage increase in the price of gold ever happened before within a 63-day stint? Absolutely. Obviously, there was the infamous race from 1979 to 1980, with a similar movement in 1982; but it was not until 2009 that the price of gold rose again by at least a similar percentage.