High open interest on Bitcoin futures might cause unrest on the market

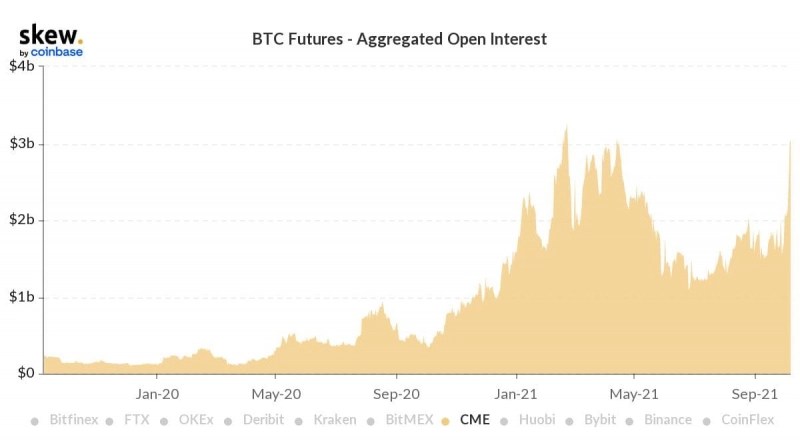

Open interest in Bitcoin derivatives, including futures, has gradually increased and has now almost reached the previous ATH, according to Skew Analytics. While the market is experiencing a massive funds inflow and Bitcoin is growing exponentially, a large volume of futures is one of the first indicators of a highly leveraged market.

Why is a high open interest rate on futures destabilizing the market?

The rise in volatility in the Bitcoin market has almost always been correlated with the increase in open interest in the derivatives market. The most recent Bitcoin growth has also been followed by high open interest in futures. Usually, traders choose futures over spot positions in order to use high leverage.

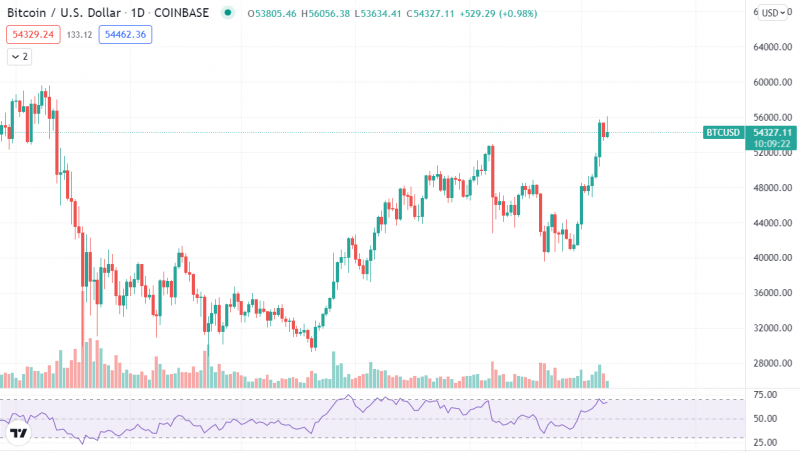

Leveraged positions on the market allow smaller traders to open positions greater than thought possible; this usually leads to an overall increase in volatility, which can be good for an asset while it is growing.

The sale of Bitcoin in May

Bitcoin’s 50% retracement in May was caused by a massive long squeeze, which was caused by a large number of over-leveraged positions. Once significant selling pressure appears on the market, the price of an overleveraged asset usually falls down as rapidly as it went up. This is happening due to the lack of any support area that has not had a chance to form as the price has skyrocketed by tens or even hundreds of percent.

The exact same situation with open interest in forming right now, but the main difference with May’s sell-off might be the measures a number of cryptocurrency exchanges took regarding margin-trading on their platforms. With fewer leveraged positions in the market, the rally will be more stable and may not experience a major correction like the one we experienced in May.