Ethereum as the second-largest cryptocurrency has continued to surprise investors and observers alike. Looking at the price performance of the asset this month, it may not look like it, but there is a market other than the spot market where Ethereum killed it last month. If this works out, Ethereum might find a new section of audience.

Lower volumes?

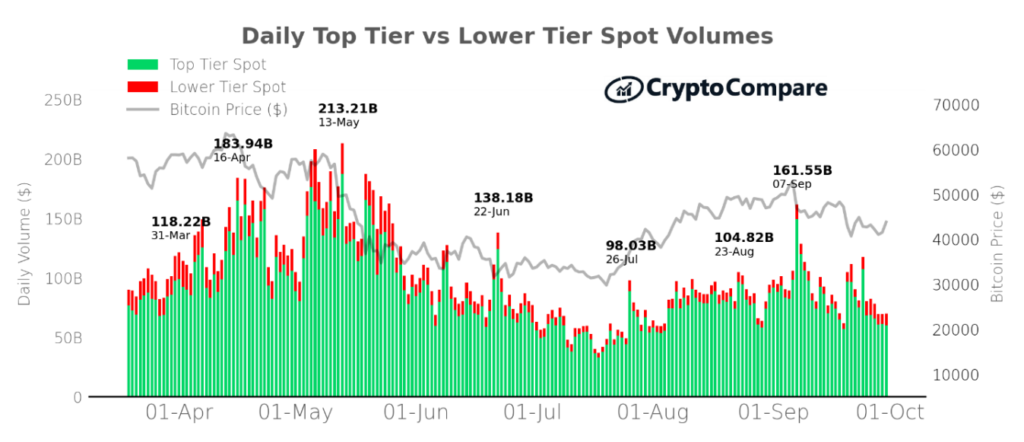

Although September was not the best in terms of price development, it still saw a sharp increase in transaction volumes. Overall volumes increased by 13.9% combining both top tier and lower tier exchanges. In fact, spot market volumes even peaked at $ 161 billion on September 7, marking a three-month high.

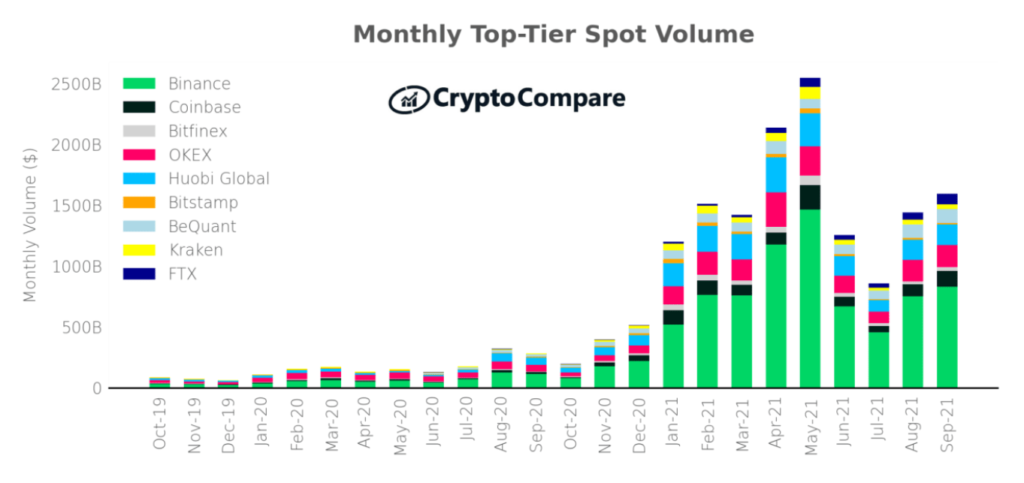

The biggest contribution to this rise came from the 15 largest “Top-Tier” exchanges, where volumes rose by 10.8% in comparison to August.

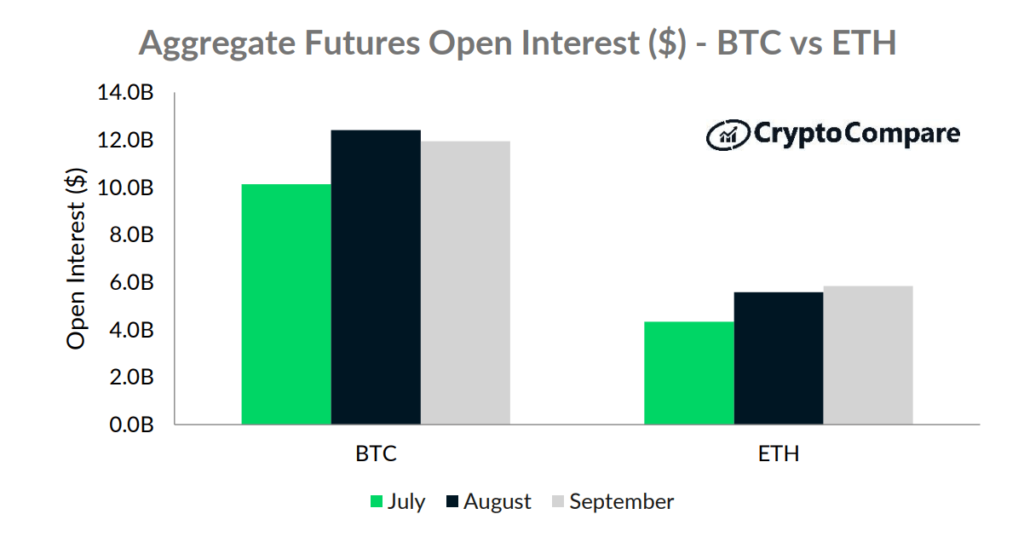

Likewise, the derivatives market has also seen an increase. Since leveraged traders invested further into the market their participation increased not owing to news surrounding Bitcoin. This time the rise was led by Ethereum.

Led by Ethereum how?

If you look at the derivatives market you’ll notice that the Open Interest (OI) across Bitcoin futures products dropped by 3.7%. During the same period, Ethereum’s OI grew by 4.7%. The case was the same for perpetual contracts as well which have gone up by 3.7% since August sitting at $4 billion.

In fact, CME, the world’s largest derivatives exchange, saw ETH’s OI hit all-time highs as it rose 10.5% last month.

Surprisingly, in the same time period, BTC’s CME OI reduced by 3.1% and ETH’s volumes also could be seen to have risen by 34.51%.

The interesting observation here is that all of these gains came at a time when the market was bleeding. September saw Ethereum’s price falling by 21.69%. But the rise in derivatives shows that investors’ focus is shifting further into leveraged trading.

This is good because it allows investors with less money to increase their purchasing power, which can increase their returns even if they are long or short.

But it also creates the possibility of a significant market shift should investors liquidate their contracts, which could result in a major price fall.