While the U.S. shows questionable jobs statistics, the cryptocurrency market is on the rise

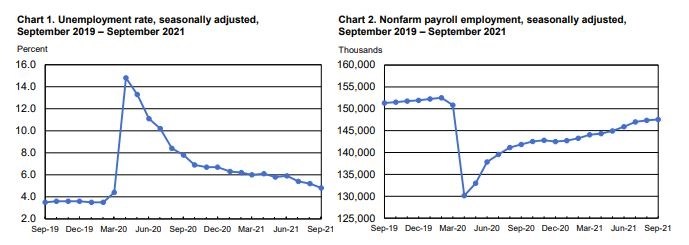

As most countries recover from the “covid crisis”, the United States has shown significant growth and recovery since the start of the year. But according to the latest jobs report, the country is not keeping up with the stated recovery rates and is adding fewer jobs than expected, which means that the cryptocurrency market might receive unexpected benefits from it.

Role of the Jobs in Economics Report

One of the main indications of the macroeconomic situation of the country is the report on the current number of employers, unemployment rates and employment growth rates, all of which are compiled in one report. According to the report, institutions like the Federal Reserve are able to correct their current rhetorics and strategies.

The positive recovery in the labor market is also an indication for non-resident investors who are more likely to invest in the country’s economy if the labor market is growing. After the latest report, we should expect an increase in the key interest rate and tapering initiation.

How could Bitcoin and crypto benefit?

First of all, questionable employment statistics in the country have a direct impact on its national currency and have a negative impact on inflation. While investors see increasing inflation in the national currency, they tend to redistribute their funds in order to protect them from it.

Bitcoin and major altcoins sometimes become effective tools that investors add to their portfolios to increase volatility and add more diversity. Though Bitcoin has been actively following the stock market in general, it may still keep more of its value due to its decentralized nature once the Fed initiates the tapering of the market.

In February 2020, as traditional markets faced a massive 30-50% crash due to the introduction of the first covid restrictions, Bitcoin responded with 30% growth, indicating that the cryptocurrency can always remain an alternative means of preserving capital in times of crisis. in traditional financial markets.