It’s been 10 days since October started and Ethereum’s daily chart still looks more or less like September. The alt’s price rallied during the initial days of both months and then gave in by getting into the consolidation mode.

Nonetheless, this new month brought a slight twist in history – candles hit higher lows over the daily period. Additionally, throughout last month Sundays were quite dramatic, while this time around, they seem less so.

The volatility actually went from 82.23% to 71.79% in just five days and this is mainly why the price of Ethereum has been in the range of $ 3.5,000 to $ 3.6,000. lately.

Interestingly, since the beginning of this month, the alt’s velocity also depicted a change in trend. The same has become less turbulent compared to September.

Simply put, an uptrend on the price charts is usually accompanied by steady velocity, while turbulent landscapes pave way for corrections. Thus, the current state of this metric has opened the doors to a regular rally.

What the foreseeable future looks like

Well, gauging the broader trader sentiment at this stage would further help us in deducing whether or not the uptrend narrative holds true in the short term.

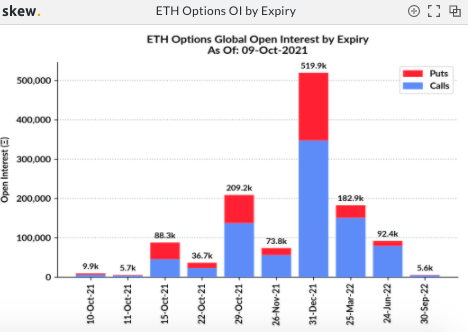

According to Skew data, more than 103.9,000 Ethereums are expected to expire in three batches this week – 9.9,000 on October 10, 5.7,000 on October 11, and the remaining 88.3,000 on October 15.

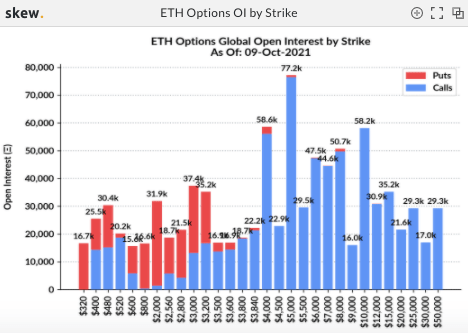

A bird’s-eye view would instinctively suggest that the number of call contracts are dominating the proceedings. However, a closer look at the attached chart would show that options have the upper hand in the strike price range below $ 3.2,000.

After recording a weekly hike of more than 5%, the largest alt was seen trading around $3.6k at the time of writing. Additionally, it should be noted that the $ 3.5,000 region has moved from resistance to support since the 6th of this month.

Thus, the odds of Ethereum’s price dropping below the same level in the coming days seem to be fairly slim relative to the odds of its price sustaining the current levels. So, if the price of Ethereum hovers around $ 3.5,000 or a few inches beyond, we can expect a buying frenzy to set in, as this would entice call owners. to exercise their option to purchase their respective ETH tokens.

However, a failure to do so would make the environment favorable for put owners to exercise their selling option at the strike price. Indeed, a bearish sentiment would creep into the market.