Ethereum has been struggling to make a mark this month. For most of this month, the price movement has been fairly flat and the altcoin king is struggling to break above $ 3,600.

This has caused some investors to repeat their bearish behavior which may not be the best thing to do during a growth-expecting market. This is what you need to watch out for now, before investing in Ethereum

Which part of Ethereum investors did what?

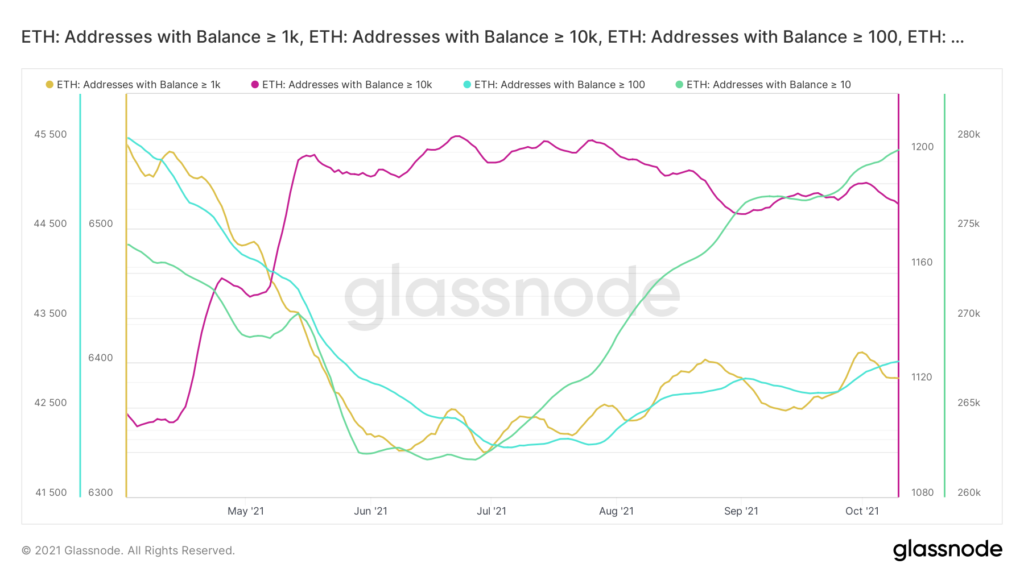

Usually big wallet holders (addresses holding 1k to 10k ETH), be it individual investors, whales, or institutional investors are known to trigger the investment drive for the rest of the investors. If they buy, others buy; if they sell others sell.

With the exception of the last 2 months, their behavior has been quite different. These big wallet holders buy during a falling market and sell at the first signs of profit.

They first did this in August when they sold their holdings as ETH rose 51.21%. Then came September, which along with other alts saw the second generation coin fall by 21.69% during which they bought back.

And now when Ethereum rose 20% in October, they are selling again. The same is evident in the price action and RSI depicted in the chart below.

Cumulatively, these holders caused an estimated $ 267.8 million in cash outflows in a matter of days.

However, smaller investors have surprisingly not followed their cues. Their figures have been rising cautiously and addresses holding 10 to 1k ETH are countering the selling from bigger holders.

And their decision could actually prove to be very profitable for them.

Profitable how?

Well, this month’s rise has put Ethereum only 14.2% away from its all-time high of $4179. Now, while it wasn’t quite there yet, investor profitability already was. Over 87% of all addresses were profitable at the time of writing.

Now, most of you might be looking at Ethereum as a solid investment opportunity. But before you do that, you need to pay attention to the high volatility that ensues in the market.

However, the good thing is that Ethereum was neither overbought nor oversold. The RSI being in the bullish neutral zone showed that optimism is strong for the asset and a rise in prices could take place if conditions are favorable.

Having said that, as always, DYOR and invest with caution.