Bitcoin has actually as soon as again cleared expectations for the month of October. The price of the digital asset had grown from its $40K lows to over $57K at the time of this writing. Its healing patterns have actually put it on a course of least resistance towards the previous $64K all-time high. But on-chain metrics have shown even more favorable trends among investors in the asset.

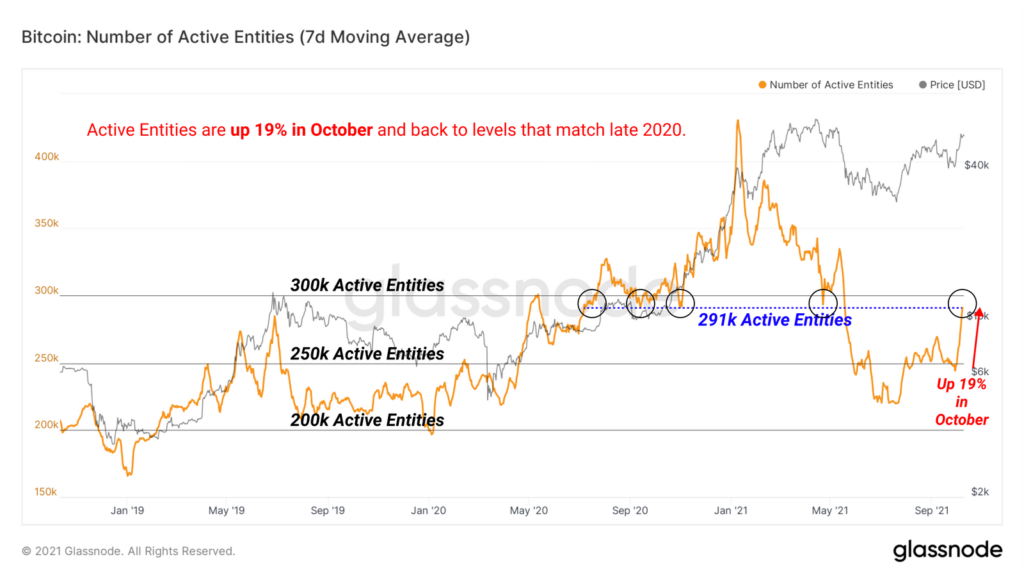

Bitcoin Active Entities (i.e variety of active users on the blockchain every day) paints a bullish photo for the possession moving forward. This metric had dropped between May and September 2021, nearing lows seen in January 2020 when the bear market was still in full force. However, there has actually been a substantial uptick in the variety of Active Entities on the blockchain following the bull rally began at the start of October.

Bitcoin Active Entities Up 19%

Data from Glassnode shows that bitcoin Active Entities have seen an increase in recent weeks. At its least expensive, Active Entities dropped to a little over 200K this year, down over 50% from its high of over 400K in between January and February 2021. As the price of the asset has begun to soar again, so has the number of Active Entities.

The significance of this displays in the motion of the rate. The last time Active Entities saw a significant uptick, the market had seen a bull rally that put the digital asset on a path to new all-time highs. While the boost in Active Entities might not be substantial this time around, it might still bring the very same undertones for the marketplace.

If history is anything to go by, then the increase in Active Entities signifies renewed interest in the market. And something that has actually constantly preceded a bull run has actually been returning interest, which typically marks the start of a long bull rally.

More Bullish Signals

Active Entities is not the only metric that recorded an increase. In the very same report, Glassnode details that the typical quantity of bitcoin being negotiated is on the increase. The median transaction size on the blockchain grew to 1.3 BTC, nearing the 1.6 BTC levels that were seen with the liquidity crash of March 2020.

Like Active Entities, one metric cannot alone identify just how much the rate of a possession will value or diminish. But as the report notes, the increase in the average transaction size shows an increased interest from institutional investors who have more money to put into the market.

If the average deal size now sits at over 1.3 BTC, then the dollar worth on these deals is over $60K. This kind of money moving through the market shows inflows from wealthier investors, which could very well push the value of the digital asset higher. Although it is likewise essential to keep in mind that institutional financiers normally invest when the marketplace is headed into a bear. So these accumulation patterns could represent the beginning of a bear when institutions begin to fill up their bags.