With Bitcoin and Ethereum so close to their pre-crash highs, the general sentiment in the market seems to be predominantly bullish. In that pick up, expert CroissantEth took the job to sum up the elements triggering such belief among traders and operators.

Via Twitter, the analyst claimed that Bitcoin has increased its levels of attention to levels last seen during May, just before the cryptocurrency lost over 50% of its value in the first of several capitulation events.

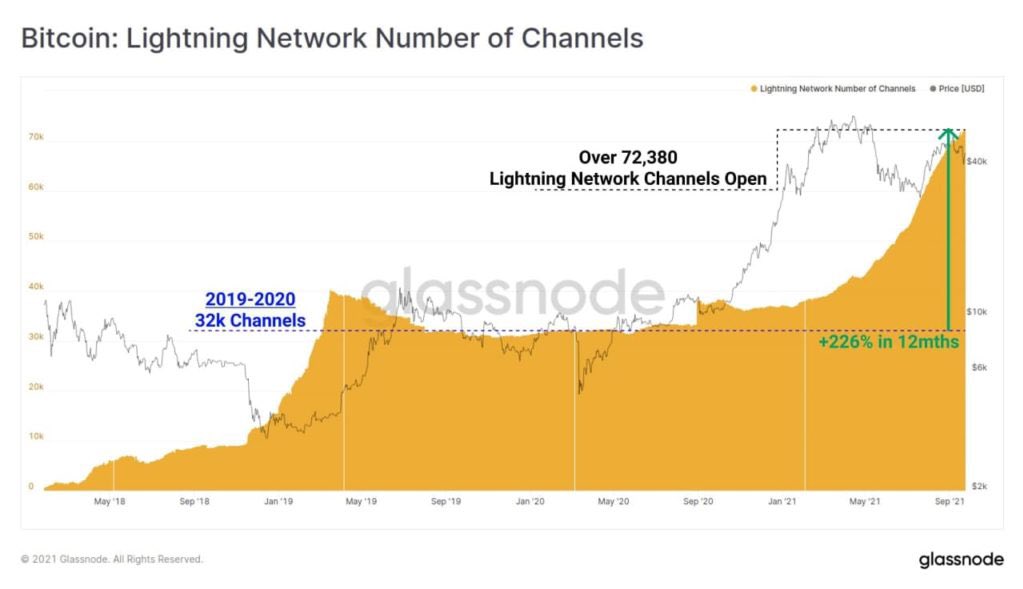

In addition, BTC’s 2nd layer payment option Lightning Network has actually experienced enormous development in its levels of adoption. The analyst attributed this growth to the introduction of the Bitcoin Law in El Salvador.

As seen listed below, the Lightning Network just recently saw a surge in its variety of payment channels. At present, this metric stands at an all-time high with a 226% increase in the past 12 months.

Bitcoin will quickly carry out of its most significant upgrades because its creation, Taproot. To be rollout in November 2021, the upgrade will improve the network privacy and security, and smart contract capabilities. As the Croissant kept in mind, when BTC upgrades “you probably want to pay attention”.

A third potential price catalyzer for BTC is the approval of an Exchange Traded Fund based on Bitcoin derivatives by the U.S. Securities and Exchange Commission (SEC).

How Bitcoin Could Benefit From A ETF Approval

Some experts think that the BTC ETF approval in the U.S. might activate a “buy the rumor, sells the news” occasion. The CEO of Pantera Capital Dan Morehead even went as far as to claim this event will mark the end of Bitcoin’s current bullish cycle.

However, the Croissant disagrees with this take and has actually protected the value of a BTC ETF as a method to draw in fresh capital into the crypto market. As the analyst previously explained, investing in Bitcoin, after China banned it from its territory, could be considered ESG friendly.

Thus, this might develop a brand-new layer of rewards for organizations to designate capital on the cryptocurrency, the Croissant stated:

Investing in Bitcoin is investing in ESG. The significance of this can’t go understated, because it will be the argument needed for institutional adoption of BTC & several key players in the financial industry know this…

Finally, the expert mentioned that BTC tends to trend to the advantage towards completion of the year. The macro-economic landscape offers further incentives, with a “monetary policy disassociated from reality”, for investors to feel attracted to Bitcoin.

Ethereum On Its Way To A New Era

The 2nd cryptocurrency by market cap Ethereum continues to control the majority of the significant patterns in the area. From Non-Fungible Tokens (NFTs), decentralized finances (DeFi), to the play-to-earn model popularize by platforms such as Axie Infinity.

Ethereum appears to have limitless usage cases and applications. Thus, many institutions and big players have been turning their attention to this network.

Of course, the current application of EIP-1559, an upgrade on Ethereum’s charge design, has actually developed a bullish catalyzer for ETH’s rate. The update burns a portion of every transaction fee on the network effectively turning ETH into a deflationary asset.

The ramifications of this modification are yet to be felt throughout the marketplace, as the Croissant declared:

EIP-1559 has worked behind the scenes to burn $1.8M worth of $ETH in just 68 days. This is ETH being gotten rid of from the existing supply, that would’ve otherwise entered to the hands of miners (& likely been offered). This is going to have huge results with time

The transition from Ethereum to Eth 2.0 in an event referred to as “The Merge”, is also part of the bullish factors for the cryptocurrency. The “supply shock” impact on ETH’s rate and the enhancements on the network scalability shouldn’t be ignored, according to the expert.