The bulls are back in control after a brief drop in the price of Bitcoin. The very first cryptocurrency by market cap trades north of $57,000 with a 2.5% and 11.1% earnings in the day-to-day and weekly charts, respectively.

The general sentiment in the markets it’s bullish, as operators and traders expect Bitcoin to fulfill its historical performance. BTC’s rate normally tends to trend to the advantage as the year concerns an end.

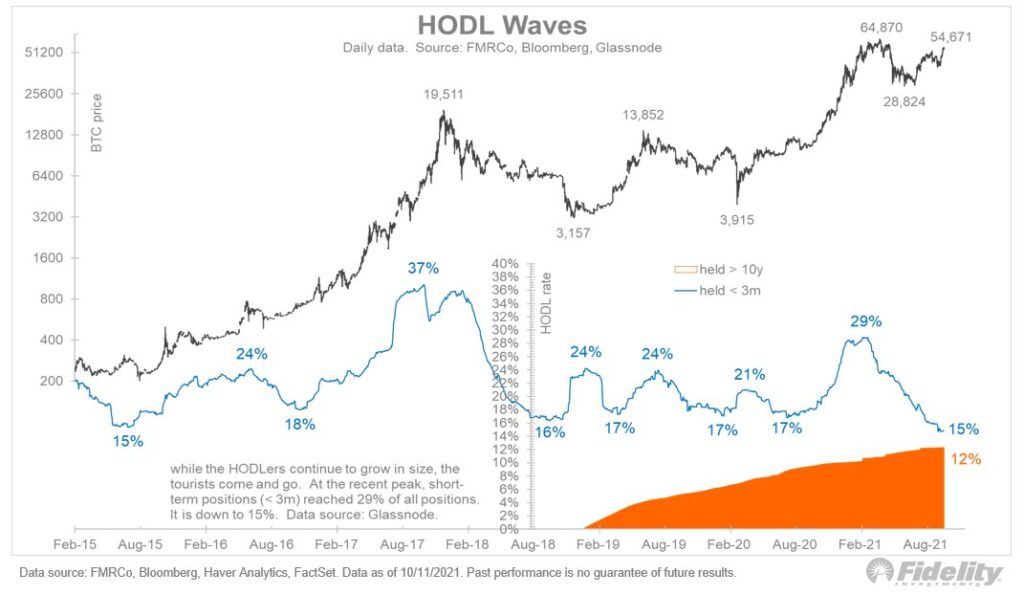

Bitcoin is trading less than $10,000 away from its all-time high at $64,870 and it could run into uncharted territory if, as the Director of Macro for Fidelity Jurrien Timmer said in an interview with CNBC, short-term holders FOMO into BTC. These investors are those that have only held BTC for the past 3 months.

As seen in the chart below, just 15% of the BTC overall supply is presently held by “momentum chasers”. In order for Bitcoin to reach new highs, this metric must stand above 20%.

In that notice, Timmer thinks Bitcoin’s existing go to the upside absence “excessiveness” which could recommend some stability and sustainability for the existing rate action. Unlike previous rallies, this time Bitcoin seems to be moving outside the influence of “speculators”, as Timmer called them.

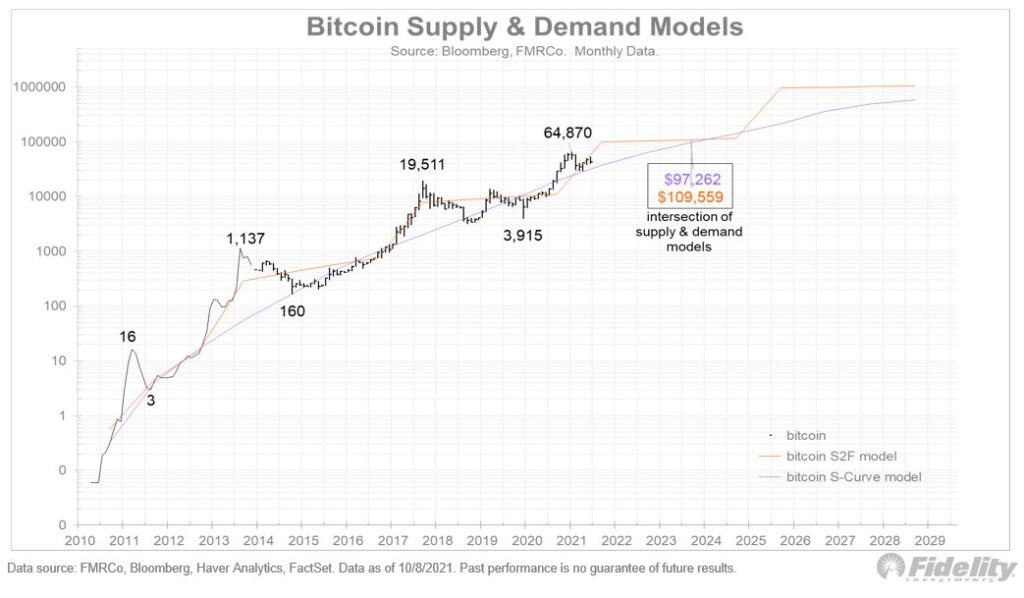

However, some traders could discover Timmer’s forecast frustrating as he thinks the criteria crypto is far from the significant mental mark of $100,000.

When the expert checked the Bitcoin/Gold ratio to analyzed BTC’s supply to demand model, he found the following:

So is bitcoin on its method to brand-new highs? I know better than to make bold price projections but I will note that the next (and last) time my supply-and-demand models intersect is at around $100k in 2023 or 2024.

Bitcoin Far From The Top, Bulls Step On The Accelerator

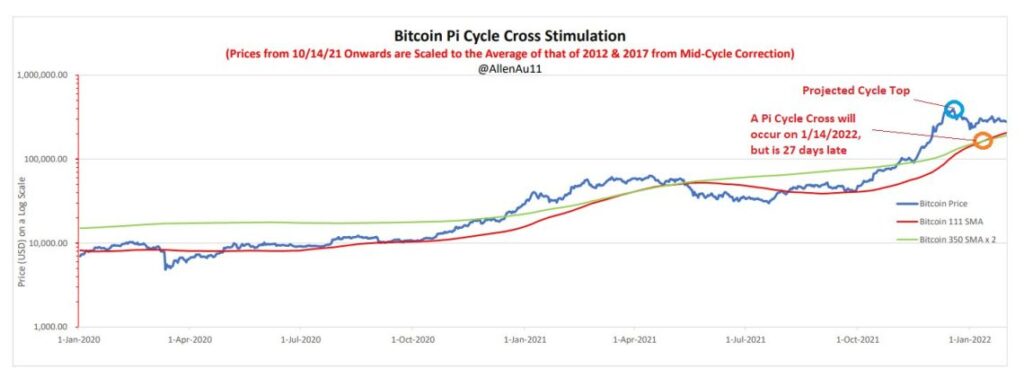

On the other hand, expert Allen Au took a look at the Bitcoin Pi Cycle Top indication to figure out if the cryptocurrency has actually gotten in a bearish stage. This metric has been historically accurate to predict market tops.

As the expert described, it utilizes the 111-day basic moving typical and the 250 basic moving average (SMA) of the rate of Bitcoin. When these two intertwine, operators begin to suspect BTC has reached its top.

Unlike Timmer, this design forecasts a Bitcoin rate beyond the $300,000 mark by the end of 2021. As the analyst clarified, Bitcoin needs to outperform the previous bullish cycle in order for the metric to be accurate:

What I’ve revealed is not to revoke the Pi Cycle Top indication or concur that there is an extending cycle. What the simulations have shown is that the Pi Cycle Top will miss BTC’s cycle peak if it were to occur in Dec. 2021 unless BTC is in a supercycle now.

In the circumstances provided by Au, without thinking about the specific BTC’s rate forecast, the cryptocurrency will trend to the advantage a minimum of up until it reaches its possible peak in 2022.