It’s been a wild few months for Bitcoin’s price. It went all the way up from around $65K in April, down to below $30K in July, and back to a new all-time high today – October 20th.

Many are making comparisons between market dynamics in April and now, and since BTC is found in price discovery, it’s worth examining a few reasons why things could be much more bullish now compared to before.

Retail FOMO Is Not Here

First things first, one of the main catalysts of parabolic advances in the BTC price have always been swarms of retail traders rushing in to buy bitcoin at the last hour.

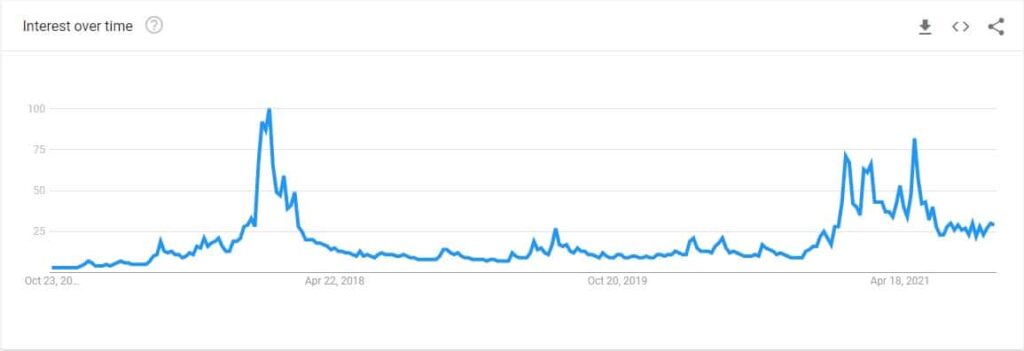

This is commonly referred to as ‘retail FOMO’, and we saw it in 2017 and April of this year – data from Google Trends confirms it:

The above chart from the past five years shows that back in December 2017, when Bitcoin peaked at around $20K, searches for the cryptocurrency reached an all-time high. They also started to rise in April of this year – when BTC set its new all-time high just below $ 65,000.

Now, however, there are no real signs that retail investors are in the market. This means that we are nowhere near the actual FOMO levels, which makes a lot of things believe that there are a lot of benefits to come.

The Market is Not Overleveraged

One way to compare how overleveraged the market was in April compared to now is to take a look at the long-term holders SOPR ratio, which shows when they were distributing coins.

The chart above reveals that in April, LTH was taking profits with an average leverage of 8X, and now they are doing so with an average leverage of 3X – a huge reduction.

Another way to gauge this is by the overall worth of liquidated positions.

Back on April 18, CryptoPotato reported that the total market cap lost around $ 360 billion in a matter of hours and the price of bitcoin collapsed by $ 9,000. This caused a historic liquidation event where over $10 billion worth of both long and short positions were wiped off the market.

Now, similar things happened in September amid the new wave of China FUD when BTC went from $ 52,000 to $ 42,000 very sharply. However, the liquidations back then were nowhere near the levels from April.

In April, we were used to seeing multi-billion dollar liquidations every day as the bulls and bears were over-leveraged – which could also have been deducted by the very high funding rates.

Now, on the day that Bitcoin broke its all-time high and has been through massive volatility over the past 24 hours, there are only about $300 million worth of liquidations.

It also means that the possibility of a major squeeze is considerably lower as fewer traders use leverage.

Strong Fundamentals

It’s true that Bitcoin’s fundamentals have been strengthening throughout 2021 in general, but the rally in April was propelled by an event that might not be as meaningful as many put it out to be – Tesla’s involvement in the market.

Now, however, things are particularly different, institutional investors continue to flow into the industry. Not only this, we just saw the approval of the very first futures-backed BTC ETF in the United States ticked BITO.

It is one of the hottest products on Wall Street, a day of trading, generating billions in volume and carrying over half a billion dollars in assets.

It outperforms other major ETFs such as the VOO by an order of magnitude in terms of the trading volume.

This has significantly legitimized the market and opened the door for more traditional investors as it offers a regulated product that they can take advantage of.