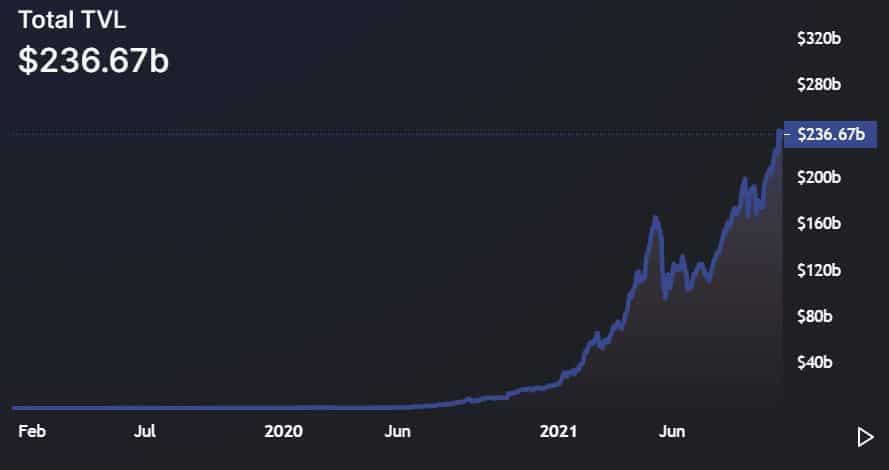

The decentralized finance (DeFi) sector is doing well in October after a month-long market lull. The latest charts show figures hitting all-time highs with respect to liquidity stored on these protocols.

The Locked-In Total Value (USD) set a new high after surpassing $ 236 billion on October 26. According to Defi Llama, the TVL figures have maintained a steady uptrend over the past month. In addition to the broader field of cryptocurrencies, DeFi also had a rather difficult month as the market fluctuated wildly. However, the trend changed, and the board looks optimistic.

Ethereum bounces

Ethereum (ETH), the decentralized financial center, also came to the rescue as it peaked. TVL locked in ETH-based protocols surged past an astonishing $160 billion this week. In fact, these levels were last seen on September 6.

Lending and Decentralized Exchanges (DEXs) on the Ethereum network continued to draw intense activity. Notably, while loans continued to generate more inflows, it is DEXs that have seen the greatest participation in recent weeks. Hence, the latest boom indicated an increasing level of confidence and interest which could spur higher inflows in the days to come.

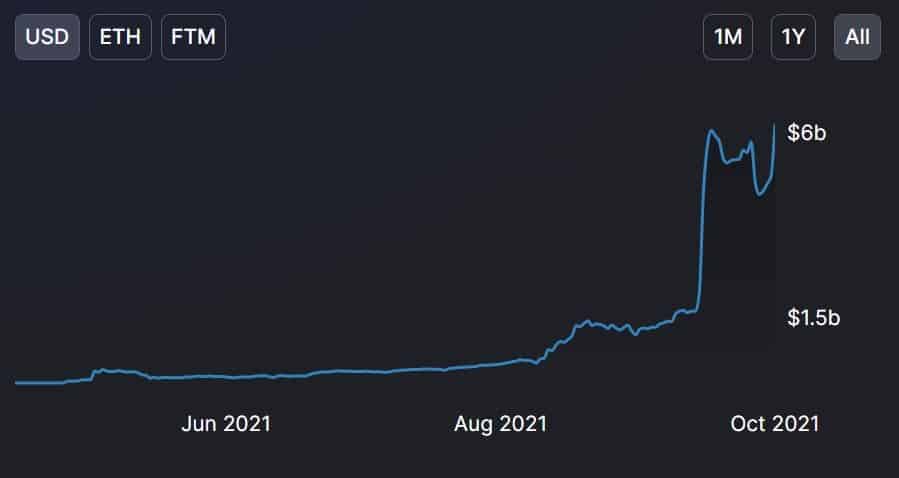

Fantom Follows Suit

Ethereum, a prominent market leader, is not alone in contributing to TVL’s rapid growth. Fantom, for one, has mostly remained unfazed throughout the ups and downs of the last few months. As a result, he managed to create a story for his entire ecosystem.

The strong investor base and the ongoing hype can be attributed to the network recently onboarding the Kyber DEX to enhance the liquidity for token swaps. Fantom too added TrueUSD to increase the transactional capabilities of the network and bridge the gap between legacy and the decentralized financial market.

The flurry of positive news by the network is reflected in the price action of its native token, FTM. The asset, which was now in the 25th position, has also hit new highs every day over the past week, and nothing can stop this bullish momentum. Over the past day alone, FTM rose by 13.18% and was trading at $3.28.

After the trial, there was yet another prominent public blockchain platform, Solana. His TVL was close to $ 14 billion today. The biggest contributor was the liquid staking protocol Marinade Finance which has garnered immense significant interest. On the other hand, the Avalanche protocol also achieved a new TVL score exceeding $ 8 billion.